Busan Green Energy Project Doosan Fuel Cell System, South Korea

Aug 31, 2021 · The Busan Green Energy Project Doosan Fuel Cell System is a 30,800kW energy storage project located in Busan, South Korea. The electro-chemical battery energy storage

South Korea launches its largest energy storage bid to

Aug 18, 2025 · The project is expected to cost about $725 million (1 trillion won) and will be awarded based on both pricing and non-price factors, such as contributions to domestic

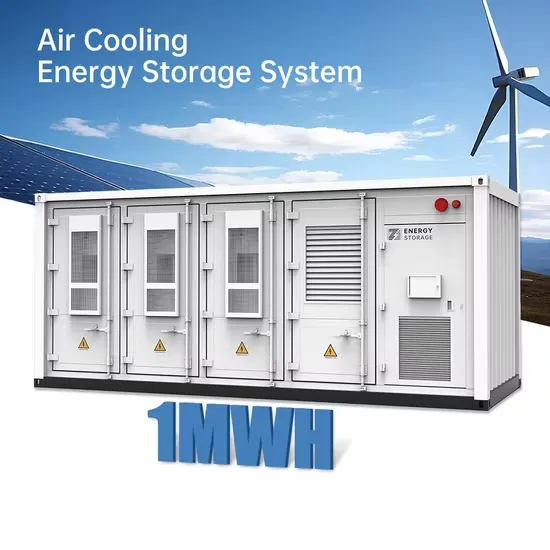

Busan South Korea Container Energy Storage Equipment

Busan''s strategic location as South Korea''s largest port city makes it ideal for manufacturing and exporting containerized energy storage systems (ESS). Over 68% of Korean ESS exports in

The value of energy storage in South Korea''s

Jul 15, 2014 · At current electricity prices, neither battery generates enough arbitrage revenue to offset capital costs. In this study we evaluate the economic potential for energy arbitrage by

Energy storage systems in South Korea

Mar 6, 2025 · Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more

South Korea Busan Power Station Energy Storage System

The Busan Green Energy Project Doosan Fuel Cell System is a 30,800kW energy storage projectlocated in Busan,South Korea. The wind power market has grown at a CAGR of 14%

Family Cabins in Busan | 𝗙𝗮𝗺𝗶𝗹𝘆 𝗩𝗮𝗰𝗮𝘁𝗶𝗼𝗻 𝗥𝗲𝗻𝘁𝗮𝗹𝘀

Busan Family Cabin Rentals. Choose from millions of properties and thousands of locations to find vacation cabins, mountain lodges, and log cabins nearby that welcome your family.

Energy Storage Converter Boost Cabin Market

Apr 21, 2025 · Key Drivers Fueling Energy Storage Converter Boost Cabin Adoption in Commercial and Industrial Sectors Rising electricity costs and grid instability are compelling

South Korea''s Power Grid Energy Storage: Innovations,

Imagine a country where energy storage systems (ESS) are as common as kimchi in a Korean household. Well, South Korea isn''t quite there yet, but it''s sprinting toward a future where

Huawei Busan Battery Energy Storage Project in South

The Gyeongsan Substation - Battery Energy Storage System is a 48,000kW lithium-ion battery energy storage projectlocated in Jillyang-eup,North Gyeongsang,South Korea. The rated

Current Status and Prospects of Korea''s Energy Storage

However, the overall price level of Korea''s ESS industry is generally about 25 to 27 percent higher than those of other global companies. Compared with the explosive expansion of the domestic

How much does the energy storage cabin cost? | NenPower

Apr 9, 2024 · ESTIMATED COSTS OF ENERGY STORAGE CABINS CAN RANGE SIGNIFICANTLY. Factors influencing the price include 2. the type of technology used, 3. the

Air Busan to disallow power banks in overhead

Feb 4, 2025 · South Korea''s Air Busan will not allow passengers to keep power banks in luggage stored in overhead cabin bins, in what on Tuesday it called a

Energy storage prices in Busan South Korea in 2025

According to BloombergNEF''''s recently published Energy Storage System Cost Survey 2024, the prices of turnkey energy storage systems fell 40% year-on-year from 2023 to a global average

How to sell Korean containerized energy storage cabins

Other major cities include Busan,Daegu,and Incheon. Energy Storage Systems are the methods and technologies used to store energy for later use to supply power. Energy is available in

1654 Busan Cabin Rentals By Execstays | 𝗘𝘅𝗲𝗰𝘀𝘁𝗮𝘆𝘀

Busan Cabin Rentals By Execstays. With millions of properties and thousands of places, find nearby vacation cabins, mountain lodges, and log cabins. Book the best cabin for your next trip.

Rail Report: First Class on the KTX from Busan to

Apr 13, 2019 · Rail Report: First Class on the KTX from Busan to Seoul, South Korea (04 February 2019) Korea''s high-speed rail network makes it incredibly

6 FAQs about [South Korea Busan Energy Storage Cabin Price]

Is Busan a good place for energy storage manufacturers?

Busan, South Korea’s second-largest city, is strategically positioned as a port city, making it an ideal hub for energy storage manufacturers. Renowned for its advanced logistics and export infrastructure, Busan offers local energy storage manufacturers an effective gateway to international markets.

Are South Korean companies investing in energy storage systems?

Less than a decade ago, South Korean companies held over half of the global energy storage system (ESS) market with the rushed promise of helping secure a more sustainable energy future. However, a string of ESS-related fires and a lack of infrastructure had dampened investments in this market.

What is the Busan green energy project Doosan fuel cell system?

The Busan Green Energy Project Doosan Fuel Cell System is a 30,800kW energy storage project located in Busan, South Korea. The wind power market has grown at a CAGR of 14% between 2010 and 2021 to reach 830 GW by end of 2021. This has largely been possible due to favourable government policies that have provided...

Is South Korea a leader in energy storage?

South Korea, a global powerhouse in the manufacturing of advanced electronics and automotive products, has in recent years also taken a prominent role in the energy storage industry. This East Asian country is home to some of the world's leading energy

How will Korea contribute to the energy storage sector?

With Seoul and Busan serving as pivotal hubs, and companies like Samsung SDI, LG Chem, Hyosung Heavy Industries, Doosan Heavy Industries & Construction, and Kokam leading the charge, the nation is set to continue its impactful contribution to the energy storage sector.

Will South Korea capture 30 percent of ESS market by 2036?

This was a heavy hit for the energy industry, but developments of safer technology and renewed state support have recently given new life to the domestic ESS market. According to South Korea’s “10th Basic Plan for Electricity Supply and Demand,” the government aims to capture over 30 percent of the global ESS market by 2036.

Learn More

- Wholesale price of mobile energy storage vehicle in Busan South Korea

- Busan South Korea promotes new energy storage power stations

- Busan South Korea containerized energy storage cabinet manufacturer

- 30kw energy storage for Busan power grid in South Korea

- South Korea Busan PV energy storage ratio requirements

- North Korea energy storage battery price

- Cape Verde mobile off-grid energy storage cabin price

- Madrid mobile energy storage cabin price

- South Korea s largest energy storage cabinet company

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.