How can individuals invest in energy storage projects?

Sep 7, 2024 · Investors are increasingly recognizing the potential for profit in energy storage. This growth is driven by falling costs for energy storage technologies, particularly battery systems,

Why More European Households Are Installing Home Energy Storage

Across Europe in 2025, home energy storage systems are becoming a vital part of modern households. Driven by high electricity prices, a surge in solar panel installations, growing eco

12 Best Energy Storage Stocks to Buy in 2025

Mar 21, 2022 · Energy storage is crucial for China''s green transition, as the country needs an advanced, efficient, and affordable energy storage system to respond to the challenge in

Meeting Ukraine''s Home Energy Needs: Why Advanced Storage

Jan 29, 2025 · Microgrids and Community Storage Shared Resources: Neighborhoods can pool resources to fund larger, more efficient energy storage units, lowering individual costs while

Energy Storage Stocks: Investment Opportunities in

Mar 28, 2025 · Investing in energy storage stocks can lead to substantial returns as demand surges. The sector presents an exciting growth opportunity for investors looking to benefit from

10 Best Rechargeable Energy Storage Solutions for Your Home

May 19, 2025 · As homeowners in 2025, you''re likely exploring reliable energy storage solutions that prioritize efficiency and safety. With advancements in battery technology, you now have

How can individuals invest in energy storage? | NenPower

Apr 30, 2024 · Individuals can invest in energy storage by exploring various avenues, including 1. purchasing stocks in energy storage companies, 2. investing in ETFs focused on clean

Which companies are investing in energy storage? | NenPower

Apr 5, 2024 · The significance of energy storage cannot be overstated, given its capacity to store excess energy produced during peak generation times. This capability allows for a more

Impact Investing into Energy Storage Provides

Apr 13, 2023 · Interested in investing into energy storage? If you are interested in impact investing into energy storage solutions, consider partnering with

How to Invest in Energy Storage and Battery Technologies

Aug 31, 2024 · Investing in energy storage and battery technologies can seem daunting at first, especially if you''re new to the field. However, understanding the basics of energy storage

Home energy storage systems for modern smart homes

Investing in a home energy storage solution means investing in reliability, efficiency, and peace of mind, especially in an era of fluctuating energy prices and increasing concerns about grid

China''s Energy Storage Sector: Policies and Investment

Mar 21, 2022 · Energy storage is crucial for China''s green transition, as the country needs an advanced, efficient, and affordable energy storage system to respond to the challenge in

Home energy storage: How to know if it''s right for you

Aug 29, 2024 · The market for home energy storage could double in the next decade, but it''s not right for everyone. Here''s how to know if it makes sense for you.

Why Invest in a Home Energy Storage System?

Jun 2, 2025 · Explore the key financial benefits of home energy storage systems and learn how HESS can reduce peak demand charges, optimize time-of-use rates, and enhance energy

7 Energy Storage Stocks to Invest In | Investing

Jul 9, 2025 · Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration

How much to invest in energy storage

Jul 23, 2024 · Investing in energy storage also presents opportunities to capitalize on price arbitrage—where energy is purchased during off-peak times and sold or used during peak

Home Energy Storage Systems and Inverters: Technological

Mar 4, 2025 · As global energy transition accelerates and household electricity demands diversify, home energy storage systems (HESS), combined with photovoltaic (PV) self-consumption

12 Best Energy Storage Stocks to Buy in 2025

Apr 4, 2022 · Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth as the demand for renewable energy

How can individuals invest in energy storage and sell

Apr 11, 2024 · Individuals can engage in the investment of energy storage and subsequently sell electricity through various avenues. 1. Understanding energy storage systems enables

Energy Storage Stocks: Investment Opportunities in

Mar 28, 2025 · Anyone looking to invest in energy storage solutions needs a comprehensive understanding of the regulatory landscape and market considerations. Government policies

Home energy storage systems ensure power resilience.

Investing in home energy storage is more than just installing batteries; it is about taking a forward-looking approach to energy that ensures safety, optimizes costs, and contributes to a cleaner

Home energy storage systems for greener futures.

Jun 12, 2025 · Unlock the Power: Why Invest in Home Energy Storage? The decision to integrate home energy storage brings a multitude of benefits that extend far beyond simple

Harnessing Power: The Future of Home Energy Storage

By investing in home energy storage, not only are you saving money, but you''re also contributing to a cleaner environment. Using stored solar energy means reducing reliance on fossil

6 FAQs about [Anyone interested in investing in home energy storage ]

Is energy storage a good investment?

Energy storage is an attractive emerging high-growth sector. It's still wide open with many upcoming companies. The market has seen more pure energy storage players coming online with different technologies. These are often high-risk, high-reward investments. ESS (energy storage solutions) offers a compelling new segment in renewable energy.

Should you invest in battery storage stocks?

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth. As the demand for renewable energy continues to expand, investing in well-known energy storage companies like Tesla, Panasonic, and LG Chem can be a strategic move.

Is investing in energy storage stocks a good idea?

Given the global shift from fossil fuels to renewable energy, which is expected to take about three decades and require massive investment, investing in energy storage stocks has become an attractive option for investors seeking safer returns.

Are battery storage systems a good investment?

With advancements in technology and decreasing costs, battery storage systems are becoming more accessible and efficient, allowing for greater integration of renewable energy sources into the grid and reducing reliance on fossil fuels. Identifying top energy storage stocks in an industry with many players can be challenging.

What are the future opportunities for energy storage?

Energy storage is a fast-emerging sector. Pumped hydro is the most used solution for now. Batteries are the next step to support renewable energy. Lithium technologies lead the way, but many upcoming technologies have different benefits. I provide an overview of possible opportunities.

What are the top energy storage companies?

Energy storage companies specialize in developing and implementing technologies and strategies to store energy for later use. As demand for renewable energy sources like solar and wind power increases, these companies are expected to grow. Some of the top energy storage companies include Tesla, LG Chem, and Fluence Energy.

Learn More

- Home energy storage system composition

- Can a home solar energy storage box be placed

- Western European Home Energy Storage

- Home energy storage cost performance

- Home energy storage expansion

- East Africa Home System Energy Storage Battery

- Nanya Home Energy Storage System Cost

- Which brand of home solar energy storage equipment is good

- Energy storage form suitable for home microgrid

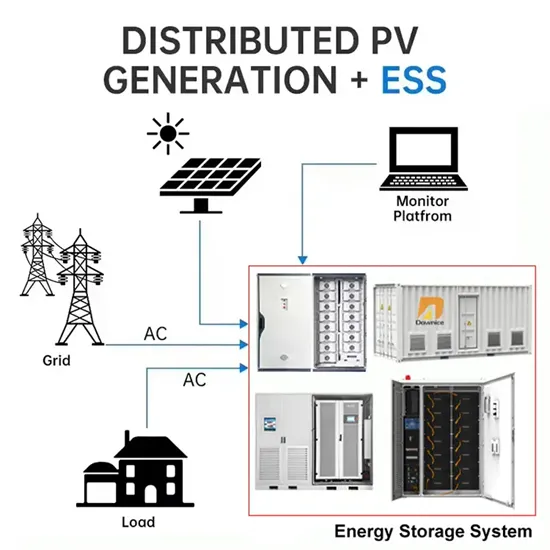

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.