Dynamical modelling and cost optimization of a 5G base station

May 13, 2024 · A cellular network, also known as a mobile network, is a form of wireless communications that operates over discrete geographic areas, or "cells", each of which is

A super base station based centralized network architecture for 5G

Apr 1, 2015 · In future 5G mobile communication systems, a number of promising techniques have been proposed to support a three orders of magnitude higher network load compared to what

Why Is Base Station Analysis Crucial for 5G Network

Apr 21, 2025 · A base station connects mobile devices to the broader telecommunications network, ensuring seamless voice and data transmission. With 5G networks relying on a

Small cell base station design resources | TI

Our integrated circuits and reference designs help you create small cell base stations that enable multiband operation, higher bandwidth and better system reliability. Our analog front-end

COMONENTS OR 5G BASE STATIONS AND ANTENNAS

the need for true 5G network architecture. The number of base stations needed increases with each generation of mobile technolo y to support higher levels of data trafic. Antenna systems

Murata-Base-station-app-guide

Sep 30, 2022 · Until recently, 5G integration has primarily focussed on large-scale base stations and buildings, but the next stage will focus more on smaller-scale sites that can fill the gaps in

Energy-efficient indoor hybrid deployment strategy for 5G mobile small

May 1, 2024 · In the context of 5th-generation (5G) mobile communication technology, deploying indoor small-cell base stations (SBS) to serve visitors has become common. However, indoor

Base Station Antennas for the 5G Mobile System

Dec 19, 2018 · The fifth-generation (5G) mobile communication system will require the multi-beam base station. By taking into account millimeter wave use, any antenna types such as an array,

(PDF) Review on 5G Small Cell Base Station Antennas

Jan 1, 2024 · Small-cell Base Station (SBS) antennas are crucial for exploring the full potential of 5G networks by expanding the network in urban areas, densely populated regions, indoor

5g base station architecture

Dec 13, 2023 · 5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

Small Cells: 5 Advantages and Disadvantages

Small cells are crucial for high-speed broadband and low-latency applications in LTE-Advanced and 5G NR deployments. They are essentially miniature base stations that divide a cell site

Chapter 2: Architecture — Private 5G: A Systems

Jul 3, 2025 · To further confuse matters, 3GPP terminology often changes with each generation (e.g., a base station is called eNB in 4G and gNB in 5G). We

有道翻译_文本、文档、、在线即时翻译

有道翻译提供即时免费的中文、英语、日语、韩语、法语、德语、俄语、西班牙语、葡萄牙语、越南语、印尼语、意大利语、荷兰语、泰语全文翻译、翻译、文档翻译、PDF翻译、DOC

5G Network Equipment Manufacturers: Modem, Base Station

5G RAN The 5G Radio Access Network (RAN) is the interface between user devices and the 5G core network. It comprises base stations and small cells that manage radio communications,

6 FAQs about [Communication 5g small home base station settings]

Why do small cells use low-powered 4G & 5G base stations?

These small cells commonly use low-powered 4G and 5G base stations designed to increase localized network capacity and improve coverage. However, with base stations deployed in small cell configurations, there is a risk of overlapping signal interference, which can reduce network capacity and degrade service quality.

Will a 4G base station be upgraded to a 5G network?

ation components and antenna mast systems. Upgrading 4G base stations by software to non-standalone (N A) 5G will still require hardware changes. It will act as an interim, but it will still not satisfy the need for true 5G network architecture. The number of base stations needed increases with each generation of mobile technolo

Why do we need a True 5G network architecture?

the need for true 5G network architecture. The number of base stations needed increases with each generation of mobile technolo y to support higher levels of data trafic. Antenna systems will also need to evolve to handle increases in capacity, frequency ranges and the ability to minim

Does 5G still require hardware changes?

