Custom Solar Inverters in Naypyidaw Tailored Solutions for

Discover how customized solar inverters are transforming energy management in Myanmar''s capital – and why flexibility matters more than ever. With annual sunlight exceeding 2,800

List of 13 Registered Companies in Naypyidaw, Myanmar

Top verified registered companies in the Naypyidaw, Myanmar. Companies near me, Businesses in Naypyidaw, Business directory Naypyidaw, Big companies in Naypyidaw, Corporate

Naypyidaw lithium battery with inverter manufacturer

Naypyidaw battery cell manufacturing companies ranking CATL (Contemporary Amperex Technology Co. Limited) is a Chinese battery manufacturer and technology company that is

艾伏新能源

May 27, 2022 · 近日,艾伏被全球权威研究机构EuPD Research授予"2022顶级光伏品牌"。 EuPD Research凭借深度的市场知识和专业方法,在业界享有广泛盛誉,素来就有"行业风向标"之称

Naypyidaw Energy Storage Solar Power Generation Cost

The cost of the co-located, DC-coupled system is 8% lower than the cost of the system with PV and storage sited separately, and the cost of the co-located, AC-coupled system is 7% lower.

24V Inverters in Naypyidaw Reliable Power Solutions for

Why Choose 24V Inverters in Myanmar''s Capital? Imagine a scorching summer day in Naypyidaw – air conditioners hum, refrigerators work overtime, and sudden power fluctuations threaten

Huawei Naypyidaw Energy Storage Equipment

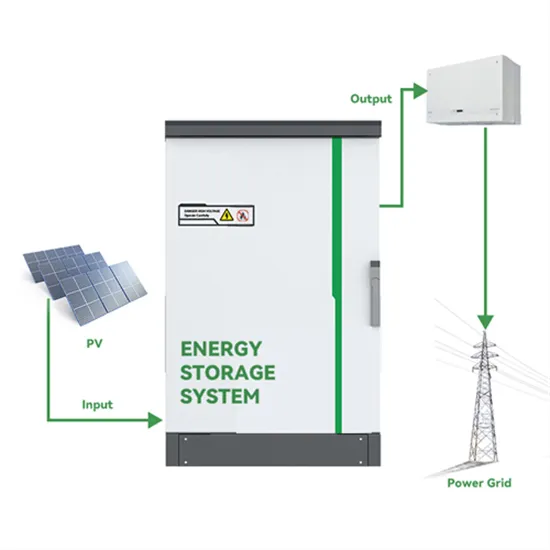

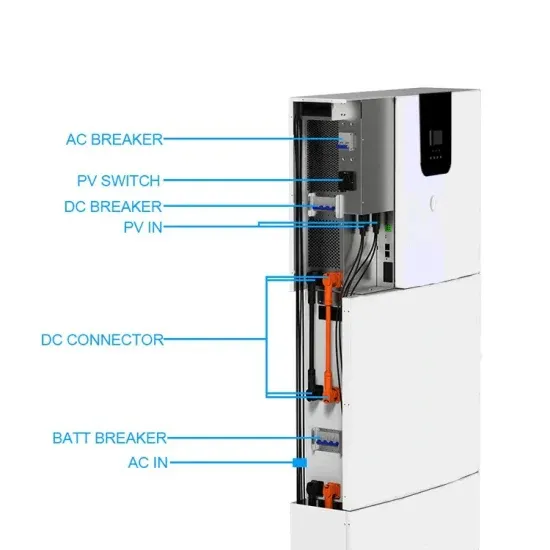

They can intelligently manage the flow of electricity between solar panels, energy storage systems, and the electrical grid. These inverters not only convert the direct current (DC) from

Naypyidaw Solar Inverter Solutions Powering Global Energy

Summary: Discover how solar inverters from Naypyidaw-based manufacturers are reshaping renewable energy systems worldwide. This guide explores technical innovations, market

THE 15 BEST THINGS TO DO IN NAYPYIDAW 2024

What is a 15 kW solar system? These 15 kW size grid-connected solar kits include solar panels, DC-to-AC inverter, rack mounting system, hardware, cabling, permit plans and instructions.

Learn More

- Zambia Photovoltaic Inverter Modification Company

- Luxembourg 50kw photovoltaic inverter company

- 2000w AC inverter

- Photovoltaic inverter quality company

- Communication DC to AC Inverter

- High quality small solar inverter for sale company

- Inverter AC voltage requirement

- DC to AC inverter

- AC voltage measurement of string inverter

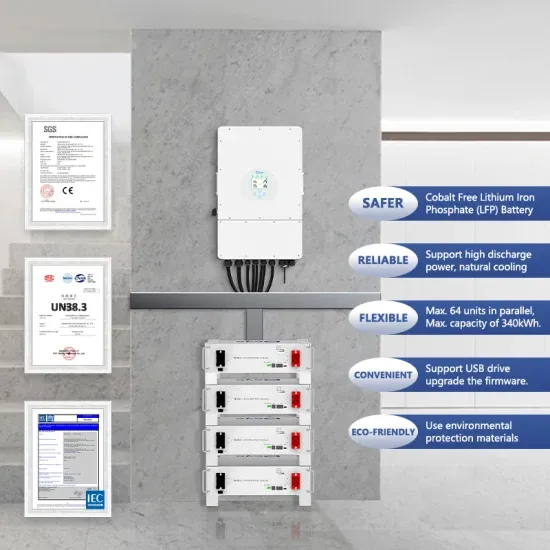

Industrial & Commercial Energy Storage Market Growth

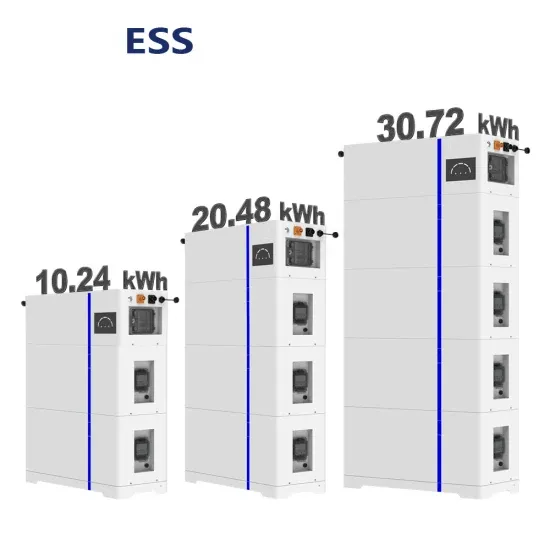

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.