South Korea Gaseous Hydrogen Storage Equipment Market

Jun 24, 2025 · The South Korea gaseous hydrogen storage equipment market is witnessing robust growth driven by increasing demand for clean energy solutions.

South Korea Energy Storage Technology Research

8 comprehensive market analysis studies and industry reports on the Energy Storage Technology sector, offering an industry overview with historical data since 2019 and forecasts up to 2030.

South Korea Busan Power Station Energy Storage System

The Busan Green Energy Project Doosan Fuel Cell System is a 30,800kW energy storage projectlocated in Busan,South Korea. The wind power market has grown at a CAGR of 14%

KOREA''S ENERGY STORAGE THE SYNERGY OF

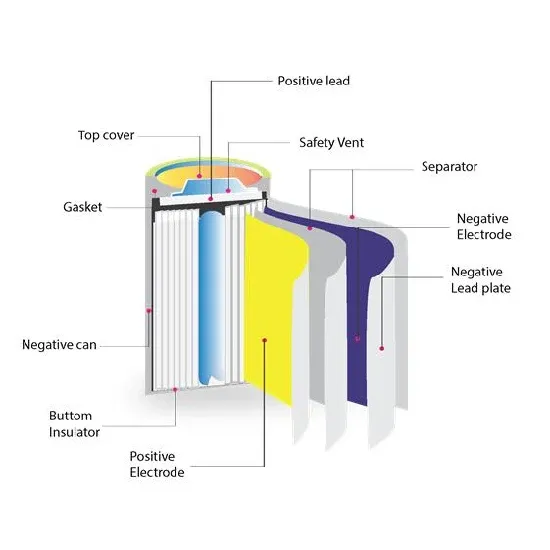

1 day ago · Energy Storage System (ESS) has emerged as the most viable technology option to deal with this intermittency problem. ESS is a device used to store energy produced, to use

Wholesale Energy Storage Manufacturers in South Korea

Jun 7, 2025 · Busan, South Korea''s second-largest city, is strategically positioned as a port city, making it an ideal hub for energy storage manufacturers. Renowned for its advanced logistics

Busan South Korea energy storage battery container

The Gyeongsan Substation - Battery Energy Storage System is a 48,000kW lithium-ion battery energy storage projectlocated in Jillyang-eup,North Gyeongsang,South Korea. The rated

Busan South Korea energy storage battery container

Busan to test out "smart" container to nip lithium-ion battery Busan is a key logistics hub for lithium-ion battery exports, as South Korea is home to major battery makers such as LG

South Korea Battery Energy Storage Market Overview: Key

Jun 27, 2025 · The battery energy storage market in South Korea is experiencing significant growth due to the country''s transition toward renewable energy and smart grid integration.

South Korea Off Grid Energy Storage Batteries Market

Jun 30, 2025 · South Korea Off Grid Energy Storage Batteries Market size was valued at USD 2.8 Billion in 2024 and is forecasted to grow at a CAGR of 15.

South Korea Solid-state Hydrogen Storage Solution Market

Jun 25, 2025 · South Korea Solid-state Hydrogen Storage Solution Market size is estimated to be USD 1.2 Billion in 2024 and is expected to reach USD 4.

Busan South Korea s energy storage battery industry

Given the high efficiency, they will provide an effective strategy for mass production of large-scale energy storage systems," concludes Prof. Lee. READ the latest Batteries News shaping the

Huawei Busan Battery Energy Storage Project in South

The Gyeongsan Substation - Battery Energy Storage System is a 48,000kW lithium-ion battery energy storage projectlocated in Jillyang-eup,North Gyeongsang,South Korea. The rated

Energy storage systems in South Korea

Mar 6, 2025 · Domestic infrastructural support for large-scale utilization, improved safety due diligence, and quick adoption of new technologies are some of the concerns likely to heavily

South Korea Portable Energy Storage Power Supply Market

Jun 27, 2025 · The South Korea portable energy storage power supply market has experienced significant growth driven by increasing demand for reliable and mobile power solutions.

What are the energy storage companies in South Korea?

Sep 17, 2024 · 1. The energy storage sector in South Korea showcases a formidable landscape equipped with diverse companies contributing significantly to the global market. 2. Key players

Busan South Korea Container Energy Storage Equipment

Busan''s strategic location as South Korea''s largest port city makes it ideal for manufacturing and exporting containerized energy storage systems (ESS). Over 68% of Korean ESS exports in

80kW Off-Grid Photovoltaic Inverter Solutions for Busan South Korea

Summary: Busan, South Korea''s vibrant coastal hub, is increasingly adopting renewable energy solutions to meet its growing power demands. This article explores the role of 80kW off-grid

Top five energy storage projects in South Korea

Sep 10, 2024 · Listed below are the five largest energy storage projects by capacity in South Korea, according to GlobalData''s power database. GlobalData uses proprietary data and

Workshops at MAN Energy Solutions Busan

Jun 11, 2025 · MAN PrimeServ Academy in Busan, South Korea Under the slogan of "Training is our product", our professional instructors and dedicated staff work with passion to satisfy our

Top Energy Storage Inverter Solutions in Busan South Korea

Summary: Busan, South Korea, is emerging as a hotspot for renewable energy innovation. This article explores the growing demand for energy storage inverters in the region, analyzes

