Power plant profile: Luanda Gas Turbine Power Plant, Angola

Apr 25, 2023 · Luanda Gas Turbine Power Plant is a 148MW gas fired power project. It is located in Luanda, Angola. According to GlobalData, who tracks and profiles over 170,000 power

List Of Companies in Luanda

May 5, 2025 · List of Companies in Luanda There are 1068 Companies in Luanda as of May 5, 2025; which is an 2.10% increase from 2023. Of these locations, 1037 Companies which is

Luanda OCGT Power Plant Angola

Aug 17, 2018 · Luanda OCGT Power Plant Angola is located at Luanda, Angola. Location coordinates are: Latitude= -8.8148, Longitude= 13.3077. This infrastructure is of TYPE Gas

Sonangol Luanda Refinery Power Station

A Fortaleza de São Pedro da Barra de Luanda localiza-se no antigo morro de Cassandama, atual bairro de Angola Quiluanje, na cidade de Luanda, província de Luanda, em Angola. Fortaleza

Table of Iranian Nuclear Sites and Related Facilities

1 day ago · Table of Contents Introduction Table 1: Iran''s fuel cycle facilities Table 2: Iran''s undeclared facilities suspected of a connection to its nuclear weaponization effort Introduction

Base Station Components | Radio Comms Warehouse

The NOVA range of power supplies is the most extensive by far. Each unit has been developed over the years incorporating value added features such as metering and adjustable voltage.

List Of Stores in Luanda

May 5, 2025 · List of Stores in Luanda There are 138 Stores in Luanda as of May 5, 2025; which is an 5.30% increase from 2023. Of these locations, 136 Stores which is 98.55% of all Stores

Luanda new energy storage power station

Which thermal power plants will operate in Luanda? The remaining thermal power plants in Luanda will operate as backup. The Caculo Cabaça hydropower plant will be built in phases,

Power Generation in Angola

Jan 3, 2020 · With a current installed capacity of approximately 5,01 GW, three power stations primarily power Angola; Laúca (1000 MW), Capanda (520 MW) and Cambambe (960 MW), as

Presentation to OMT 5th April 2018

Apr 16, 2022 · The AfDB jointly with JICA supported the Government with US$ 1.2 billion through its Power Sector Reform Support Program to support the energy sector reforms undertaken by

Power Plants in Angola (Map) | database.earth

Angola has 14 utility-scale power plants in operation, with a total capacity of 1071.2 MW. This data is a derivitive set of data gathered by source mentioned below. Global Energy

6 FAQs about [How many factories are there in Luanda Power Base Station]

How many power plants are in Angola?

Generation Capacity With a current installed capacity of approximately 5,01 GW, three power stations primarily power Angola; Laúca (1000 MW), Capanda (520 MW) and Cambambe (960 MW), as hydroelectric plants generate nearly two-thirds of Angola’s electricity. Meanwhile, the Luanda OCGT power plant is the only operating gas turbine in the country.

What is the power sector in Angola?

Revised in May 2023, this map provides a detailed view of the power sector in Angola. The locations of power generation facilities that are operating, under construction or planned are shown by type – including liquid fuels, gas and liquid fuels, natural gas, hybrid, hydroelectricity, solar PV, wind and biomass/biogas.

Which OCGT power plant is the only operating gas turbine in Angola?

Meanwhile, the Luanda OCGT power plant is the only operating gas turbine in the country. To meet rising demand, Angola will install 9,900 MW of capacity, with a focus on natural gas and hydropower.

How many transmission lines does Angola have?

Three transmission systems comprise Angola’s national power grid. Through 400kv and 220kv lines, the northern grid encompasses the provinces of Luanda, Uige, Bengo, Zaire, Malange, Kwanza Norte and Kwanza Sul. The central grid runs 400 kV lines from Benguela to Bie and Huambo, while the southern grid covers Huila and Namibe through 220kv lines.

Can Angola reach 60 percent electricity access rate by 2025?

To reach a 60 percent electricity access rate by 2025, the Angola Energy 2025 Vision will augment transmission capabilities through the extension of the electrical grid to urban areas, as well as the promotion of decentralization solutions to provide energy services to rural and off-grid populations.

Why is energy consumption rising in Angola?

In the past decade, energy consumption in Angola has skyrocketed, with an annual growth rate of more than 15 percent due to higher living standards, government efforts to expand electricity coverage and an increase in available generation capacity.

Learn More

- How to use the Mbabane container wind power base station

- How far is the distance of communication base station battery power generation

- How to connect the leads of the base station power cabinet

- How to use the base station battery as a communication power supply

- How to connect the power supply battery of the communication base station

- How to use the 5g base station power supply to receive correctly

- How many volts are normal for charging the base station power supply

- How much does the Muscat base station power module cost

- How much current does the external power supply of the base station have

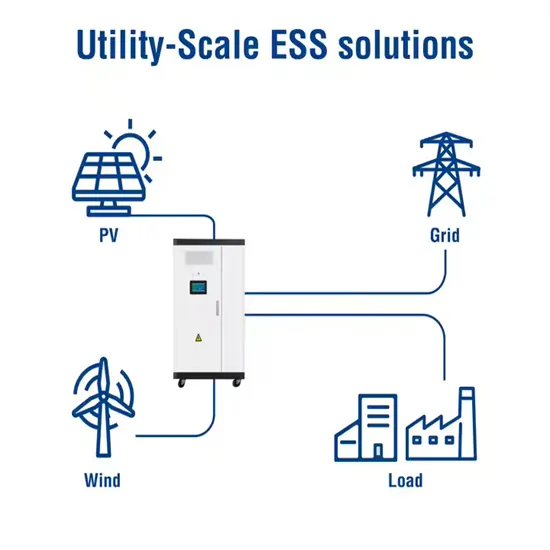

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.