The Global Supercapacitors Market 2026-2036

1 day ago · Published: August 2025 Pages: 352 Tables: 62 Figures: 22 The global supercapacitors market stands at a pivotal juncture, poised for substantial growth as industries

Rice straw -derived lignin-based carbon nanofibers as self

Jan 1, 2025 · The influence of lignin content on the on the structural, morphological, and electrochemical properties of the carbon nanofibers were examined, particularly in their

Supercapacitor Activated Carbon Market | Size, Price, import,

Supercapacitor Activated Carbon Global Supercapacitor Activated Carbon market was valued at USD 139 million in 2024 and is projected to reach USD 259 million by 2031, at a CAGR of 9.5%.

Green and theft-proof – Why supercapacitor

Jun 30, 2025 · Hailed as a revolution in power storage, lithium-ion batteries are a $70 billion industry, expected to grow to up to $400 billion by 2032. However,

Supercapacitors: A new source of power for electric cars?

Mar 1, 2019 · The active materials of present supercapacitors are based on porous carbon or carbon compounds, which are more abundant and are obtained with lower environmental

A review of carbon materials for supercapacitors

Sep 1, 2022 · Carbon materials are the most commonly used electrode materials for supercapacitors and the researches of carbon materials are significant for developing

Activated Carbon Powder for Supercapacitor Market

May 25, 2025 · Key Demand Drivers for Activated Carbon Powder in the Supercapacitor Industry by Region The supercapacitor industry''s reliance on activated carbon powder stems from its

Supercapacitor Activated Carbon Market Size [2025 To 2033]

Jul 28, 2025 · Supercapacitor Activated Carbon Market Size, Share, Growth, and Industry Analysis by Type (Under 1500 m2/g, 1500-1900 m2/g, 2000-2200 m2/g, Above 2200 m2/g and

Supercapacitors: Mapping Out the Complex Ecosystem | TTI,

Sep 18, 2024 · The high capacitance of a supercapacitor under a controlled release can either be used to (1) replace more expensive batteries (lithium-ion) for memory protection in low voltage

Exploring recent advances in the versatility and efficiency of carbon

The study systematically evaluates various forms of carbon, including ACs, graphene, CNTs, CA, xerogels, template-derived carbons, heteroatom-doped carbons, and waste-derived carbons,

Activated Carbon Supercapacitor Manufacturers & Suppliers

activated carbon supercapacitor manufacturers/supplier, China activated carbon supercapacitor manufacturer & factory list, find best price in Chinese activated carbon supercapacitor

Supercapacitors: Overcoming current limitations and

Jan 25, 2025 · Their recyclability and extended lifespan compared to batteries make them environmentally advantageous. Despite their numerous advantages, the primary limitation of

A comprehensive review of lithium ion capacitor:

Feb 1, 2021 · The supercapacitors group includes EDLCs and pseudo-capacitors [20]. In EDLCs, the mechanism of energy storage is based on the physical sorption of ions at the electrode''s

6 FAQs about [Lithium Carbon Supercapacitor Price]

Are lithium batteries supercapacitors a thing?

If you have a hybrid vehicle, and it requires lithium-ion batteries, you can go for lithium-ion capacitors. Yes, they are a thing and they are a combination of the best of both worlds. Other than that, you cannot replace your batteries with a capacitor, no matter even if it is a super cap. Are lithium batteries supercapacitors? No.

What is the market size of lithium rechargeable cells & supercapacitors?

The market size for all supercapacitors was about $3 billion in 2020 and (depending on the source of research) is expected to grow 14% to 20% per year between 2021 and 2027. A pure and basic comparison of the characteristics of lithium rechargeable cells and supercapacitors looks like this: In the chart, there are many facts to digest.

What makes a supercapacitor energy efficient?

The energy-efficient functionality is enabled by a supercapacitor, an electronic device that is traditionally composed of carbonaceous material such as activated carbon and metal oxide such as ruthenium oxide as the major components in order to store and provide energy.

Why should you trade with Iosco-compliant lithium price data?

Trade with lithium price data that is unbiased, IOSCO-compliant and widely used across the energy commodity markets. Our lithium prices are market-reflective, assessing both the buy- and sell-side of transactions.

Who provides the lithium commodity price?

We provide the lithium commodity price for the following: Fastmarkets’ mission is to meet the market’s data requirements honestly and independently, acting with integrity and care to ensure that the trust and confidence placed in the reliability of our pricing methodologies is maintained.

What is a lithium futures contract?

The new lithium futures [contract] will provide our customers with another tool for managing the price risk associated with the manufacturing of electric vehicles. Get long-term clarity and market intelligence in the critical lithium market Understand the battery material demands of today and plan for tomorrow Trade on market-reflective prices

Learn More

- Lithium battery supercapacitor price comparison

- Supercapacitor price in Kigali

- Costa Rica regular lithium battery pack factory price

- Sao Tome lithium energy storage power supply sales price

- Kyrgyzstan cylindrical lithium battery price

- Lithium energy storage power price in Johannesburg South Africa

- What is the price of lithium iron phosphate battery pack

- Riga lithium energy storage power supply sales price

- Paraguay supercapacitor module price

Industrial & Commercial Energy Storage Market Growth

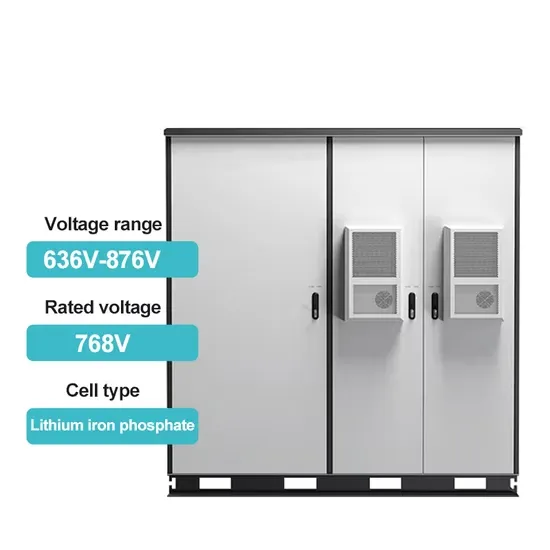

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.