Lithium iron phosphate batteries have a broad market-

Estimated based on a single station energy consumption of 2700W and emergency 4h, the 5G base station energy storage market will provide 155GWh of demand for lithium iron phosphate

5G base station application of lithium iron phosphate battery

Jan 19, 2021 · In the future new 5G base station projects, we will continue to encourage the use of lithium iron phosphate batteries as backup power batteries for base stations, and promote the

Feasibility study of power demand response for 5G base station

Jan 24, 2021 · In order to ensure the reliability of communication, 5G base stations are usually equipped with lithium iron phosphate cascade batteries with high energy densit

5g Base Station Lithium Iron Battery Future-Proof Strategies:

Jul 19, 2025 · The 5G base station lithium iron phosphate (LiFePO4) battery market is experiencing robust growth, driven by the rapid expansion of 5G networks globally. The

Application of lithium iron phosphate battery backup power supply in 5G

After upgrading to 5G, the performance of lithium iron phosphate battery in the base station system will greatly affect the stability of the network signal, which is related to the user''s use

5G communication iron phosphate battery -Lithium -|stacking

Apr 3, 2023 · At present, the world''s mainstream operators are actively preparing for 5G, 5G commercial base station to drive the demand for lithium iron phosphate cells. The trial of the

Uninterrupted Power for 5G Base Stations: How the 51.2V

Apr 14, 2025 · Section 2: The 51.2V 100Ah Rack Battery – A Technical Breakthrough for 5G''s Toughest Challenges At the heart of this solution lies cutting-edge lithium iron phosphate

5G Base Station Lithium Battery Market

Feb 28, 2025 · Lithium iron phosphate (LFP) batteries dominate 5G installations due to safety and cycle life advantages, but securing high-purity lithium carbonate faces constraints.

What are the requirements for 5G commercial base stations

5G commercial applications are getting closer, and the construction of base stations will drive the demand for lithium iron phosphate batteries above 155GWh. The commercial application of 5G

Uninterrupted Power for 5G Base Stations: How the 51.2V

Apr 14, 2025 · At the heart of this solution lies cutting-edge lithium iron phosphate (LFP) chemistry, a technology born from aerospace and EV industries, now optimized for telecom

5G Base Station Lithium-Iron Battery Market Disruption

May 11, 2025 · The global 5G base station lithium-iron battery market is experiencing robust growth, driven by the rapid expansion of 5G networks worldwide. The increasing demand for

5G layout speeds up, base station batteries are expected to

Jan 21, 2021 · Standby power supply for communication base stations: lead-acid ends and iron-lithium comes on stage. As the cost of lithium batteries continues to decline, the market price

Lithium iron phosphate batteries have a broad market-

In the field of energy storage, the application of lithium iron phosphate batteries in 5G base stations has also shown rapid growth, opening up new market opportunities. In the first half of

5G energy storage orders come and go lithium iron phosphate battery

Mar 21, 2020 · 5G construction acceleration, lithium iron phosphate industry chain for the opening of the base station energy storage market space; and in the cost pressure and technological

Lithium iron phosphate 5G power supply system

The utility model discloses a lithium iron phosphate 5G power supply system, including box and second semi-ring, all weld the installation cover on the outer wall of box both sides, and install

China''s 5G construction turns to lithium-ion batteries for

As of the end of 2018, China Tower has used about 1.5GWh of echelon lithium batteries in about 120,000 base stations in 31 provinces, municipalities, and municipalities across the country,

5G communication iron phosphate battery -Lithium -|stacking

Apr 3, 2023 · The high level of power consumption of 5G base stations puts forward new demand for the communication power system. We expect that in the future important construction

What are the requirements for 5G commercial base stations

Oct 13, 2020 · 5G commercial applications are getting closer, and the construction of base stations will drive the demand for lithium iron phosphate batteries above 155GWh. The

Everything You Need to Know About LiFePO4 Battery Cells: A

Apr 18, 2025 · Complete Guide to LiFePO4 Battery Cells: Advantages, Applications, and Maintenance Introduction to LiFePO4 Batteries: The Energy Storage Revolution Lithium Iron

Lithium iron phosphate energy storage battery for base

In 2019, the shipments of energy storage lithium-ion batteries, which are dominated by lithium iron phosphate batteries, were 11.6GWh (including energy storage, communication backup power,

Carbon emission assessment of lithium iron phosphate batteries

Nov 1, 2024 · The cascaded utilization of lithium iron phosphate (LFP) batteries in communication base stations can help avoid the severe safety and environmental risks associated with battery

Lithium Battery for 5G Base Stations Market

Feb 9, 2025 · A 5G base station battery pack might use lithium iron phosphate (LFP) chemistry, which eliminates cobalt and nickel, lowering costs to $95–$110 per kWh while maintaining

5G Base Station Lithium-Iron Battery Market Size, Industry

May 15, 2025 · 5G Base Station Lithium-Iron Battery Market size was valued at USD 1.2 Billion in 2024 and is projected to reach USD 4.5 Billion by 2033, exhibiting a CAGR of 16.5% from

Lithium Iron Batteries for Telecommunications Base Stations

A telecommunication base station (TBS) depends on a reliable, stable power supply. For this reason, base stations are best served by lithium batteries that use newer technology – in

Learn More

- Lithium iron phosphate battery 5g base station

- Is the 5g base station powered by lithium iron phosphate batteries

- How long does it take for the lithium iron phosphate battery station cabinet to charge the base station

- What is the voltage difference of lithium iron phosphate battery station cabinet

- Lithium iron phosphate battery station cabinet 10 kWh

- How to install lithium iron phosphate battery station cabinet

- Can the lithium iron phosphate battery station cabinet be used at low temperatures

- Base station lithium iron battery pack communication

- Beirut Communication Base Station Lithium Ion Battery Room

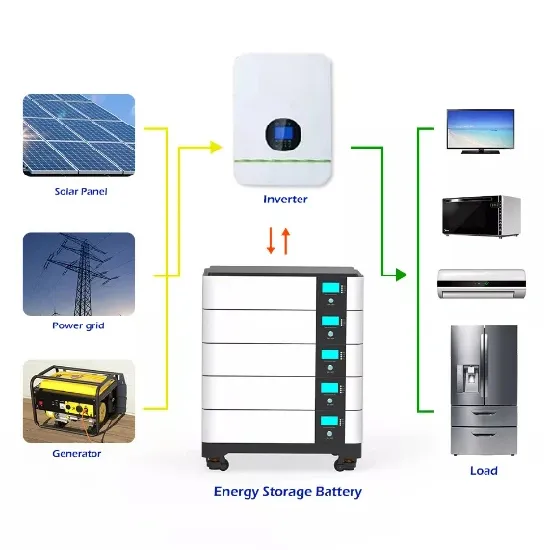

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.