Communication Base Station Energy Storage Battery

May 8, 2025 · The Communication Base Station Energy Storage Battery market is experiencing robust growth, driven by the increasing demand for reliable and efficient power backup

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In the future, especially after the 5G upgrade, lithium battery companies will no longer simply focus on communication base stations, but on how the communication network

Singapore Communication Base Station Battery Market 2026

Jul 30, 2025 · Singapore Communication Base Station Battery Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR of XX%

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries. To maximize overall

Optimal configuration of 5G base station energy storage

Mar 17, 2022 · The optimized configuration results of the three types of energy storage batteries showed that since the current tiered-use of lithium batteries for communication base station

What is the purpose of batteries at telecom base

Feb 10, 2025 · Telecom batteries refer to batteries that are used as a backup power source for wireless communications base stations. In the event that an

Battery Storage Regulations for Communication Base

Vast quantities of 5G base stations, featuring largely dormant battery storage systems and advanced communication technology, represent a high-quality fast frequency regulation

Global Battery for Communication Base Stations Market

Jul 31, 2025 · The global Battery for Communication Base Stations market is projected to grow from US$ 1692 million in 2024 to US$ 3129 million by 2031, at a CAGR of 9.3% (2025-2031),

An optimal dispatch strategy for 5G base stations equipped with battery

The escalating deployment of 5G base stations (BSs) and self-service battery swapping cabinets (BSCs) in urban distribution networks has raised concer

Battery technology for communication base stations

In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate cascade batteries with high energy density and high charge and

【MANLY Battery】Lithium batteries for communication base stations

Mar 6, 2021 · In general, as the demand for 5G communication base stations continues to increase, there will be considerable market space for lithium battery energy storage in the

Communication Base Station Battery Market Size, Share

Aug 6, 2025 · The Communication Base Station Battery Market is experiencing significant growth driven by the rapid expansion of telecommunication infrastructure, advancements in battery

Optimization of Communication Base Station Battery

Dec 7, 2023 · In the communication power supply field, base station interruptions may occur due to sudden natural disasters or unstable power supplies. This work studies the optimization of

Usage of telecommunication base station batteries in

Oct 26, 2017 · Usage of telecommunication base station batteries in demand response for frequency containment disturbance reserve: Motivation, background and pilot results | IEEE

Optimal configuration of 5G base station energy storage

Jun 21, 2025 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries.To maximize overall

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · This study conducts a comparative assessment of the environmental impact of new and cascaded LFP batteries applied in communication base stations using a life cycle

2024-2030全球与中国通信基站用锂电池市场现状及未来发展趋势

2024-2030 Global and China Lithium Battery for Communication Base Stations Market Status and Forecast 报告编码: qyr2404221027288 服务方式: 电子版或纸质版 电话咨询: +86-176 7575

Lithium battery for communication base station

In this paper, we closely examine the base station features and backup battery features from a 1.5-year dataset of a major cellular service provider, including 4,206 base stations distributed

Communication Base Station Backup Battery

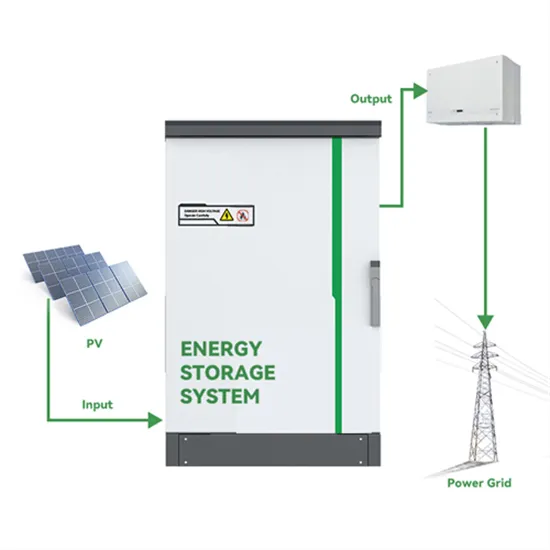

High-capacity energy storage solutions, specifically designed for communication base stations and weather stations, with strong weather resistance to ensure continuous operation of

China High Quality Communication Base Station Suppliers

Dec 1, 2024 · The Communication Base Station is a versatile device that acts as a wireless repeater, enhancing the range and quality of communication signals. It is designed to be

Communication Base Station Energy Storage Lithium Battery

Apr 22, 2025 · The Communication Base Station Energy Storage Lithium Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced

Global Communication Base Station Li-ion Battery

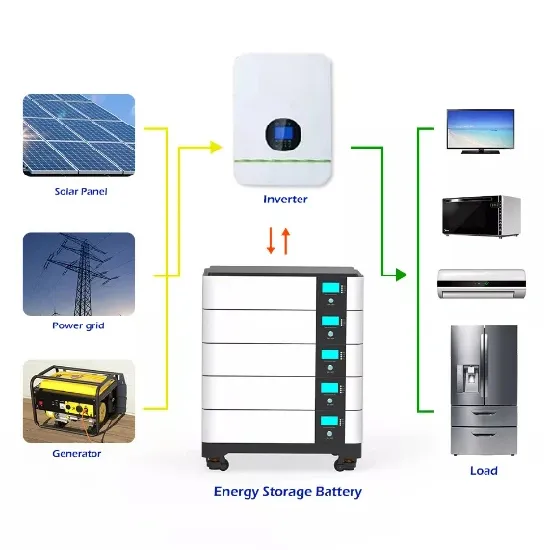

Jul 12, 2025 · Since these communication equipment need to operate 24 hours a day, a reliable backup power supply is required to ensure the normal operation of the communication

