South Africa Has the Critical Minerals, But Is That

Sep 3, 2024 · Mining is unavoidable but needs strong policies in place To become a player in global battery storage requires more targeted policies. A report by

South Africa''s Leading Lithium Battery Manufacturer

about us IG3N (Pty) Ltd is a manufacturing start-up that assembles LiFePO 4 batteries and is currently the "Premier player" [assembler] in the Lithium Iron storage market in South Africa.

Flow batteries offer low-carbon alternative for South Africa telecoms

Sep 18, 2019 · Australia-headquartered flow battery manufacturer Redflow is continuing with a strategy of selling devices into the telecoms sector, agreeing a second deal to repower mobile

Building a local battery industry

Nov 3, 2023 · The company develops energy storage projects and is also localising manufacturing of vanadium redox flow batteries in South Africa. Mikhail also serves as the Chairman of the

Update on Vanadium Flow Battery market, supply chain

Dec 19, 2023 · In the last few years, other flow battery chemistries to gain traction include iron, iron-chrome and zinc-bromine. Some are even looking at vanadium and either iron or chrome

SOUTH AFRICA BATTERY COMPANIES

Despite the higher CapEx cost in contrast to lithium-ion batteries, flow batteries are expected to be used extensively for both front-of-the-meter and behind-the-meter applications in the next

South Africa Battery Companies

This report lists the top South Africa Battery companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and identified these

Flow battery to be paired with solar at South African vanadium

Nov 12, 2020 · A solar-plus-storage microgrid being deployed at an alloys mine in South Africa will feature a vanadium flow battery energy storage system, using locally sourced vanadium

Primus gets South Africa flow battery order from supplier

Apr 25, 2018 · Anglo American Platinum, listed on the Johannesburg Securities Exchange (JSE) with mining, smelting and refining operations in South Africa, will install 200kW / 1,000kWh of

Top 10 Battery Storage Makers Shaping the Continent''s Future

Jun 16, 2025 · Discover the top battery storage manufacturers in Africa shaping the continent''s clean energy future. From BYD to BlueNova, explore the best lithium-ion and clean energy

Africa''s Competitiveness in Global Battery Supply Chains

Nov 1, 2024 · Demand Global battery demand is projected to reach 7.8 TWh by 2035, with China, the US, and Europe representing 80%; Lithium-ion is ~80% of the demand. In Africa, majority

Vanadium Redox Flow Batteries

Oct 2, 2021 · DEPLOYMENT Invested in 2 OEMs2 Invinity3 and Enerox4 With the IDC, identifying support of local VRFB manufacturing in South Africa MW scale energy storage project

South African Renewable Energy Masterplan (SAREM)

Oct 18, 2024 · In South Africa, the early deployment of renewable energy and battery technologies consisted of pilot projects and niche applications, such as the electrification of

FLOW BATTERY | Solar Power Solutions

As a vanadium flow battery, the new energy storage system differs from the common lithium-ion batteries in use in today''s electric vehicles and smartphones. They use massive tanks to store

6 FAQs about [South African flow battery manufacturer]

Who are the leading battery manufacturers in South Africa?

There are profiles of Eveready, Energizer, and Duracell, among other major battery manufacturing companies in South Africa.

Why is afrivolt building Africa's Battery value chain?

Currently, 100% of Li-ion battery cells deployed in Southern Africa are imported, leading to dependence upon increasingly unstable global supply chain inefficiencies. Afrivolt is leading the charge in building Africa’s battery value chain by: acting as an off-taker for locally produced battery minerals

Does redox one have a flow battery in South Africa?

Redox One’s 40 kWh flow battery in use in South Africa Redox One has an additional 5 kW (8 hour) flow battery in use at our Electrolyte Development Center in South Africa. Since September 2023, this battery has been employed to validate our electrolyte development.

Will afrivolt meet Africa's energy storage needs?

Afrivolt is positioned to meet Africa’s energy storage demands, with Southern Africa’s BESS market expected to exceed 70GWh by 2030. The rapid expansion of renewable energy projects presents a huge opportunity for local battery manufacturing.

What makes Fe-Cr redox flow batteries so successful?

They achieve this with our groundbreaking Fe-Cr Redox Flow Battery technology, which is revolutionising the way they harness and store energy. Their innovative technology and mine-to-machine strategy are game changers for power storage solutions. The secret to their success lies in a threefold approach:

Why is local battery manufacturing important?

The rapid expansion of renewable energy projects presents a huge opportunity for local battery manufacturing. Currently, 100% of Li-ion battery cells deployed in Southern Africa are imported, leading to dependence upon increasingly unstable global supply chain inefficiencies.

Learn More

- South Sudan outdoor communication battery cabinet manufacturer ranking

- Australia Sydney flow battery manufacturer

- South Tarawa pack lithium battery custom manufacturer

- South America professional battery cabinet manufacturer

- Lithium-ion battery manufacturer for wireless communication base stations in Tunisia

- Sana 72V battery cabinet manufacturer

- All-vanadium liquid flow battery rate

- Flow battery electrolyte composition

- Vietnam Ho Chi Minh Energy Storage Battery Container Manufacturer

Industrial & Commercial Energy Storage Market Growth

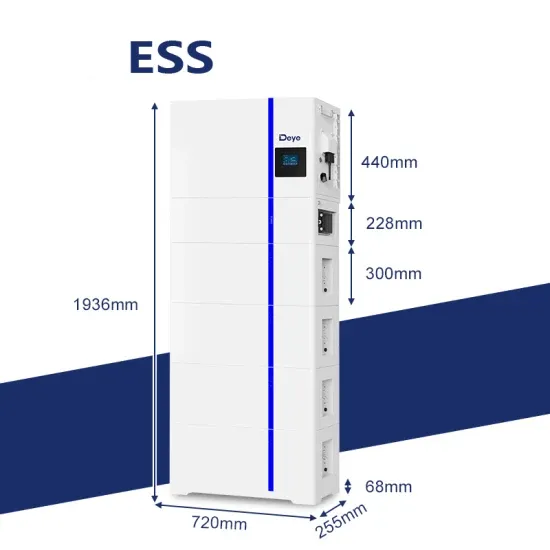

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.