Is Wind Power Cheaper Than Gas? – Watts Up With That?

Jan 7, 2025 · In fact the only valid comparison is to compare the TOTAL COST of wind power, with the FUEL COST of CCGT power stations. The latter, of course, will still have to be fully

Which energy storage container power station is cheaper

Oct 27, 2020 · The station, covering approximately 2,100 square meters, incorporates a 630kW/618kWh liquid-cooled energy storage system and a 400kW-412kWh liquid-cooled

Analysis: Yes, coal & natural gas remain much cheaper than wind

Mar 4, 2025 · Wind power costs $291 per mwh. Nuclear power costs $122. Coal power costs $90. Natural gas power costs merely $40. That is a huge price differential between wind and solar

The cost-effectiveness of wind energy: An

Jul 23, 2023 · The reduction in wind curtailment can be attributed to investments in large-scale transmission lines, enabling the efficient transmission of wind

Optimal sizing of photovoltaic-wind-diesel-battery power

Mar 1, 2022 · The paper proposes a novel planning approach for optimal sizing of standalone photovoltaic-wind-diesel-battery power supply for mobile telephony base stations. The

Renewables Increasingly Beat Even Cheapest Coal

Jun 2, 2020 · The report highlights that new renewable power generation projects now increasingly undercut existing coal-fired plants. On average, new solar photovoltaic (PV) and

Wind Power vs. Gas: Which is More Affordable? – Blog

Jan 8, 2025 · Wind Power Costs: In contrast, wind power must account for £57 billion in initial capital investment, plus an estimated £100 billion or more in grid enhancements and

Wind Power vs Solar Power: Which Offers the Best Bang for

Sep 28, 2024 · In terms of location, wind power tends to be more cost-effective in areas with consistent, strong winds, such as offshore or in open plains. Solar power, on the other hand, is

Is wind power the cheapest way to produce electricity?

Is wind power cheaper than fossil fuels? Of the wind, solar and other renewables that came on stream in 2020, nearly two-thirds – 62% – were cheaper than the cheapest new fossil fuel,

Wind Energy Is One of the Cheapest Sources of

While the all-in price of wind energy directly depends on the wind speeds at a particular site, examining national trends in the installed cost of wind energy definitively shows that wind

Which energy storage container power station is cheaper

The station, covering approximately 2,100 square meters, incorporates a 630kW/618kWh liquid-cooled energy storage system and a 400kW-412kWh liquid-cooled For that purpose--a few

Is wind energy cheaper than fossil fuels? • Renewables

The comparison between the cost of the wind power and Fossil fuels It is not just an economic debate, but an analysis that covers environmental issues, technological advances and global

91% of New Renewable Projects Now Cheaper Than Fossil

Jul 22, 2025 · Onshore wind remained the most affordable source of new renewable electricity at USD 0.034/kWh, followed by solar PV at USD 0.043/kWh. The addition of 582 gigawatts of

6 FAQs about [Which outdoor wind power base station is cheaper]

How much does wind power cost in Texas?

Wind power costs $291 per mwh. Nuclear power costs $122. Coal power costs $90. Natural gas power costs merely $40. That is a huge price differential between wind and solar versus all other energy sources. In most places, it costs even more to produce wind and solar power than in the favorable climate conditions of Texas.

How much does wind energy cost?

The biggest drop in prices over the last five years was registered in onshore wind energy and is mainly due to a scale-up in average turbine size to 4.1MW and a price of $0.7m/MW. Brazil has the lowest cost, with prices for onshore wind energy at $24/MWh, followed by the US, India and Spain with $26/MWh, $29/MWh and $29/MWh respectively.

Are wind power costs understated?

Even then wind power costs are understated, because we should add on the cost of grid upgrades, projected at over £100 billion, or at least the appropriate share for the extra 26 GW. We know that wind power already on the system costs considerably more than the BEIS’ optimistic calculations.

How much does onshore wind cost in 2024?

For example, IRENA found that while onshore wind generation costs were similar in Europe and Africa with around USD 0.052/kWh in 2024, the cost structures varied significantly. European projects were capital-expenditure driven, while African projects bore a much higher share of financing costs.

Which country has the lowest cost of wind energy?

Brazil has the lowest cost, with prices for onshore wind energy at $24/MWh, followed by the US, India and Spain with $26/MWh, $29/MWh and $29/MWh respectively.

How much does offshore wind power cost?

Now we come on to offshore wind power. The BEIS costings assumed capital costs of £2200/kW – this is the top of their range, which is more realistic, given the massive increase in strike prices offered in last summer’s CfD auction. To generate 101 TWh, we would need 26 GW of new offshore wind capacity, which is more than we have presently.

Learn More

- Outdoor base station wind power generation system

- Swaziland outdoor wind power base station manufacturer

- Outdoor base station wind power technical specifications

- Athens Communication Base Station Wind Power Outdoor Site

- Venezuela outdoor wind power base station customization store

- Which mobile communication wind power base station is the best

- Uzbekistan 5g communication base station wind power construction project

- 5g communication base station wind power layout

- Cape Town Telecommunications Base Station Wind Power Management Measures

Industrial & Commercial Energy Storage Market Growth

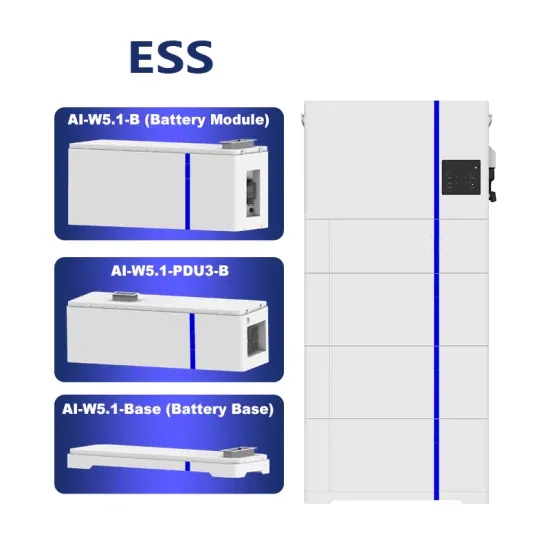

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.