Challenges to Overcome in Communication Base Station

Apr 20, 2025 · The Communication Base Station Energy Storage Lithium Battery market is experiencing robust growth, driven by the increasing demand for reliable and efficient power

Global Communication Base Station Battery Trends: Region

Mar 31, 2025 · The Communication Base Station Battery market is experiencing robust growth, driven by the expanding deployment of 5G and 4G networks globally. The increasing demand

Multi-objective cooperative optimization of communication base station

Sep 30, 2024 · Recently, 5G communication base stations have steadily evolved into a key developing load in the distribution network. During the operation process, scientific dispatching

6 FAQs about [Communication base station battery R]

Which battery is best for telecom base station backup power?

Among various battery technologies, Lithium Iron Phosphate (LiFePO4) batteries stand out as the ideal choice for telecom base station backup power due to their high safety, long lifespan, and excellent thermal stability.

What makes a telecom battery pack compatible with a base station?

Compatibility and Installation Voltage Compatibility: 48V is the standard voltage for telecom base stations, so the battery pack’s output voltage must align with base station equipment requirements. Modular Design: A modular structure simplifies installation, maintenance, and scalability.

Why is backup power important in a 5G base station?

With the rapid expansion of 5G networks and the continuous upgrade of global communication infrastructure, the reliability and stability of telecom base stations have become critical. As the core nodes of communication networks, the performance of a base station’s backup power system directly impacts network continuity and service quality.

How do you protect a telecom base station?

Backup power systems in telecom base stations often operate for extended periods, making thermal management critical. Key suggestions include: Cooling System: Install fans or heat sinks inside the battery pack to ensure efficient heat dissipation.

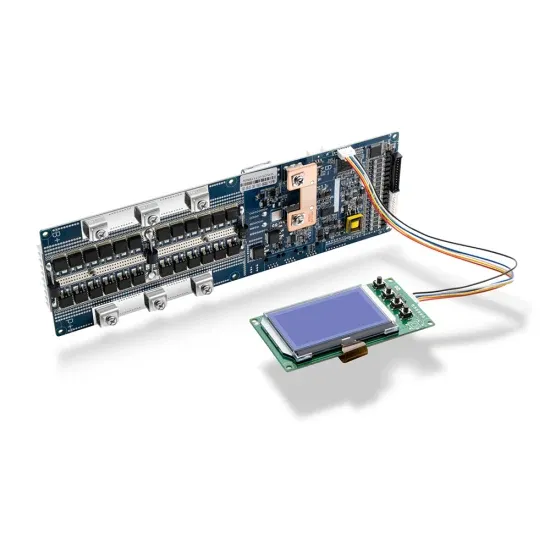

What is a battery management system (BMS)?

Battery Management System (BMS) The Battery Management System (BMS) is the core component of a LiFePO4 battery pack, responsible for monitoring and protecting the battery’s operational status. A well-designed BMS should include: Voltage Monitoring: Real-time monitoring of each cell’s voltage to prevent overcharging or over-discharging.

What makes a good battery management system?

A well-designed BMS should include: Voltage Monitoring: Real-time monitoring of each cell’s voltage to prevent overcharging or over-discharging. Temperature Management: Built-in temperature sensors to monitor the battery pack’s temperature, preventing overheating or operation in extreme cold.

Learn More

- Nordic Communication Base Station Flow Battery Construction Regulations

- The company that provides battery energy storage system equipment for Paramaribo communication base station

- Battery room optical exchange box for communication base station

- Communication base station flow battery cost details

- Communication base station flow battery power supply solution

- Dominica Aviation Tower Communication Base Station Battery Energy Storage System Project

- Working Principle of Wireless Communication Base Station Battery Energy Storage System

- How far is the distance of communication base station battery power generation

- Communication base station battery parallel connection method

Industrial & Commercial Energy Storage Market Growth

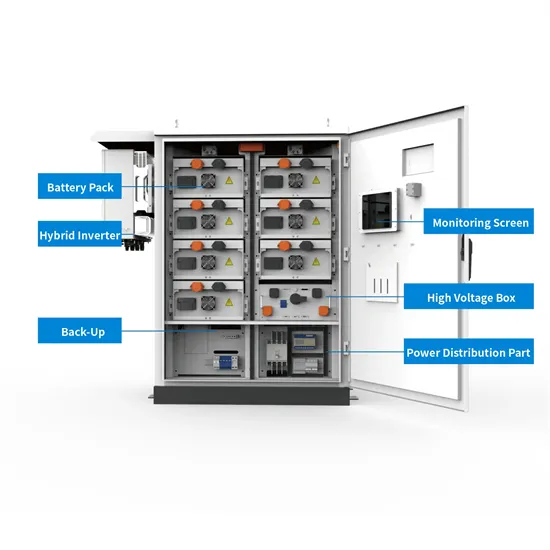

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.