Vietnam Offshore Wind Development

Aug 18, 2025 · Vietnam, a net coal importer, currently mostly relies on coal for electricity generation. The ambitious Power Development Plan 8 (PDP8), approved in May 2023, plans

Best Lighting Companies in Vietnam – Zanfi

Dec 20, 2022 · Vietnam is known to have some of the finest lighting companies in the world. That means, if you are looking for lighting products in Vietnam, the

Vietnam Implements Anti-Dumping Measures on Chinese Wind

On December 24, 2024, the Ministry of Industry and Trade of Vietnam issued Decision No. 3453/QĐ-BCT to impose anti-dumping measures for five years on certain Chinese wind

Siemens Gamesa wins its largest onshore wind farm order in Vietnam

Jan 15, 2021 · Siemens Gamesa will supply 29 units of its Siemens Gamesa 4.X platform in the 145 meters rotor diameter variant to new local independent power producer Hanbaram Wind

CS Wind Sets Sights on a Second Manufacturing Base in Vietnam

Sep 11, 2024 · CS Wind plans to invest 200 million USD in a new manufacturing facility in Long An, Vietnam in partnership with Dong Tam Group. The plant will be capable of producing

GOLDWIND | Global Clean Energy Solutions_Wind Turbine

Goldwind is a global leader in clean energy, energy conservation, and environmental protection. As a world-top wind turbine manufacturer, we are committed to providing integrated wind

Vietnam Wind Energy Guide

Feb 9, 2024 · Vietnam''s topography and climate naturally lends itself to wind power development, with more than 3,000 km of coastline, average annual wind speeds of 6m/s (as high as 10m/s

Gusty growth: Vietnam''s remarkable wind energy story

5 days ago · And with the wind power industry boasting long supply chains and requiring plenty of workers to manufacture, operate and maintain turbines, wind power also brings a myriad of

Vietnam Wind Energy Guide

Feb 9, 2024 · Vietnam''s onshore, nearshore and offshore wind power potential is particularly significant, and is attracting diverse global interest, including recent characterization by the

6 FAQs about [Hanoi outdoor wind power base station manufacturer]

Who makes wind turbines in Vietnam?

Siemens Gamesa, a major global wind turbine manufacturer and project developer, has a strong presence in Vietnam. The company supplies wind turbines for several onshore and offshore projects and provides maintenance and technical support.

What is the landscape of wind turbine manufacturing in Vietnam?

The landscape of wind turbine manufacturing in Vietnam is diverse, featuring both homegrown companies and international collaborations. Several Vietnamese companies have made significant strides in wind turbine production: 1. CS Wind Vietnam

What is the largest offshore wind project in Vietnam?

This is one of the largest offshore wind projects in Vietnam, being developed by Mainstream Renewable Power in collaboration with local partners. Located off the coast of Soc Trang province, the project has a planned capacity of up to 1,400 MW. It will be developed in multiple phases, with the first phase expected to provide 400 MW of capacity.

Who are the major wind power companies in Vietnam?

Major domestic wind power companies in Vietnam include Trung Nam Group, BIM Group, T&T Group, REE Corporation, and Gelex Group, all actively involved in developing wind farms across the country. Which foreign companies are involved in Vietnam’s wind power industry?

Who are the key players in Vietnam's wind power industry?

Gelex Group is another key player in Vietnam’s wind power industry, focusing on the development and operation of wind power projects. The company’s wind farms are primarily located in the central and southern regions, contributing to the local electricity supply and supporting Vietnam’s renewable energy targets.

What are the advantages of local wind turbine manufacturing in Vietnam?

Vestas, a Danish wind turbine manufacturer, has partnered with local companies to produce wind turbine components in Vietnam. The rise of local wind turbine manufacturing offers several economic advantages: Local manufacturing allows for the customization of wind turbines to suit Vietnam’s specific environmental conditions:

Learn More

- Swaziland outdoor wind power base station manufacturer

- Papua New Guinea communication base station wind power tower manufacturer customization

- Outdoor base station wind power generation system

- Sukhumi communication base station wind power outdoor cabinet

- Outdoor base station wind power technical specifications

- Seychelles builds communication base station to complement wind and solar power

- Praia Communication Base Station Wind Power Products

- Cape Town Telecommunications Base Station Wind Power Management Measures

- Abu Dhabi communication base station lithium-ion battery wind power generation

Industrial & Commercial Energy Storage Market Growth

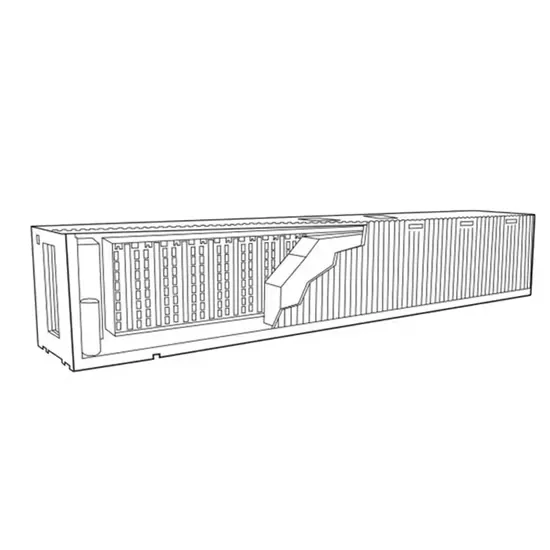

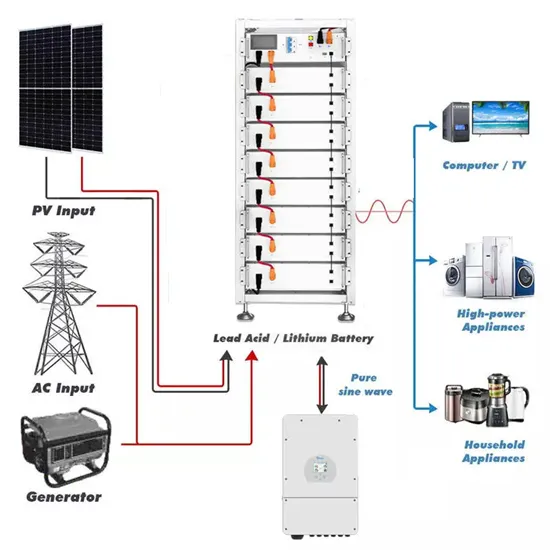

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.