Southeast Asia''s emerging energy storage opportuniti

Dec 17, 2022 · Southeast Asia''s emerging energy storage opportunities Southeast Asia''s emerging energy storage opportunities Southeast Asia | There has been an uptick in energy

Current Status, Future Prospects, and Existing Challenges of Power

Jun 5, 2025 · Energy storage facilities lag far behind, with Southeast Asia accounting for only 1% of global energy storage installations in 2023, well below levels in Europe and the United States.

Unlocking the potential of Battery Energy Storage Systems

12 hours ago · As Southeast Asia continues to experience rapid economic growth and urbanization, the demand for reliable and sustainable energy solutions is higher than ever.

Rethinking Energy in Southeast Asia

5 days ago · The Rethinking Energy in Southeast Asia series discusses key global and local factors that shape the energy sector. Driven by national energy strategies, falling installation

Exploring clean, renewable energy sources to

Apr 8, 2025 · The International Energy Authority estimated that energy demand in Southeast Asia is set to surge at an annual rate of 4% through 2035. To fully

Battery energy storage systems: Southeast Asia''s key to

By providing flexible, reliable, and scalable power, BESS enables Southeast Asia to overcome traditional infrastructure limitations and embrace a sustainable future. What role will BESS play

Top 10 Energy Storage Companies in Asia

Jul 14, 2025 · Explore our list of the top energy storage companies in Asia, driving the continent''s renewable energy revolution. ENGIE UK is a utility company and Independent Power Producer

South East Asia: The coming solar-storage revolution

May 19, 2023 · Why gas-fired power stations should integrate storage However, any headlong dash towards a clean energy economy in South East Asia is certain to present major

Southeast Asia''s Largest Energy Storage System Officially

Feb 2, 2023 · From renewables to innovative energy and urban solutions, we play our part in creating a sustainable and low-carbon future across Asia and the world.

6 FAQs about [Southeast Asian portable energy storage power supply company]

Will Sembcorp build Southeast Asia's largest energy storage system?

Sembcorp Successfully Commissions Southeast Asia’s largest Energy Storage System”, December 23, 2022. Based on independent assurance provider DNV’s global database of 4,210 ESS projects totalling 32GWh and publicly available information as of January 5, 2023 for a comparable size utility-scale ESS (same or higher rating and same design).

What is Sembcorp energy storage system (ESS)?

Singapore, February 2, 2023 – Sembcorp Industries (Sembcorp) and the Energy Market Authority (EMA) today officially opened the Sembcorp Energy Storage System (ESS). The Sembcorp ESS is Southeast Asia’s largest ESS and spans across two hectares of land in the Banyan and Sakra region on Jurong Island.

Who is Tu Energy Storage Technology (Shanghai)?

Safe operation and system performance optimization. TU Energy Storage Technology (Shanghai) Co., Ltd., founded in 2017, is a high-tech enterprise specializing in the research and development, production and sales of energy storage battery management systems (BMS) and photovoltaic inverters.

Are battery energy storage systems revolutionizing energy solutions?

In an article featured on The Business Times, Rodrigo Hernandezvara, Head of Solar C&I at ENGIE highlights how Battery Energy Storage Systems (BESS), combined with renewable energy sources like solar power, are revolutionizing energy solutions for the region.

Will Sembcorp ESS support Singapore's transition to cleaner energy sources?

Mr Ngiam Shih Chun, Chief Executive of the Energy Market Authority, said: “Energy Storage Systems (ESS) such as the Sembcorp ESS will play a significant part in supporting Singapore’s transition towards cleaner energy sources. This large-scale ESS marks the achievement of Singapore’s 200MWh energy storage target ahead of time.

How will Bess help Southeast Asia reshape the energy landscape?

By providing flexible, reliable, and scalable power, BESS enables Southeast Asia to overcome traditional infrastructure limitations and embrace a sustainable future. What role will BESS play in reshaping Southeast Asia’s energy landscape? Explore the insights here.

Learn More

- Mongolia portable energy storage power supply company

- Asian lithium energy storage power supply customization company

- Portable energy storage power supply manufacturer

- Cape Verde portable energy storage power supply

- Niger portable energy storage power supply wholesale price

- 500w outdoor portable energy storage power supply

- Canberra portable energy storage power supply customization

- Tallin Portable Energy Storage Power Supply Price

- Madrid portable energy storage power supply production

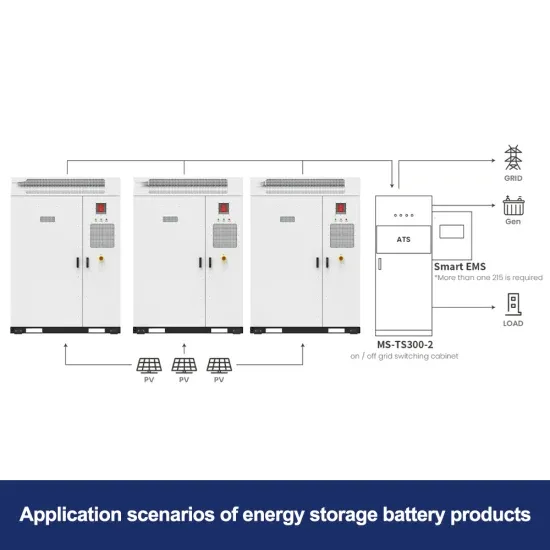

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.