Scalable LiFePO4 Energy Storage Systems from NPP Vietnam

Not stopping at VRLA batteries, NPP Vietnam factory has additionally carved a specific niche in producing lithium-ion batteries, which are renowned for their high energy density, lightweight,

5kWh LiFePO4 Battery in Vietnam: Key Insights & Trusted

May 29, 2025 · 5kWh LiFePO4 Battery in Vietnam: Best Prices, Suppliers & FAQs (2025 Guide) As Vietnam''s energy demands surge, 5kWh LiFePO4 batteries are becoming a cornerstone

Cooli Lifepo4 Battery Factory

Cooli Lifepo4 Battery Factory. 43,854 likes · 2,670 talking about this. A professional battery factory with 15 years of experience, providing you with high-quality products and services. Rack

Top 20 Lithium-ion Battery Manufacturers in Vietnam

This article aims to provide an overview of the top 20 lithium-ion battery manufacturers in Vietnam, highlighting their key features, manufacturing capabilities, and market presence. 1.

Quality Solar Energy Battery Power & Portable Power Station

China leading provider of Solar Energy Battery Power and Portable Power Station Battery, Guoan Energy Technology (dongguan) Co., Ltd. is Portable Power Station Battery factory.

Company Profile_Dongguan Huanhuan Energy Technology

Dongguan Huanhuan Energy Technology Co., Ltd. specializes in advanced energy solutions with core expertise in lithium battery systems and integrated energy storage technologies. Our

Best 7 Lifepo4 Battery Pack Supplier In Vietnam

May 29, 2024 · 3st Manufacturer: A well-known provider for Lifepo4 battery packs available in all fields of housing, industry and commerce. They strive to create

Vietnam Battery Manufacturer-Ritar International Group

Sep 24, 2024 · In today''s rapidly evolving world, the demand for reliable and efficient batteries is on the rise. As technology continues to advance, batteries play a crucial role in powering a

Li-ion and Ni-MH battery manufacturing plant inaugurated

Jan 18, 2025 · HÀ NỘI — Exquisite Power Vietnam has officially inaugurated its Li-ion and Ni-MH battery manufacturing plant at the Nam Đình Vũ Industrial Park in Hải Phòng, marking a

Trouble with Power? LiFePO4 Power Stations Explained

A LiFePO4 power station is a portable energy storage device built using lithium iron phosphate (LiFePO₄) batteries. These batteries fall under the lithium-ion family but use a different

Get Reliable Power Anywhere with Our Lifepo4 Power Station

Jun 16, 2025 · lifepo4 power station Get Reliable Power Anywhere with Our Lifepo4 Power Station Solutions Chengdu FireflyTree Greenpower Co., Ltd. is a China-based manufacturer, supplier

SunPlus Power Technology Co., Ltd.-Solar Battery,Sealed

Sunplus Power was founded in 2006, as a high-tech enterprise Supercapacitor, specializing in the production, R&D, and sales of lead acid battery, Lithium batteries and LiFePO4 batteries.

6 FAQs about [Lifepo4 power station factory in Vietnam]

Where is LiFePO4 battery manufactured?

The manufacturing factory is located at Lane 2, Road 3, Phu Lo, Soc Son, Hanoi City. We manufacture and supply high quality Lithium-ion battery products with newest technology of Lithium LiFePO4 battery, with the desire to accompany businesses for a green future, promoting the use of green energy.

What is a LiFePO4 power station?

A LiFePO4 power station is a type of portable power station that uses lithium iron phosphate (LiFePO4) batteries. These power stations are ideal for certain environments, particularly hot areas, due to their stable chemistry. The most popular brand using LiFePO4 batteries is Bluetti.

Who is Hoa Phat lithium battery manufacturing?

Hoa Phat Lithium Battery Manufacturing specializes in lithium-iron phosphate (LiFePO4) batteries used in EVs, renewable energy storage, and industrial applications. Their high-performance battery cells and stringent quality control measures have positioned them as a recognized leader in the Vietnamese lithium-ion battery market. 12.

What is Cobra battery Vietnam?

Cobra Battery Vietnam: Cobra Battery Vietnam is a prominent lithium-ion battery manufacturer known for its wide range of battery types, including cylindrical, prismatic, and pouch cells. The company serves various industries, such as automotive, consumer electronics, and renewable energy storage, ensuring superior quality and performance.

Who is hycom Power Battery Vietnam?

Hycom Power Battery Vietnam specializes in the production of lithium-ion batteries for solar energy storage, electric bicycles, and backup power systems. The company’s focus on providing eco-friendly and reliable energy storage solutions has contributed to its growing presence in the Vietnamese lithium-ion battery market.

Who makes lithium batteries in Vietnam?

Dai Phuc Vinh is a Vietnamese manufacturer specializing in lithium-ion batteries for EVs, motorcycles, and portable electronic devices. The company’s dedication to research and development, coupled with its stringent quality control measures, enables it to deliver reliable and high-performance batteries. 16. TMI Lithium Batteries Vietnam:

Learn More

- Lifepo4 power station factory in Toronto

- Cheap lifepo4 power station factory Buyer

- Lifepo4 power station factory in Sydney

- Lifepo4 power station factory in Finland

- Lifepo4 power station factory in Cape-Town

- Cambodia Energy Storage Power Station Factory Direct Sales

- 1000 wh power station factory in Botswana

- Does an energy storage power station need a factory building

- Wholesale 100ah power station in Vietnam

Industrial & Commercial Energy Storage Market Growth

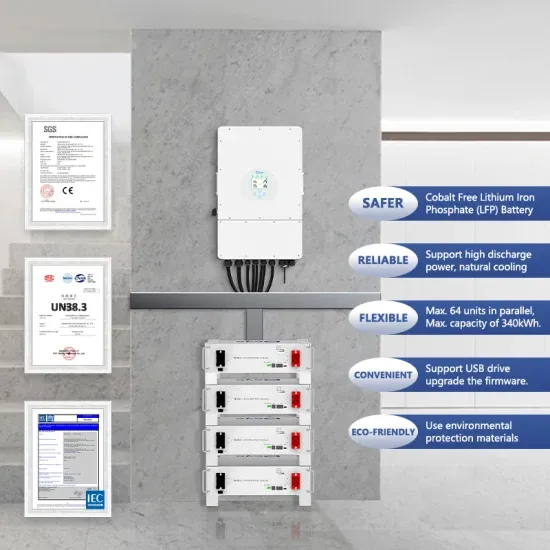

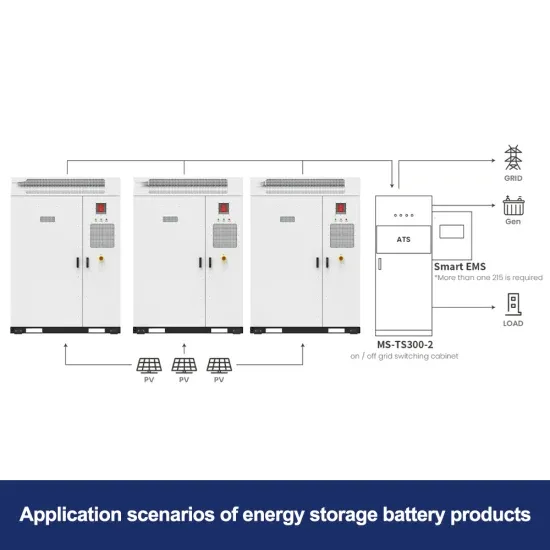

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.