South Korea Liquid Cooled Battery Energy Storage Solution

Jun 30, 2025 · The South Korea liquid cooled battery energy storage solution market is witnessing robust growth, driven by the increasing demand for high-efficiency energy systems and the

Busan s New Energy Storage Solutions Powering a

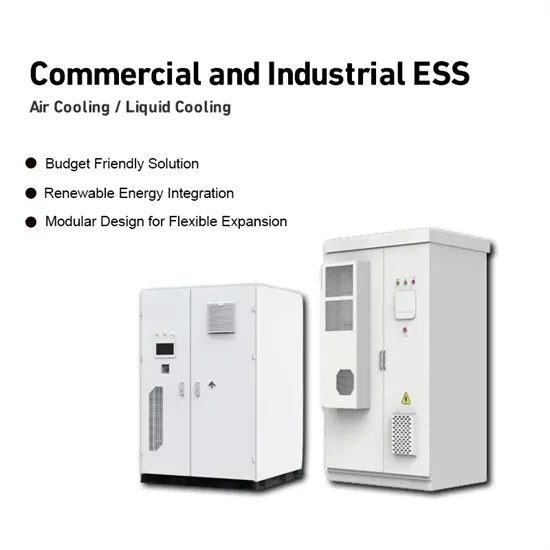

Summary: As a leading energy storage equipment manufacturer in Busan, South Korea, we explore cutting-edge ESS technologies transforming renewable energy integration, industrial

Korea Energy Storage Power: Innovations, Challenges, and

Jan 13, 2022 · Let''s face it—storing energy isn''t as simple as stacking kimchi in a fridge. With Korea aiming to achieve 20% renewable energy by 2030, energy storage systems (ESS) have

South Korea Busan Southern Power Grid Energy Storage

The Busan Green Energy Project Doosan Fuel Cell System is a 30,800kW energy storage project located in Busan, South Korea. The wind power market has grown at a CAGR of 14% between

Busan South Korea Container Energy Storage Equipment

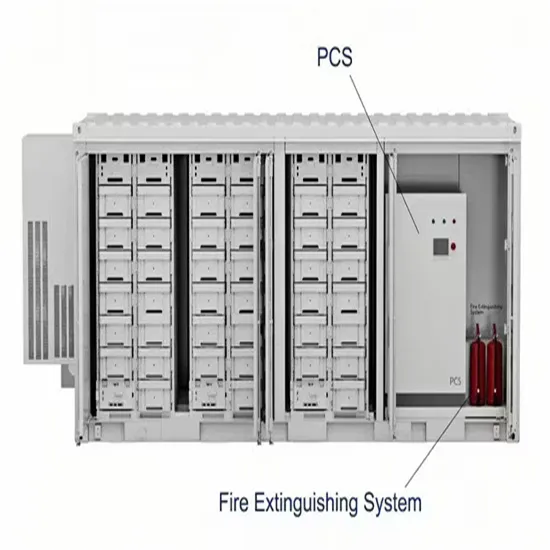

Summary: As a leading container energy storage equipment manufacturer in Busan, South Korea, we explore how modular energy storage systems are transforming industries like renewable

6 FAQs about [10kw energy storage solution in Busan South Korea]

Is Busan a good place for energy storage manufacturers?

Busan, South Korea’s second-largest city, is strategically positioned as a port city, making it an ideal hub for energy storage manufacturers. Renowned for its advanced logistics and export infrastructure, Busan offers local energy storage manufacturers an effective gateway to international markets.

Are South Korean companies investing in energy storage systems?

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more sustainable energy future. However, a string of ESS-related fires and a lack of infrastructure had dampened investments in this market.

How will Korea contribute to the energy storage sector?

With Seoul and Busan serving as pivotal hubs, and companies like Samsung SDI, LG Chem, Hyosung Heavy Industries, Doosan Heavy Industries & Construction, and Kokam leading the charge, the nation is set to continue its impactful contribution to the energy storage sector.

Is South Korea a leader in energy storage?

South Korea, a global powerhouse in the manufacturing of advanced electronics and automotive products, has in recent years also taken a prominent role in the energy storage industry. This East Asian country is home to some of the world's leading energy

What is Gyeongsan substation – battery energy storage system?

The Gyeongsan Substation – Battery Energy Storage System is a 48,000kW lithium-ion battery energy storage project located in Jillyang-eup, North Gyeongsang, South Korea. The rated storage capacity of the project is 12,000kWh. The electro-chemical battery storage project uses lithium-ion battery storage technology.

What is Uiryeong substation – Bess?

The Uiryeong Substation – BESS is a 24,000kW lithium-ion battery energy storage project located in Daeui-Myoen, Uiryeong-Gun, South Gyeongsang, South Korea. The rated storage capacity of the project is 8,000kWh. The electro-chemical battery storage project uses lithium-ion battery storage technology.

Learn More

- Busan South Korea containerized energy storage cabinet manufacturer

- 30kw energy storage for Busan power grid in South Korea

- South Korea Busan Energy Storage Cabin Price

- South Korea Photovoltaic Energy Storage Inverter

- South Korea Power Station Energy Storage Site Energy Project

- South America Portable Energy Storage Solution Provider

- Huawei s small energy storage vehicle solution

- Huawei photovoltaic panel energy storage solution

- Energy storage power application solution

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.