Underlying drivers and barriers for solar photovoltaics diffusion: The

Sep 1, 2020 · Limited transmission grid capacity and complex administrative procedures are among the key barriers. Looking forward, Vietnam has substantial potential to continue to

Rooftop PV with Batteries for Improving Self-consumption in Vietnam

Jan 26, 2024 · In 2021–2022, Shizen Energy, a Japan-based international renewable energy company with a track record of 21 MW wind and 35 MW solar in Vietnam, conducted a similar

From boom to balance in Vietnam''s clean

Jun 17, 2025 · As global costs for solar, wind, and battery storage systems fall, Vietnam could replace fixed feed-in tariffs (FiTs) with standardized competitive

How Battery Energy Storage Systems Can Transform Vietnam''s Energy

Dec 13, 2024 · As Vietnam''s economy grows, the demand for energy is rising rapidly, putting significant pressure on the country''s infrastructure. This surge in demand has exposed

Transition pathways for Vietnam''s major coal-thermal power

Mar 28, 2024 · The study explored viable transition pathways for Vietnam''s major coal-thermal power plants—namely Pha Lai, Cao Ngan, and Van Phong—assessing the potential impacts,

the top ten companies in vietnam s energy storage sector

As the photovoltaic (PV) industry continues to evolve, advancements in the top ten companies in vietnam s energy storage sector have become critical to optimizing the utilization of renewable

Energy Revolution in Vietnam: A New Chapter for the Photovoltaic Energy

Mar 20, 2024 · Marubeni will begin part of its collaboration with feasibility studies of battery energy storage system (BESS) units that may be deployed at Vingroup commercial and industrial

Economic analysis of solar power plant and battery energy storage

May 1, 2025 · The rapid growth of RE sources, particularly PV systems has become a cornerstone of global efforts to transition towards sustainable energy systems. Despite these

Sigenergy Expands Presence in Vietnam with Launch New Products in Vietnam

Hanoi, Vietnam – April 15, 2025 – Sigenergy, a leading energy innovator, held a high-profile product launch event in Hanoi today, unveiling its flagship commercial and industrial (C&I)

Sector Analysis Vietnam

Aug 14, 2025 · At the same time, the demand for battery energy storage systems (BESSs) is accelerating, driven by Vietnam''s abundant renewable energy (RE) potential, particularly in

Opportunities and Challenges in Vietnam''s Photovoltaic

Jul 21, 2023 · Vietnam''s economy is experiencing steady growth, with a notable acceleration in industrialization and an increasing demand for electricity. As a vital component of clean

6 FAQs about [Which energy storage photovoltaic power generation company is the best in Vietnam]

Why is Vietnam a good place to invest in solar energy?

The sunny quality of Vietnam’s climate is actually a good sign right now because it means that this country can be a place where the solar industry can thrive. And the solar industry will thrive because there is already a growing demand for renewable energy nowadays and solar is arguably the most popular choice for renewable energy.

Who makes solar panels in Vietnam?

In particular, the company produces monocrystalline and polycrystalline solar panels with current capacities that range from 3W to 320W. Located in the suburban area of Ho Chi Minh City, Vietnam, Solar Power Vietnam makes use of solar cells from Solar World (Germany) and Suniva (the U.S.A.).

Who are the key players in the solar energy industry in Vietnam?

The Vietnam solar energy sector is moderately dispersed with a number of key players operating within the market. These firms range from local enterprises to multinational corporations, all contributing to the growth and development of the solar energy industry in the country.

Which companies are leading the solar power industry?

Numerous companies globally are making significant strides in the solar power industry. These corporations, which include a mix of public and private entities, are contributing to the growth and development of renewable energy solutions. From Vietnam to Berkeley, these firms are leading the way in providing innovative solar power systems.

Why should you choose a PV service company in Vietnam?

Being led by a mission to constantly strive for the best, high efficiency PV products, as well as supreme value-added services to customers, its focus lies not just on the premium market, but also the average Vietnamese market in terms of maintenance operations.

Who is Dehui solar power?

Dehui Solar Power Co., Ltd. is an emerging force in the renewable energy industry. The company has been passionate about building a vertical supply chain, including solar cells, PV modules, energy storage systems, and project development to share value for a green future.

Learn More

- Which photovoltaic energy storage company is best in Brussels

- Which glass photovoltaic power generation company is the best in Freetown

- The best energy storage method for photovoltaic power generation

- Mogadishu Photovoltaic Energy Storage Power Generation Company

- Which energy storage photovoltaic company is the best in Slovenia

- Shanghai greenhouse photovoltaic power generation energy storage pump

- Kazakhstan Photovoltaic Energy Storage Power Generation Charging Station

- Taipei Photovoltaic Power Generation Project Energy Storage

- Photovoltaic power generation and energy storage microgrid

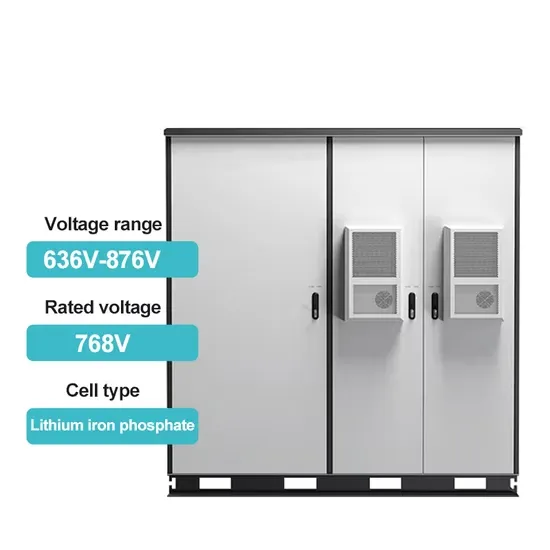

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.