Energy Storage Industry in Bandar Seri Begawan: Powering Brunei

Mar 26, 2024 · A city where mangrove rivers meet cutting-edge battery technology. Welcome to Bandar Seri Begawan, Brunei''s capital that''s quietly emerging as a strategic player in the

Brunei Strengthens Electricity Infrastructure to

Mar 7, 2025 · Both projects, utilizing energy-efficient combined-cycle technology, are expected to be operational between 2027 and 2028. These developments

Brunei unveils first licensing round for more than a decade

Brunei Darussalam in 2025 is offering two offshore blocks for competitive bidding in a rare licensing exercise — its last bid round was more than a decade ago — which the government

Brunei Darussalam: Shifting to a Hydrogen Society

Currently hydrogen is highlighted globally. Some East Asia Summit (or ASEAN 10 + 8 countries – Australia, China, India, Japan, Republic of Korea, New Zealand, Russian Federation, and the

Gadong 2 Power Plant Brunei Darussalam

Mar 16, 2015 · Gadong 2 Power Plant Brunei Darussalam is located at Bandar Seri Begawan, Brunei and Muara, Brunei Darussalam. Location coordinates are: Latitude= 4.9111, Longitude=

Pulau Muara Besar power station

Jul 22, 2025 · Pulau Muara Besar power station is a 4 x 55 MW coal plant in Pulau Muara Besar, Brunei. It is to support a petrochemical project owned by the Hengyi Group (70%) and Brunei

Berakas CCGT Power Plant Brunei

Mar 17, 2015 · Berakas CCGT Power Plant Brunei is located at Bandar Seri Begawan, Brunei and Muara, Brunei Darussalam. Location coordinates are: Latitude= 4.9707, Longitude= 114.9303.

Brunei Energy Reform | US ABC

Apr 30, 2025 · The Government of Brunei is undertaking major reforms to improve energy efficiency in the power sector, aiming to boost generation efficiency from 28% to 50% by 2035.

Brunei: EnQuest awarded Production Sharing Agreement for

Jul 16, 2025 · EnQuest has been awarded a Production Sharing Agreement for Block C in Brunei by the Petroleum Authority of Brunei Darussalam. Block C is located offshore Brunei

Power infrastructure ready to meet rising demand, says

Electricity coverage is nearly 100%, with ongoing projects like the Bukit Panggal Power Plant (phase 2) and a new plant by Berakas Power Company set to increase total installed capacity

Brunei Darussalam prioritises renewable energy to confront

Jun 26, 2016 · Renewable Targets Having embraced the idea that mitigating climate change is an important policy consideration, the "Energy White Paper" sets a number of ambitious

Brunei plans new solar plant to boost renewable energy

BANDAR SERI BEGAWAN, March 5 (Xinhua) -- Brunei plans to set up a 30 MW new solar power plant to ramp up to 200 MW of the country''s solar energy by 2025, according to a senior

BRUNEI''S ENERGY TRANSITION

Jun 3, 2025 · Transition Statement. Commit to accelerate deployment of renewable energy and phase out the use coal by 2050. • Brunei Darussalam, Malaysia & Singapore signed

Energy Generation In Brunei: Sources And Methods

Nov 7, 2024 · Learn about the energy landscape in Brunei, including its primary sources of energy and methods of generation, as well as the country''s plans for a sustainable future.

6 FAQs about [Brunei New Energy Base Station]

How does Brunei produce electricity?

Brunei's power stations primarily produce electricity through natural gas and oil sources, with a small-scale renewable energy project pipeline. The country's electricity sector is overseen by the Department of Electrical Services (DES) and has a total installed capacity of 1,054 MW, serving a small population of approximately 460,000.

Does Brunei have a solar power plant?

As a result, Brunei's second solar power plant, the 3.3 MW BSP Flagship Solar PV plant, was completed in 2021. This plant has almost 7,000 solar panels and can generate power for approximately 600 homes. The government has also taken steps to transition its own infrastructure to renewable energy sources.

How has Brunei developed its power grid?

Brunei’s power grid management has evolved significantly from its early dependence on oil and gas-driven electricity generation. The sultanate has strategically developed its electrical infrastructure to support economic diversification and meet growing energy demands.

How much PV is installed in Brunei?

The amount of PV installed capacity was 1.2 MW as of 2019, but Brunei plans to gradually increase the installed capacity of PV to about 100 MW by 2025, about 200 MW by 2030, and about 300 MW by 2035.

What is the power system in Brunei Darussalam?

There are two power systems in Brunei Darussalam, as mentioned. The DES power system covers the whole country, supervises Temburong district, and comprises four power stations and transmission lines at 275 kV, 132 kV, and 66 kV. However, the current maximum operating voltage is 66 kV.

How can Brunei improve power transmission and distribution?

These include managing voltage fluctuations, preventing transmission losses, and integrating renewable energy sources into the existing infrastructure. The geographical diversity of Brunei’s terrain adds complexity to power transmission and distribution networks.

Learn More

- Kazakhstan new energy battery cabinet base station power

- New Energy Battery Base Station

- New energy storage base station power supply recommendation

- New Energy Battery Cabinet Base Station Energy Equipment

- Kigali New Energy Battery Cabinet Base Station Power Generation Store

- Manama container energy storage fire fighting system base station

- Industrial Park Energy Storage Base Station Battery

- Base station refined energy management

- Lebanon s new energy storage industry base

Industrial & Commercial Energy Storage Market Growth

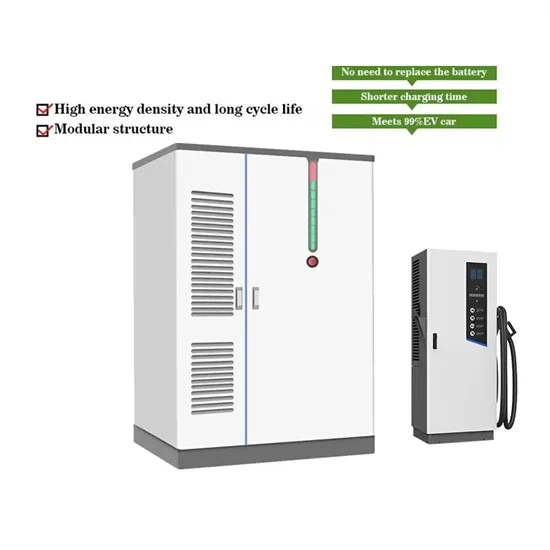

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.