Global Communication Base Station Battery Supply, Demand

The global Communication Base Station Battery market size is expected to reach $ million by 2030, rising at a market growth of % CAGR during the forecast period (2024-2030).

Battery for Communication Base Stations Market

The global rollout of 5G infrastructure directly amplifies battery demand, as each 5G base station consumes 2-3× more power than 4G systems due to massive MIMO antennas and higher

Communication Base Station Backup Power Supply / LifePO4 Battery

Apr 19, 2023 · A life PO4 battery manufacturer can provide communication base station backup power supplies that are custom-designed to meet the specific requirements of the

China Custom Communication base station battery Manufacturers Suppliers

The structure of our outdoor portable power supply, 32700 lifepo4 battery, Battery storage cabinet, Outdoor energy storage is ahead of similar domestic instruments, and the design

Communication Base Station Li-ion Battery Market

Quick Q&A Table of Contents Infograph Methodology Customized Research Key Drivers Accelerating Li-ion Battery Adoption in Communication Base Stations The transition to lithium

What is the purpose of batteries at telecom base

Feb 10, 2025 · The lead storage battery is the most widely used energy storage battery in the current communication power supply. Among the many types of

Global Battery For Communication Base Stations Market

China is the largest producer of Battery For Communication Base Stations, followed by South Korea and Japan. This latest report researches the industry structure, capacity, production,

Global Battery for Communication Base Stations Market

Jul 31, 2025 · The global Battery for Communication Base Stations market is projected to grow from US$ 1692 million in 2024 to US$ 3129 million by 2031, at a CAGR of 9.3% (2025-2031),

China High Quality Communication Base Station Suppliers

Dec 1, 2024 · The Communication Base Station is a versatile device that acts as a wireless repeater, enhancing the range and quality of communication signals. It is designed to be

China Communication Station, Communication Station

The Communication Station is classified under our comprehensive Storage Battery range llaborating with a manufacturer for custom storage batteries allows you to tailor

Telecom Battery Backup System | Sunwoda Energy

A telecom battery backup system is a comprehensive portfolio of energy storage batteries used as backup power for base stations to ensure a reliable and stable power supply. As we are

China Communication Base Station Backup Power Supply

Mar 5, 2025 · DAW is one of the most professional energy storage battery manufacturers and suppliers in China, featured by quality products and good service. Please feel free to

Communication Base Station Battery Manufacturers & Suppliers

communication base station battery manufacturers/supplier, China communication base station battery manufacturer & factory list, find best price in Chinese communication base station

Lithium-ion Battery For Communication Energy Storage System

Aug 11, 2023 · If so, let''s get to know the right LiFePO4 manufacturers? Specialist Suppliers - We keep comprehensive stocks across the range and and offer excellent technical back-up,

6 FAQs about [Managua communication base station battery supplier]

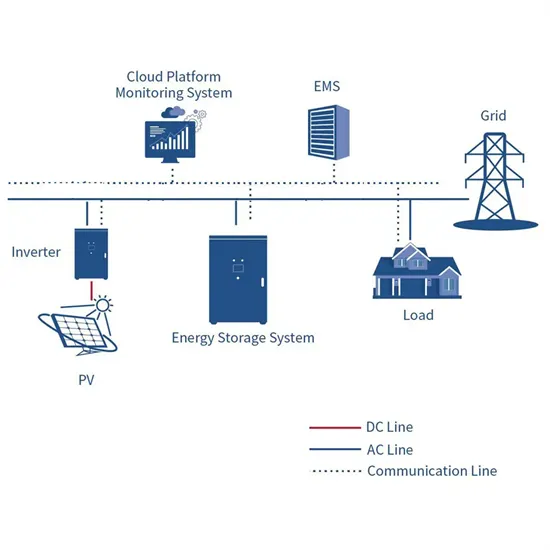

What is a telecom battery backup system?

A telecom battery backup system is a comprehensive portfolio of energy storage batteries used as backup power for base stations to ensure a reliable and stable power supply. As we are entering the 5G era and the energy consumption of 5G base stations has been substantially increasing, this system is playing a more significant role than ever before.

Which battery is best for telecom base station backup power?

Among various battery technologies, Lithium Iron Phosphate (LiFePO4) batteries stand out as the ideal choice for telecom base station backup power due to their high safety, long lifespan, and excellent thermal stability.

What makes a telecom battery pack compatible with a base station?

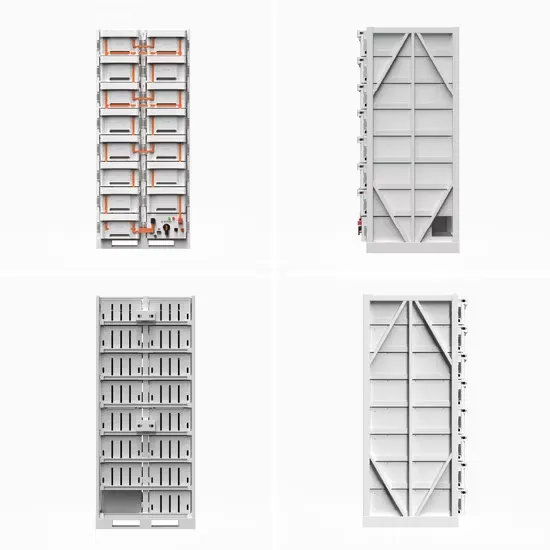

Compatibility and Installation Voltage Compatibility: 48V is the standard voltage for telecom base stations, so the battery pack’s output voltage must align with base station equipment requirements. Modular Design: A modular structure simplifies installation, maintenance, and scalability.

Should telecommunication operators invest in a telecom battery backup system?

Investing in a telecom battery backup system is always one of the priorities for telecommunication operators in the 5G era. Sunwoda 48V telecom batteries have a capacity covering 50Ah-150Ah, which can easily meet the power backup needs of macro and micro base stations.

What is a battery management system (BMS)?

Battery Management System (BMS) The Battery Management System (BMS) is the core component of a LiFePO4 battery pack, responsible for monitoring and protecting the battery’s operational status. A well-designed BMS should include: Voltage Monitoring: Real-time monitoring of each cell’s voltage to prevent overcharging or over-discharging.

What makes a good battery management system?

A well-designed BMS should include: Voltage Monitoring: Real-time monitoring of each cell’s voltage to prevent overcharging or over-discharging. Temperature Management: Built-in temperature sensors to monitor the battery pack’s temperature, preventing overheating or operation in extreme cold.

Learn More

- Sao Tome and Principe LTE emergency communication base station flow battery supplier

- Suriname communication base station battery energy storage system supplier

- Battery installation for communication base station

- Tokyo communication base station battery energy storage system hybrid power supply

- Nordic Communication Base Station Flow Battery Construction Regulations

- Communication base station battery series multiplexing equipment

- Communication base station lead-acid battery sales information

- Dominica Aviation Tower Communication Base Station Battery Energy Storage System Project

- Communication base station battery parallel connection method

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.