Modular Communications Transceiver for 4G/5G

Apr 1, 2023 · This application report describes the methodology to construct modular 4G/5G distributed antenna systems (DAS) and base stations (BTS). It provides an example of an

A super base station based centralized network architecture for 5G

Apr 1, 2015 · In future 5G mobile communication systems, a number of promising techniques have been proposed to support a three orders of magnitude higher network load compared to what

Power consumption based on 5G communication

Oct 17, 2021 · At present, 5G mobile traffic base stations in energy consumption accounted for 60% ~ 80%, compared with 4G energy consumption increased three times. In the future, high

Overview and Prospects of High Power Amplifier Technology Trend for 5G

May 13, 2021 · Abstract High power amplifier technologies for base transceiver stations (BTSs) for the 5th generation (5G) mobile communication systems and so-called beyond 5G (B5G)

The communication base station architecture development of 2G 3G 4G 5G

(1G) began to develop gradually, and has now developed to the fifth-generation mobile communication system (5G), which begun to be standardized, and be commercially available

What is 5G base station architecture?

Dec 1, 2021 · What are your power requirements? 5G base stations typically need more than twice the amount of power of a 4G base station. In 5G network planning, cellular operators

Smart Base Station Antennas for

Sep 3, 2019 · The challenges that face base station antenna designers for 3G, 4G and 5G mobile networks can be summarized as having a reconfigurable smart antenna that can operate in

Carbon emissions and mitigation potentials of 5G base

Jul 1, 2022 · Compared to traditional infrastructures, such as railways, highways, and airports, ''new'' infrastructure, such as fifth-generation (5G) base stations, has significantly enhanced

Study on Power Feeding System for 5G Network

Oct 24, 2019 · Development of communication technology Since the 1980s, global wireless communications have undergone changes from 1G to 4G per 10-year cycle. 1G(1980''s) Voice

Ambitious 5G base station plan for 2025

Dec 28, 2024 · Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base

5G Mobile Communication Systems: Fundamentals,

Sep 2, 2018 · Wireless and mobile communication technologies exhibit remarkable changes in every decade. The necessity of these changes is based on the changing user demands and

Cell sites and cell towers in a mobile cellular

Nov 17, 2019 · These cells are created by the radiations from the cell towers owned by mobile operators. Our cellular service providers employ various 2G,

Simulating 4G/5G base stations and terminals based on

System principle: Using LW-USRP/SDR-LW software radio hardware, combined with srsRAN, OpenAirInterface5g and other software platforms, to achieve the construction of 4G/5G analog

6 FAQs about [Mobile communication 4g and 2 5g base stations]

What is a 5G base station?

Base station is a stationary trans-receiver that serves as the primary hub for connectivity of wireless device communication. The architecture of the 5G network must enable sophisticated applications, which means the base stations design required must also be specialist.

What are the architectures of 2G & 3G mobile networks?

A technical overview of the architectures of 2G, 3G, 4G, and 5G mobile networks. 1. Architecture: Mobile Station (MS): Represents the mobile device used by the subscriber. Base Transceiver Station (BTS): Responsible for the radio communication with the mobile device.

What are the differences between 5g and 4G base stations?

There are great differences between 5G and 4G base stations in a number of areas, which together empower 5G to offer better speeds, lower latency, and higher connection density. The differences are reflected in the following areas: 5G base stations adopt a more flexible architecture that supports network slicing and virtualization technologies.

What is a base station in a GSM network?

The cell towers or base stations are called Base Transceiver Stations or BTS in 2G GSM networks, Node B in 3G UMTS networks, eNodeB in 4G LTE networks and gNodeB or ng-eNodeB in 5G NR networks. In the second generation of mobile networks powered by GSM technology, the base stations are called Base Transceiver Stations or BTS for short.

What are the differences between a 5G base station and virtualization?

