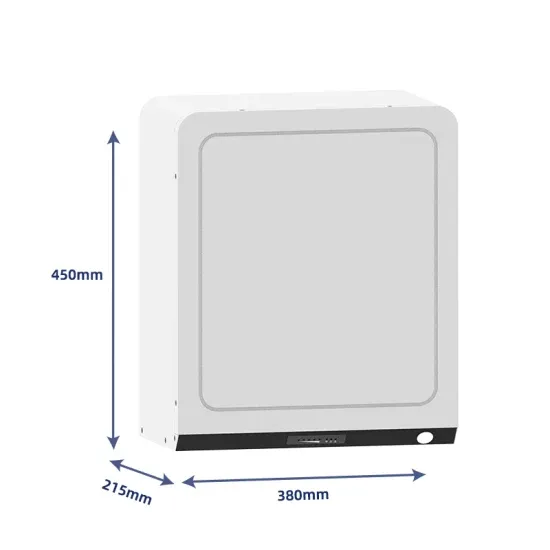

Portable energy storage power supply

The utility model belongs to the technical field of the battery production is made, concretely relates to portable energy storage power supply, which comprises an outer shell, the group battery of

Portable Energy Storage Modules Market Size and Forecasts

Jun 19, 2025 · Key Findings Portable energy storage modules (PESMs) are compact, rechargeable systems that provide off-grid or backup power using lithium-ion, LFP, or other

Energy storage in Spain: Forecasting electricity excess and assessment

Jan 15, 2018 · Given the intermittent behaviour of renewable energy sources (RES), a detailed assessment of future energy scenarios is required to estimate the potential surplus in

Global Portable Energy Storage Power Supply Market

Portable Energy Storage Power Supply is a kind of multi-functional portable energy storage power supply with built-in lithium ion battery, which can store electric energy and have AC output.

Comprehensive review of energy storage systems

Jul 1, 2024 · The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Madrid energy storage power supply customization

overview. Battery Energy Storage Solutions: our expertise in power conversion, power management and quality are your key to a successful project Whether you are investing in

Top 5 Madrid-Based Portable Energy Storage Manufacturers

Summary: Discover Madrid''s leading portable energy storage manufacturers, their competitive advantages, and market trends. Learn how to choose reliable suppliers for outdoor,

Madrid lithium battery energy storage equipment

As the future of energy storage solution, Lithium-ion battery technology, provides sustainable changes in transforming our way to store and consuming energy. Lithium-ion batteries have

Madrid Energy Storage Power Generation: How Spain is

Mar 31, 2020 · Welcome to Madrid''s energy landscape, where solar power and energy storage solutions are rewriting Europe''s renewable playbook. With Spain aiming for 22.5GW of energy

Portable Energy Storage: Devices Driving Energy Independence

Jul 23, 2025 · In a world that increasingly demands mobility, convenience, and energy independence, portable energy storage devices (PESDs) have become indispensable. From

Portable Energy Storage Power Supply 17.3 CAGR Growth

Mar 28, 2025 · The portable energy storage power supply market is experiencing robust growth, projected to reach a market size of $2221.8 million in 2025, expanding at a compound annual

Top 100 Energy Storage Companies in Spain (2025) | ensun

EDP Renewables (EDPR) is a prominent player in the renewable energy sector, specializing in energy storage systems alongside its expertise in wind energy production and solar power.

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

6 FAQs about [Madrid portable energy storage power supply production]

What is the market energy storage in Spain?

The market energy storage in Spain, particularly in relation to the BESS systems (Battery Energy Storage Systems), is undergoing a dynamic and accelerated evolution. This transformation is driven by the growing need to integrate renewable energy sources into the electricity grid, improve supply stability and optimize energy use.

Why do we need battery energy storage systems in Spain?

Due to the large capacity of installed hydroelectric and thermal storage systems and the resilience of the Spanish power grid, the need for Battery Energy Storage Systems (BESS) in Spain has been relatively low. The lack of a clear regulatory framework for BESS has also hindered its development in Spain so far.

How much energy storage capacity does Spain have?

When it comes to installed energy storage capacity in general, Spain is one of the leading countries within Europe (see figure 2). Currently, Spain has 6.3GW of hydroelectric and 1GW of thermal storage capacity installed. In fact, the non-BESS storage capacity in Spain is higher than in any other European country.

How does Spain support the development of energy storage?

To support this growth, Spain has implemented several policies and regulations that encourage the development of energy storage. The Energy Storage Strategy 2030, promoted by the Ministry for the Ecological Transition and the Demographic Challenge, is one of the key initiatives. This strategy aims to achieve a storage capacity of 20 GW by 2030.

Does Spain need a Bess energy system?

Currently, Spain has 6.3GW of hydroelectric and 1GW of thermal storage capacity installed. In fact, the non-BESS storage capacity in Spain is higher than in any other European country. As a result, the need for BESS to integrate renewable energy sources into the electricity system is less immediate than in the UK, for example.

Why is energy storage a problem in Spain?

Despite having a clear strategy and ambitious goals in the sector of energy storage In Spain, subsidies and direct aid specific to these technologies remain limited. This creates a significant barrier for companies and individuals interested in investing in energy storage solutions.

Learn More

- Uzbekistan EK portable energy storage power supply

- Basic box of portable energy storage power supply

- Benin portable energy storage power supply direct sales manufacturer

- Castrie portable energy storage power supply

- Kyrgyzstan energy storage portable power supply manufacturer

- Tallin Portable Energy Storage Power Supply Price

- Nouakchott portable energy storage power supply

- 500w outdoor portable energy storage power supply

- Kazakhstan energy storage portable power supply manufacturer

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.