10 Energy Storage Companies to Know in 2025

Jan 21, 2025 · The race to develop efficient and scalable energy storage systems has never been more crucial. These technologies underpin the transition to a low-carbon future by ensuring

10 New Energy Storage Companies | StartUs Insights

Jan 31, 2025 · Gain data-driven insights on energy storage, an industry consisting of 14K+ organizations worldwide. We have selected 10 standout innovators from 2.8K+ new energy

Top 10 Energy Storage Companies in 2025

Feb 21, 2025 · Below, we take a closer look at some of the top battery manufacturers and their cutting-edge solutions, with Dawnice standing out as a fast-growing force in the global energy

Which companies are the best in energy storage? | NenPower

May 25, 2024 · The best companies in energy storage encompass various sectors that play a pivotal role in advancing technology, delivering reliable solutions, and meeting the growing

100 Top Energy Storage Companies in United States

Aug 1, 2025 · Detailed info and reviews on 100 top Energy Storage companies and startups in United States in 2025. Get the latest updates on their products, jobs, funding, investors,

Top 10 Energy Storage Companies Powering Renewables

Jun 3, 2025 · The top 10 companies driving cutting-edge storage tech and supporting the push toward a safe and decentralized carbon-free future are highlighted in this article. 1. Tesla

New Energy Storage Technologies Empower Energy

Aug 3, 2025 · KPMG China and the Electric Transportation & Energy Storage Association of the China Electricity Council (''CEC'') released the New Energy Storage Technologies Empower

Nation to become a global energy storage powerhouse

Mar 31, 2025 · Workers match up cells at the production line of Chongqing Haichen Energy Storage Technology Co Ltd in Chongqing on Sept 27. [Photo/Xinhua] China''s energy storage

New Energy Storage Plant Ranking: Who''s Leading the

May 30, 2025 · With renewables now supplying over 35% of global electricity, the demand for reliable energy storage systems (ESS) has turned battery makers into rockstars. But how do

Top 10 Energy Storage Companies to Watch in 2025

Aug 13, 2025 · Companies are pushing for longer-duration storage, AI-based optimization, and modular solutions that integrate smoothly with renewable energy sources. These shifts are

10 Leading Energy Storage Companies to Watch in 2025

Companies that deliver sub-3-minute response times and full-stack support are setting a new bar for what ''operations'' means in energy storage. Looking ahead, BESS deployments are

Top 10 Energy Storage startups in USA

2 days ago · Form Energy Funding: $1.6B Form Energy is developing a brand new class of ultra-low cost, long duration energy storage systems. With these new systems, renewables can be

Comprehensive review of energy storage systems

Jul 1, 2024 · The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage companies in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

6 FAQs about [Which company is the best in new energy storage]

What are the best battery energy storage companies?

When it comes to the 10 Best Battery Energy Storage Companies, industry leaders like BYD, Tesla, MANLY Battery, and CATL set the benchmark with cutting-edge technology and global market dominance.

What are the most promising battery storage companies in 2024?

The most common way of storing electricity is with batteries. Various technologies are being developed by promising companies, from lithium to redox flow batteries. Let’s have a look at four most promising battery storage companies in 2024. 1. Alpha ESS Company Profile

Who is shaping the future of battery energy storage?

Leading companies, from BYD, MANLY Battery to Johnson Controls, are playing pivotal roles in shaping the future of battery energy storage through strategic expansions and product innovations.

What are the key innovations in energy storage?

Key Innovation: Advanced lithium-ion batteries for consumer and grid applications. Panasonic’s battery storage solutions provide reliable backup power and enhance renewable energy use, particularly in collaboration with electric vehicle manufacturers. 5. Nostromo Energy Key Innovation: IceBrick thermal energy storage for commercial buildings.

Which companies have pioneered the world's largest lithium-ion battery projects?

Key Innovation: Development of lithium-ion battery projects like Hornsdale Power Reserve. A trailblazer in battery innovation, Neoen has pioneered iconic energy storage installations, including one of the world’s largest batteries in Australia, enabling grid stabilization and renewable energy integration. 3. Enphase Energy

Which country has the most energy storage batteries?

China, in particular, is a major player, with CATL leading globally in battery deliveries for energy storage. The country’s aggressive push to build out its renewable energy capacity is supported by the large-scale implementation of energy storage lithium batteries.

Learn More

- Which is the best new energy storage company in Venezuela

- Which container energy storage company is the best in West Asia

- Which energy storage photovoltaic power generation company is the best in Vietnam

- Which 30kw energy storage company is the best in Kuwait City

- Which is the best emergency energy storage company in Monterrey Mexico

- Which energy storage photovoltaic company is the best in Slovenia

- Which photovoltaic energy storage company is best in Brussels

- Papua New Guinea Home Energy Storage Battery Company

- Which distributed energy storage vehicle is the best

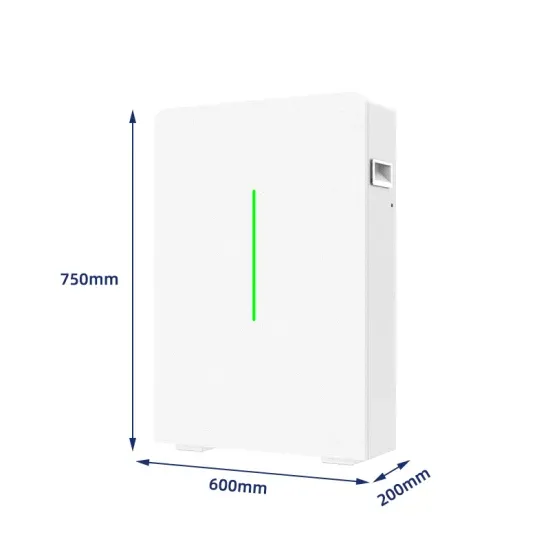

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

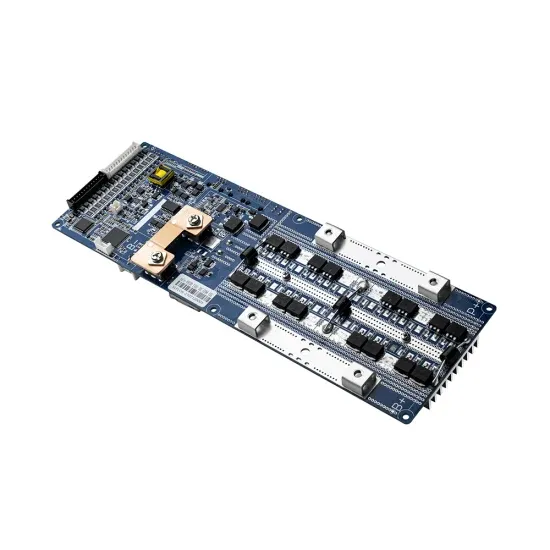

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.