Lithium-Ion Battery Pack Prices Hit Record Low

Nov 26, 2023 · For battery electric vehicle (BEV) packs, prices were $128/kWh on a volume-weighted average basis in 2023. At the cell level, average prices for

How much does the Bissau lithium energy storage power

As of recent data, the average cost of a BESS is approximately $400-$600 per kWh. Here''s a simple breakdown: This estimation shows that while the battery itself is a significant cost, the

Guinea-Bissau lithium battery test line price

Shop 12V 100Ah LiFePO4 Lithium Battery (2-Pack), 4000~15000 Deep Cycle Lithium Iron Phosphate Battery, Built-in 100A BMS, Support in Series/Parallel, for RV, Camping, Trolling

Guinea-Bissau cabinet energy storage system price

M) HPL Lithium-Ion Battery Energy Storage System. Designed by data center experts for data center users, the Vertiv(TM) HPL battery cabinet brings you cutting edge lithium-ion battery

Manufacturers of rechargeable batteries in Guinea-Bissau

Shop Lir2032 Rechargeable Battery Replace Cr2032 Batteries for Airtag Key Fob Battery with Button Battery Charger 8 Pack- 3.6V Lithium Ion Coin Cell online at a best price in Guinea

Where are EV battery prices headed in 2025 and

3 days ago · Lithium-ion (Li-ion) EV battery prices have decreased dramatically over the past few years, mainly due to the fall in prices of critical battery

Price of selected battery metals and lithium-ion battery

Aug 15, 2025 · IEA analysis based on data from Bloomberg and Bloomberg New Energy Finance Lithium-Ion Price Survey (2024). "Battery pack price" refers to the volume-weighted average

Bissau standard lithium battery pack ex-factory price

Deep Cycle 12V 200AH lithium battery for Solar RV EV The 12V 200AH lithium battery BSLBATT® offers high-level safety through the use of rhombus cells in Lithium Phosphate

Guinea-Bissau lithium battery outdoor power supply

China''''s Leading Custom Lithium Battery Manufacturer Vade Battery offers Custom Rechargeable 18650, Li-ion battery, Lithium polymer and LifePo4 Battery Pack for Customers World-widely,

Guinea-Bissau lithium iron phosphate battery specifications

Shop 12V 100Ah LiFePO4 Lithium Battery (2-Pack), 4000~15000 Deep Cycle Lithium Iron Phosphate Battery, Built-in 100A BMS, Support in Series/Parallel, for RV, Camping, Trolling

Guinea-Bissau bnef battery storage

BloombergNEF''''s Battery Price Survey predicts that pack prices for stationary storage and electric vehicles (EVs) will fall to $101/kWh within three years. Average pack prices have sat at around

Guinea-Bissau battery price trend analysis chart

Lithium-ion battery prices (including the pack and cell) represent the global volume-weighted average across all sectors. Nickel prices are based on the London Metal Exchange, used here

Bissau regular lithium battery pack reference price

Lightweight and long-lasting, this ExpertPower lithium battery takes the hassle out of micromanaging your golf cart''''s power, providing you instead with the simplistic joy of lithium

Prices of Lithium Batteries: A Comprehensive Analysis

Apr 11, 2025 · Lithium battery prices fluctuate due to raw material costs (e.g., lithium, cobalt), manufacturing innovations, geopolitical factors, and demand surges from EVs and renewable

6 FAQs about [Bissau lithium battery pack price]

How much does a lithium battery cost in China?

Meanwhile, the stationary storage market has surged, with intense competition among cell and system suppliers, particularly in China. Regionally, the average prices of lithium battery packs were lower in China, at $94 per kWh, while prices in the U.S. and Europe were 31% and 48% higher, respectively.

How much does a lithium battery cost in 2024?

In 2024, the average global prices of lithium-ion batteries dropped by 20%, reaching $115 per kWh. For electric vehicle batteries, the price fell below $100 per kWh Why Are Lithium Battery Prices Falling?

How much does a lithium ion battery cost?

The electric vehicle market, the primary driver for lithium-ion batteries, grew more slowly than in previous years but still showed the lowest price at $97 per kWh. Meanwhile, the stationary storage market has surged, with intense competition among cell and system suppliers, particularly in China.

How much does a battery cost in 2023?

The figures represent an average across multiple battery end-uses, including different types of electric vehicles, buses and stationary storage projects. For battery electric vehicle (BEV) packs, prices were $128/kWh on a volume-weighted average basis in 2023. At the cell level, average prices for BEVs were just $89/kWh.

How much does lithium iron phosphate cost?

The industry continues to switch to the low-cost cathode chemistry known as lithium iron phosphate (LFP). These packs and cells had the lowest global weighted-average prices, at $130/kWh and $95/kWh, respectively. This is the first year that BNEF’s analysis found LFP average cell prices falling below $100/kWh.

Why did lithium spodumene prices drop?

The most significant drop was in LFP cells for stationary storage systems, which saw a 6.4% monthly decrease, reaching a price of 0.35 CNY/Wh ($0.049/Wh). The drop in prices is linked to the weak market for battery metals such as nickel, cobalt, and lithium, particularly lithium spodumene, which saw a sharp drop, falling 16% quarter-over-quarter.

Learn More

- Akla 26650 lithium battery pack price

- Dushanbe professional lithium battery pack factory price

- Xia flashlight lithium battery pack price

- Reference price of Ethiopian quality lithium battery pack

- 16 cells to make a lithium battery pack

- What is the average lifespan of a lithium battery pack

- 1850 lithium battery pack capacity 20ah

- 20Ah lithium battery pack

- What shock absorption is used for lithium battery pack

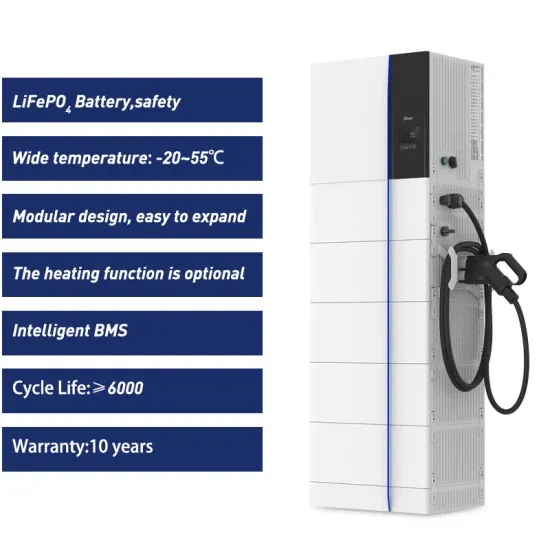

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.