HNOLOGY MANUFACTURERS FACE A CHALLENGE. With the demand for 5G coverage accelerating, it’s a race to build and deploy base-s ation components and antenna mast systems. Upgrading 4G base stations by software to non-standalone (N A) 5G will still require hardware changes. It will act as an interim, but it will still not satisfy

What is a 5G antenna?

l.Typically used: internal circuit boardsThe types of antenna used in mobile communication already vary.But 5G antenna design is a difer nt animal than what we’re familiar with. It has to be in order to deliver the speeds up to 100 times faster than 4G. This usually involves MIMO antenna

What is a 5G cable grommet?

ideal for your 5G small-cell base station. These cable grommets also act as blanking plug until binetsADJUSTABLE DRAW LATCHESView onlineDesigned for flexibility and the secur ty needed for an external telecom cabinet. The secondary locking button prevents accidental opening while also performing as a compres

Learn More

- Communication 5g home base station settings

- Small base station 5g communication equipment installation

- HJ Battery Communication Home Small Base Station

- Guatemala Big Communication 5g base station

- Panama s first 5G communication base station

- South America Communication 5g base station signal

- Cameroon 5MWH liquid-cooled communication 5g base station

- Jakarta 5g communication base station inverter grid-connected energy storage

- 5g communication base station project

Industrial & Commercial Energy Storage Market Growth

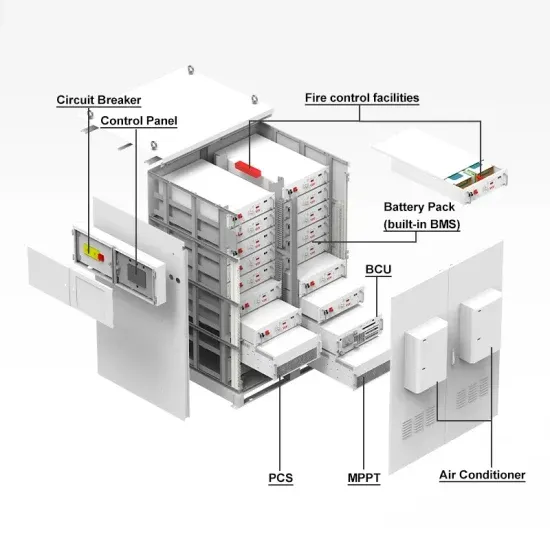

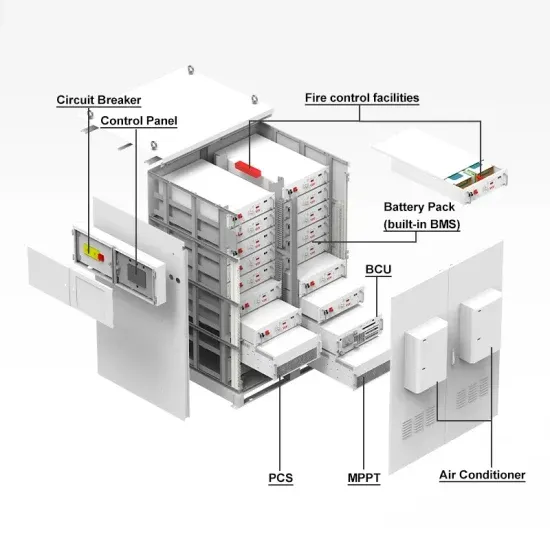

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

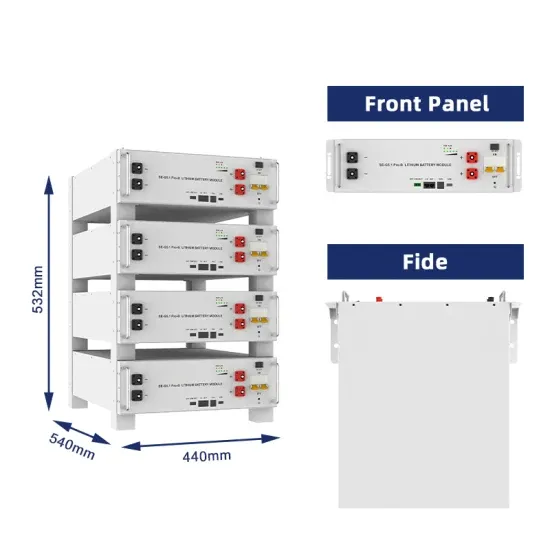

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.