StorEn: Leading the Future of Home Energy Storage

Jul 7, 2025 · Disseminated on behalf of StorEn. With home energy storage demand soaring — projected to power 47% of U.S. homes with rooftop solar by 2050 — StorEn is transforming

Exploring the Global Expansion of Domestic Energy Storage

Nov 10, 2023 · Companies like CATL, BYD, Sungrow Power, Trina Solar, Hithium Energy Storage, and EVE are actively advancing their global presence. In the third quarter of 2023,

Why More European Households Are Installing Home Energy Storage

Across Europe in 2025, home energy storage systems are becoming a vital part of modern households. Driven by high electricity prices, a surge in solar panel installations, growing eco

After Europe, Africa also sees cooling demand for home energy storage

Jun 21, 2024 · With the cooling of demand in the European home energy storage market, where next can China''s massive capacity go? Since 2022, South Africa, the most economically

Oil Supermajor Shell Acquires Sonnen for Home Battery Expansion

Feb 15, 2019 · Shell will acquire German startup sonnen, staking a claim on the home energy storage market and further expanding its ever-increasing footprint in the clean energy industry.

US storage market continues upward trend into 2025

Jan 7, 2025 · Sunny metaphors don''t really work in the storage market, but the future does look bright. The United States closed 2024 with record-breaking storage installation numbers, and

China''s Household Energy Storage Boom: Powering Homes

Let''s face it – China''s household energy storage market is growing faster than a lithium battery on a summer day. From rooftop solar enthusiasts in Guangdong to tech-savvy urbanites in

Tesla to build grid-side energy storage station in Shanghai

Jun 21, 2025 · It will be Tesla''s first grid-side energy storage station to be built on the Chinese mainland. Dong Kun, general manager of Tesla China''s energy business, said the station,

Tesla''s Megafactory Expansion: A Bold Step Forward in

Feb 2, 2025 · Amidst the development of Megapacks, Tesla continues to innovate in the home energy storage arena with the rollout of the Powerwall 3. This next-generation product, which

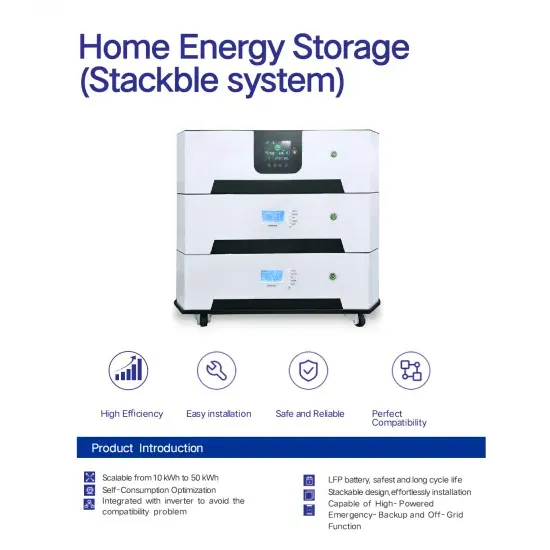

Home Wall-Mounted Energy Storage Systems: The Future

Dec 21, 2024 · Through intelligent control and flexible expansion, home wall-mounted energy storage systems will become an indispensable part of future household energy management.

US Home Energy Storage Market Size and Forecasts 2030

Apr 25, 2025 · In US Home Energy Storage Market, HES systems provide backup power during outages, ensuring critical appliances and systems remain operational.

Top 10 Home Energy Storage System Trends in 2025

In 2024, the home energy storage market reached approximately $10 billion, driven by heightened adoption of renewable energy, cost reductions in lithium-ion batteries, and government

Exploring the Latest Innovations in Home Energy Storage

Dec 2, 2024 · From cutting-edge lithium-ion batteries to distributed storage solutions, the field is brimming with possibilities. This article explores the top 10 trends in energy storage, highlights

6 FAQs about [Home energy storage expansion]

Why is Tesla expanding its megafactory network?

This next-generation product, which is being deployed in various markets, is set to enhance household energy efficiency, contributing significantly to Tesla’s gross profits in its energy sector. In conclusion, Tesla’s strategy to expand its Megafactory network is a bold step towards a sustainable future.

How much energy storage did Tesla deploy in 2024?

31.4 GWh Deployed: Throughout 2024, Tesla deployed an astonishing 31.4 GWh of energy storage, up 114% from the previous year. This surge reflects not only increased demand but also Tesla’s ability to scale its operations effectively.

Does China's Energy Storage Technology set a new global benchmark?

Chen Haisheng, Chairman of CNESA, noted: "China’s CAES technology has advanced from 100 MW to 300 MW in a decade, setting a new global benchmark." The Energy Storage Industry White Paper 2025 reveals that global new energy storage installations reached 165.4 GW in 2024, with China contributing 43.7 GW of new capacity.

Will China's energy storage capacity exceed 50 GW by 2030?

Industry projections indicate that China's compressed air energy storage capacity will exceed 50 GW by 2030, enabling annual CO₂ emission reductions of over 200 million tons - equivalent to shutting down 60 one-gigawatt coal-fired power plants - thereby providing robust support for building a new-type power system.

Is compressed air energy storage a key development focus in China?

Compressed air energy storage has been included as a key development focus in China's 14th Five-Year Plan for new energy storage technologies, with multiple regions introducing dedicated subsidy policies.

What is the energy storage industry white paper 2025?

The Energy Storage Industry White Paper 2025 reveals that global new energy storage installations reached 165.4 GW in 2024, with China contributing 43.7 GW of new capacity. Notably, compressed air energy storage (CAES) has emerged as the preferred grid-scale solution due to its long service life and superior safety characteristics.

Learn More

- Can Huawei s Brussels energy storage battery be used at home

- How do customers choose home energy storage batteries

- Dynamic capacity expansion of energy storage power stations

- Huawei Bulgaria Home Energy Storage Power Supply

- East Africa Home System Energy Storage Battery

- Energy storage form suitable for home microgrid

- Africa home energy storage battery price

- Kitja is buying home energy storage batteries

- Home energy storage 20 kWh

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.