Mobile Operators | Ministry of communications & IT

Aug 4, 2025 · Roshan (Telecom Development Company, Afghanistan Corp) is one of the leading telecommunication companies in Afghanistan with 6.5 million active customers, and a network

LARGEST COMPANIES IN AFGANISTHAN

Jun 24, 2025 · Afghanistan''s economy, with a nominal GDP of approximately USD 14.58 billion in 2021 (adjusted to ~USD 12 billion in 2024 due to a 20% contraction post-2021), is primarily

Telecommunication development in Afghanistan

Dec 25, 2022 · Currently there are five active telecom service providers and 64 licensed Internet Service Providers (ISPs) in Afghanistan, including the state

mobile communication base stations

Apr 21, 2021 · China''s mobile communication base station market is poised for significant growth, driven by the rapid expansion of 5G technology and the increasing demand for high-speed

What is a base station and how are 4G/5G base

Aug 16, 2022 · A base station is referred to a stationary trans-receiver used in telecommunications that serves as the primary hub for connectivity of wireless

Export Preview | Digital Logistics Capacity Assessments

Aug 17, 2025 · Afghanistan''s telecommunications landscape includes several private companies, such as Afghan Wireless Communication Company (AWCC), Etisalat Afghanistan, MTN

Base stations in Afghanistan

For a full breakdown of trade patterns, visit the trend explorer or the product in country profile. The following visualization shows the latest trends on Base stations. Countries are shown based

3.4 Afghanistan Telecommunications | Digital Logistics

Aug 18, 2025 · Afghanistan''s telecommunications landscape includes several private companies, such as Afghan Wireless Communication Company (AWCC), Etisalat Afghanistan, MTN

Country profile: Afghanistan

Dec 26, 2024 · The Telecom Regulatory Authority of Afghanistan (ATRA) website is no longer available but in 2021 it counted 6,917 base stations in the country. Asia Consultancy Group is

Top 10 countries with the most extensive 5G in 2022

Mar 22, 2022 · Telstra, Australia''s largest telecommunications company, has installed over 2000 5G base stations, covering 41% of the country''s population. To provide 5G services across

Export Preview | Digital Logistics Capacity Assessments

Aug 19, 2025 · Afghanistan''s telecommunications landscape includes several private companies, such as Afghan Wireless Communication Company (AWCC), Etisalat Afghanistan, MTN

China home to 4.25m 5G base stations

Jan 22, 2025 · The number of 5G base stations in China has hit 4.25 million, with the number of gigabit broadband users surpassing 200 million, official data showed Tuesday.

6 FAQs about [Which telecommunications company in Afghanistan has the most base stations]

Who is Afghan Wireless?

Afghan Wireless, with a primary motive of connecting Afghanistan seamlessly, was the first mobile services company in Afghanistan. Afghan Wireless Communication Company started in 2002 by the visionary Mr. Ehsan Bayat, the Chairman of the Company, with a zeal to establish an Afghan company for the people of Afghanistan.

Who was the first mobile service company in Afghanistan?

Afghan Wireless Communication Company Afghan Wireless, with a primary motive of connecting Afghanistan seamlessly, was the first mobile services company in Afghanistan.

Who are the mobile operators in Afghanistan?

Afghanistan has a competitive telecommunications market with several mobile operators providing services across the country. Here is an in-depth discussion of the key mobile operators in Afghanistan: Overview: Afghan Wireless is one of the oldest and largest mobile operators in Afghanistan. It was founded in 2002 and is headquartered in Kabul.

Is MTN Afghanistan ready to exit the telecom market?

With increased levels of risk and uncertainty now associated with running a telecom company in the embattled state, MTN Afghanistan has become the first operator to announce that it is in talks with prospective buyers to allow it to exit the market as quickly as possible.

Who is the fastest growing mobile phone company in Afghanistan?

The company is the fastest growing mobile phone company in Afghanistan .Etisalat is providing voice and data services in 34 provinces and more than 200 districts supported by more than 12,000 retail outlets. In addition, Etisalat has 3G coverage in 21 provinces of Afghanistan.

Does Afghanistan have a telecom market maturity?

Afghanistan was already sitting near the bottom of the world’s rankings in terms of its telecom market maturity, but it had at least been making some positive progress toward establishing widespread coverage over the prior decade under civilian administration.

Learn More

- Number of 5G base stations of each telecommunications company

- Which company is the best flywheel energy storage equipment for North African communication base stations

- Which companies have battery base stations in Argentina

- A company in Turkmenistan that makes energy storage base stations

- Number of 5G base stations of Palestinian telecommunications operators

- Uninterrupted power supply for various communication base stations

- Maintenance plan for wind power and photovoltaic power generation at communication base stations

- Battery charging and discharging of communication base stations

- Do 5G micro base stations require electricity

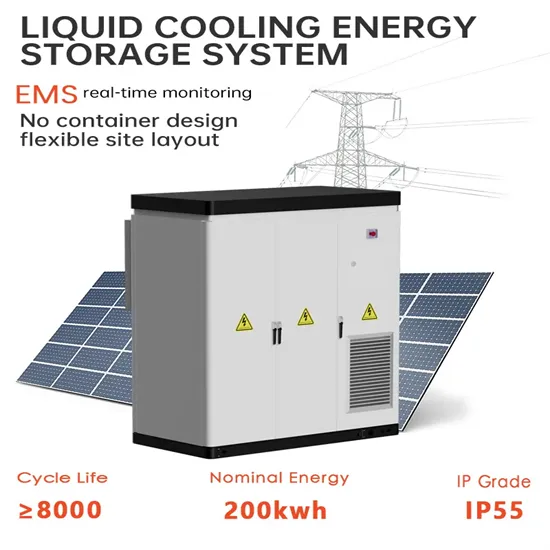

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.