Solar Generator 518 Wh 500 W Portable Power Station Botswana

Shop Solar Generator 518 Wh 500 W Portable Power Station with Solar Panel 100 W Foldable Battery Power Bank Balcony Power Station with LED Light for Camping Outdoor Adventures

Portable energy storage power supply in botswana

Explore the comparison of portable power stations, power banks, and generators. The company and its subsidiaries have won 27 patents at home and abroad, and the company has built well

Portable Power Station 500 W Peak 1000 W, 519 Wh Solar

Shop Portable Power Station 500 W Peak 1000 W, 519 Wh Solar Generator for Outdoor Use Backup Battery Pack with 2 230 V AC Outputs, 10-Port Powerhouse for RV Camping Fishing

Power Plants in Botswana (Map) | database.earth

Botswana has 2 utility-scale power plants in operation, with a total capacity of 746.0 MW. This data is a derivitive set of data gathered by source mentioned below. Global Energy

CIC picks Shanghai Electric for Botswana plant | Reuters

Dec 2, 2008 · CIC Energy said it had selected Shanghai Electric Group Co. Ltd. as the engineering and building contractor for the first power station to be built at the Mmamabula

Botswana Portable Power Station Market (2024-2030)

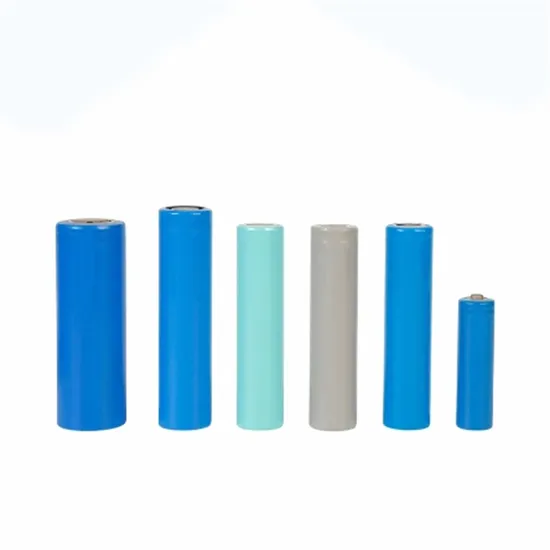

Market Forecast By Power Source (Direct, Hybrid), By Technology (Lithium-ion, Sealed lead-acid), By Capacity (0−100 Wh, 100−200 Wh, 200−400 Wh,

Botswana''s power sector infrastructure | African

Nov 11, 2022 · Revised in April 2025, this map provides a detailed view of the power sector in Botswana. The locations of power generation facilities that are

Botswana Portable Lithium Power Station Market (2024-2030

Historical Data and Forecast of Botswana Portable Lithium Power Station Market Revenues & Volume By 1,000 WH to 1,499 WH for the Period 2020- 2030 Historical Data and Forecast of

Rockpals Portable Power Station 1300w 1254 4wh Lifepo4

The ROCKPALS Portable Power Station 1300W is a versatile and powerful solar generator designed for outdoor enthusiasts and emergency preparedness. With a capacity of 1254.4Wh

Jackery Solar Generator 1000 v2 with 100W Solar Botswana

Shop Jackery Solar Generator 1000 v2 with 100W Solar Panel,1070Wh Portable Power Station LiFePO4 Battery,1500W AC100W USB-C Output,1Hr Fast Charge for Outdoor,Off-Grid

6 FAQs about [1000 wh power station factory in Botswana]

What is the power sector in Botswana?

Revised in April 2025, this map provides a detailed view of the power sector in Botswana. The locations of power generation facilities that are operating, under construction or planned are shown by type – including liquid fuels, gas and liquid fuels, coal, hybrid, hydroelectricity and solar.

Where does Botswana's electricity come from?

Prior to this period, most of Botswana’s electricity was imported from South Africa’s power utility, Eskom. In 2008 South Africa’s electricity demand started to exceed its supply, resulting in the South African government restricting power exports.

Where does Botswana get its power?

In 2023, BPC agreed to procure up to 600 MW of power generation from a yet-to-be-built coal-fired power station. Additionally, Botswana imports the bulk of its power from South African utility Eskom, and the rest from Nampower (Namibia), Zesco (Zambia), and the Southern African Power Pool (SAPP), to make up for any production shortfalls.

Does Botswana have a good electricity supply?

According to Statistics Botswana, local electricity generation and distribution has showed a slight improvement, increasing by 10.2 percent from 807,943 MWh during the fourth quarter of 2022 to 890,655 MWh during the first quarter of 2023. The increase was attributable to the performance improvement of Morupule A and B power stations.

How does the electricity section work in Botswana?

The section combines the local generation and imported electricity to come up with electricity that is available for distribution in Botswana. This does not take into account electricity used for auxiliary services, pumping, network losses as well as the production of electricity through incineration of waste.

How is Botswana strengthening its exporting capacity?

To strengthen Botswana’s exporting capacity, the GoB is investing in national and regional grid infrastructure, as well as refurbishment of general transmission infrastructure. Botswana Power Corporation (BPC)’s rural electrification program is still ongoing, and this covers new connections and expansion in some villages.

Learn More

- 1000 wh power station factory in America

- 1000 wh power station factory in Myanmar

- 1000 wh power station factory in Israel

- 1000 wh power station factory in Slovakia

- Factory solar power generation base station

- Lithium power station factory in Portugal

- China lithium power station factory Buyer

- Lifepo4 power station factory in Finland

- Cheap 100ah power station for sale Factory

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.