The differences are reflected in the following areas: 5G base stations adopt a more flexible architecture that supports network slicing and virtualization technologies. Network slicing can make the network dynamically adjust resource allocation according to the demands of different services, improving the flexibility and efficiency of the network.

Why are base stations important in cellular communication?

Base stations are important in the cellular communication as it facilitate seamless communication between mobile devices and the network communication. The demand for efficient data transmission are increased as we are advancing towards new technologies such as 5G and other data intensive applications.

Learn More

- Are all the communication base stations in Cyprus 5G

- Communication 5g base stations lag behind

- How many 5g communication base stations are there in London

- Are there the most 5G base stations in communication

- How to view 5g communication base stations

- Are there many 5G communication base stations in Castries

- What are the uninterrupted power supplies for offshore 5G communication base stations

- Cape Verde Mobile Company 5G communication signal tower base station

- Communication has base stations but no 5G

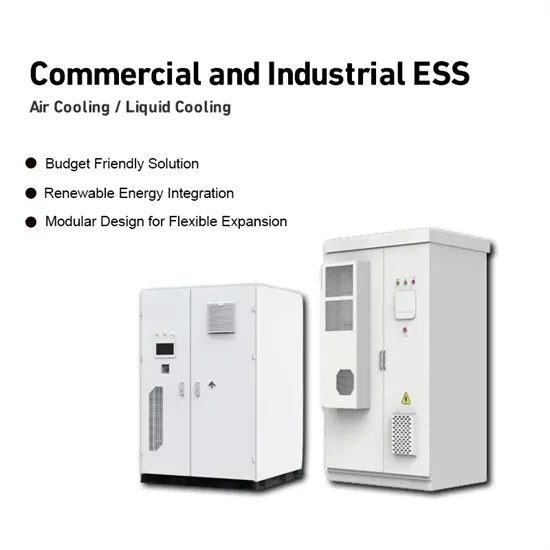

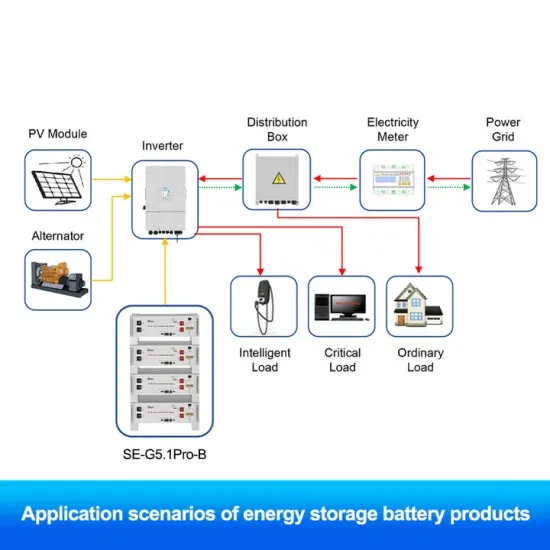

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

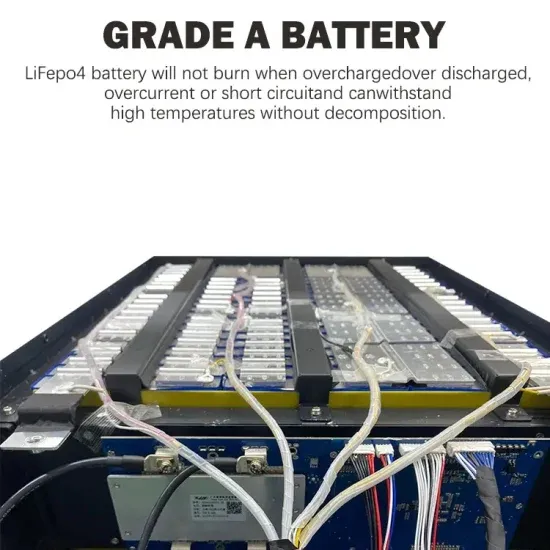

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.