China ramps up solar and wind power as clean energy

Jun 27, 2025 · China installed enough solar and wind power between January and May to match the total electricity use of countries like Indonesia or Turkey, even as its clean energy industry

China''s Electricity Pricing Shifts in Blow to Solar

Dec 11, 2023 · China is changing its power system in ways that reduce payments to solar providers while making energy storage more profitable, as it seeks to

China and South Korea extend battery battle from EVs to

Apr 28, 2025 · A global surge in renewable energy and data centre demand is powering a boom in using batteries for storage on electricity grids, creating a new front in the battle between

China Solar Energy Storage and Prices

The price of compressed air energy storage will fall from 320 to 384 USD/kWh in 2021 to 116 to 146 USD/kWh, and the price of lead-carbon batteries will be below the inflection point of 73

China | Photovoltaic: Price | CEIC

Aug 1, 2025 · CN: Price: Battery Cell: M6 data remains active status in CEIC and is reported by Shandong Longzhong Information Technology Co., Ltd.. The data is categorized under China

What Are The Implications Of $66/kWh Battery Packs In China?

Dec 26, 2024 · The Power Construction Corporation of China drew 76 bidders for its tender of 16 GWh of lithium iron phosphate (LFP) battery energy storage systems (BESS), according to

China | Photovoltaic: Price | CEIC

Aug 1, 2025 · CN: Price: Battery Cell: G1 data is updated monthly, averaging 0.776 RMB/W from May 2021 (Median) to Apr 2025, with 48 observations. The data reached an all-time high of

China''s power reform could boost solar module

Mar 11, 2025 · Analysis by S&P Global suggests new power pricing measures in China could bring a rush of new installations in the country during the first half

What Are The Implications Of $66/kWh Battery Packs In China?

Dec 26, 2024 · China''s battery packs plummet in price again. Hydrogen prices didn''t decline and BNEF triples its estimates for future costs. The implications are huge.

Solar power installations hit new highs

5 days ago · A worker inspects solar photovoltaic panels in Huaibei, Anhui province, on Dec 16. LI XIN/FOR CHINA DAILY China is on track to set a new record for solar power installations in

Changing economics of China''s power system suggest that batteries

Feb 16, 2024 · The results suggest that a near-term strategy in China might be to enable battery storage participation in the provision of operating reserves, which would encourage continued

The Future of Solar Energy Batteries in China

Jan 25, 2025 · The solar energy industry in China has seen significant growth over the past decade, with solar battery manufacturers playing a crucial role in this expansion. This article

China Solar Energy Battery, Solar Energy Battery Wholesale

The Solar Energy Battery is a key item within our extensive Storage Battery selection.Storage batteries come in various types such as lead-acid, lithium-ion, and nickel-cadmium. Each type

Why are solar panels and batteries from China

May 15, 2025 · The notion that China''s manufacturing output is purely the result of some centralised, governmental program is misguided; it has developed an

6 FAQs about [China China solar power to battery Price]

How much does photovoltaic cost in China?

The data is categorized under China Premium Database’s Energy Sector – Table CN.RBN: Photovoltaic: Price. CN: Price: Photovoltaic Module: 182 Single Crystal data was reported at 0.660 RMB/W in Apr 2025. This records an increase from the previous number of 0.650 RMB/W for Mar 2025.

Will new power pricing measures in China lead to higher solar prices?

Analysis by S&P Global suggests new power pricing measures in China could bring a rush of new installations in the country during the first half of the year and lead to an increase in solar module prices first domestically, then internationally.

Will solar module prices rise if demand increases in China?

S&P Global’s analysis suggests that due to the size of China’s solar market, a domestic increase in module prices could also lead to a global rise. “Solar module prices are most likely to get the chance to rebound once demand increases,” explained Jessica Jin, principal research analyst of Clean Energy Technology at Commodity Insights.

Will China's new solar policy lead to a global rise?

“This urgency to avoid potential revenue uncertainties under the new policy could lead to a short-term surge in solar module demand, pushing up prices,” added Qi Qin, CREA China analyst. S&P Global’s analysis suggests that due to the size of China’s solar market, a domestic increase in module prices could also lead to a global rise.

Will China's solar modules continue to grow?

S&P Global’s analysis also says that continued demand growth for China’s solar modules depends on “a comprehensive improvement of the photovoltaic industry’s entire ecosystem.” Qin explained that rapid solar capacity expansion over the past two years has highlighted existing challenges in effectively integrating solar power into the grid.

Does US tariff on Chinese electric vehicle batteries apply to grid storage?

The USA’s 25% tariff on Chinese electric vehicle batteries doesn’t apply to grid storage, behind the meter storage, charging buffering storage or industrial site storage yet. Those batteries are at 7.5% tariffs, rising to 25% only at the beginning of 2025, by which time BESS prices will have dropped by at least that much.

Learn More

- China solar power to battery in Canberra

- China solar power to battery in Monaco

- Lithium battery solar power price for communication base stations

- China solar power to battery in Bandung

- China solar power to battery in Vancouver

- Factory price solar power setup

- Solar power storage in China in Iraq

- How big a battery should I use for 25 watt solar power

- Hot sale lithium battery power station Price

Industrial & Commercial Energy Storage Market Growth

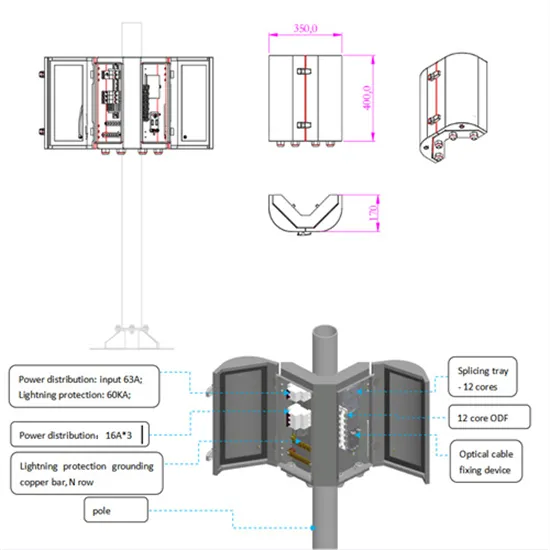

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.