Insights into the PV Glass Sector: Capacity and Price Trends

Mar 12, 2024 · Estimating a 50% ratio, the expected repaired capacity is about 3,000 tons, and the actual new addition for the year is 18,000 tons (about 5-6 thousand tons in Q2, and about

Future cost projections for photovoltaic module manufacturing using

Apr 1, 2022 · The lowest 10th percentile projections, below 0.10 US$/W, would be realised by the largest scale manufacturers with access to very low materials costs and low operational costs.

【Xinhua Finance Survey】Photovoltaic glass overcapacity

Jul 31, 2024 · According to the research report of Zheshang Securities, photovoltaic glass ranks second in the cost of modules, and the cost of auxiliary materials accounts for the highest

PV cells and modules – State of the art, limits and trends

Dec 1, 2020 · The main criteria supporting or limiting a successful placement of particular technologies on the market is the cost of electricity produced by PV systems. The Levelized

National Survey Report of PV Power Applications in China

Sep 8, 2021 · What is IEA PVPS Task 1? The objective of Task 1 of the IEA Photovoltaic Power Systems Programme is to promote and facilitate the exchange and dissemination of

Proportion of various materials of photovoltaic panels

Energy production - mainly the burning of fossil fuels - accounts for around three-quarters of global greenhouse gas emissions.Not only is energy production the largest driver of climate

Solar Photovoltaic Glass Market Size & Growth Report 2033

Asia Pacific currently dominates the solar photovoltaic glass market share of over 59.4% in 2024. The market in this region is driven by the rapid growth of renewable energy adoption,

Solar Photovoltaic Glass Market Size, Demand, Opportunities

The global solar photovoltaic glass market size was valued at USD 17.04 billion in 2024 and is estimated to grow from USD 22.13 billion in 2025 to reach USD 179.08 billion by 2033,

Solar Photovoltaic Glass Market Size, Share Analysis

Aug 13, 2025 · These policies have contributed to a cost decline more than 80%, helping solar PV to become the most affordable electricity generation technology in many parts of the world.

Xinyi Solar Holdings Limited

Mar 8, 2023 · Highlights (Hong Kong, 27 February 2023) — Xinyi Solar Holdings Limited (" Xinyi Solar " or the " Group "; stock code: 00968), the world''s largest

Technology, cost, economic performance of distributed photovoltaic

Aug 1, 2019 · As subsidies continue to fall, the technology and cost performance of distributed photovoltaic (PV) determines the progress of its grid parity. Based

The Transformation Of China''s Photovoltaic Glass,

Jan 15, 2024 · Glass products. As one of solar cell modules, according to SOLARZOOM data, photovoltaic glass accounts for about 6% -7% of module costs. Among them, photovoltaic

Analysis of Solar Power Generation Costs in Japan 2021

It is clear the unit costs for solar PV modules, which account for the highest proportion of investment costs, have been decreasing over time. Installation costs and mounting system

The cost of photovoltaics: Re-evaluating grid parity for PV

Jul 1, 2022 · We find that the integration costs account for 15% of the total system costs, which cannot be neglected with the higher penetration of PV in the electricity system. Further,

Solar energy status in the world: A comprehensive review

Nov 1, 2023 · Through a systematic literature survey, this review study summarizes the world solar energy status (including concentrating solar power and solar PV power) along with the

Does the cost of photovoltaic panels account for a high

Currently,the cost competitiveness of existing solar PV manufacturing is a key challenge to diversifying chains. Chinais the most cost-competitive location to manufacture all components

Application of photovoltaics on different types of land in

Mar 1, 2024 · The cost of PV stations includes both PV system and non-technical costs, with land leasing being a major non-technical expense. In China, land lease varies by region: mountain

How does the photovoltaic industry contribute to China''s

Feb 20, 2022 · With the gradual increase in the proportion of renewable electricity, especially the high proportion of PV applications, the integration costs of PV systems have risen significantly,

Cost Implications of Solar Photovoltaic Systems on

Oct 30, 2024 · BACKGROUND The National Association of Home Builders (NAHB) asked Home Innovation Research Labs (HI) to conduct an analysis to determine the typical construction

Solar Photovoltaic Glass Market Size & Forecast [Latest]

Feb 13, 2025 · Solar Photovoltaic Glass Market The global solar photovoltaic glass market was valued at USD 7.8 billion in 2023 and is projected to reach USD 27.3 billion by 2028, growing

Review of issues and opportunities for glass supply for photovoltaic

Current solar photovoltaic (PV) installation rates are inadequate to combat global warming, necessitating approximately 3.4 TW of PV installations annually. This would require about 89

6 FAQs about [Photovoltaic glass accounts for the largest proportion of costs]

How big is the Solar Photovoltaic Glass market?

The Market Size and Forecasts for the Solar Photovoltaic Market are Provided in Terms of Volume (tons) for all the Above Segments. The Solar Photovoltaic Glass Market size is estimated at 27.11 Million tons in 2024, and is expected to reach 63.13 Million tons by 2029, growing at a CAGR of 18.42% during the forecast period (2024-2029).

Why is solar PV glass so inefficient?

Requirements of large stocks of glass to achieve economies of scale and long duration of set-up times make the production of solar PV glass often inefficient. Hence, traditional manufacturers of glass are more focused on manufacturing automotive and construction glass than solar PV glass.

What is the largest solar PV glass market in Asia?

Asia Pacific is the largest and the second-fastest-growing solar PV glass market, in terms of volume, owing to large scale consumption of glass by solar module manufacturers located in Asia, especially in China.

Which is better solar PV glass or AR-coated glass?

Hence, traditional manufacturers of glass are more focused on manufacturing automotive and construction glass than solar PV glass. Based on the type, the AR-coated solar PV glass segment is estimated to hold the lion’s share in the market.

How has global solar PV manufacturing capacity changed over the last decade?

Global solar PV manufacturing capacity has increasingly moved from Europe, Japan and the United States to China over the last decade. China has invested over USD 50 billion in new PV supply capacity – ten times more than Europe − and created more than 300 000 manufacturing jobs across the solar PV value chain since 2011.

What is Solar Photovoltaic Glass?

Solar photovoltaic glass is a technology that enables the conversion of light into electricity. The glass is incorporated with transparent semiconductor-based photovoltaic cells, also known as solar cells. These cells are sandwiched between two sheets of glass, which enables them to capture these solar rays and convert them into electricity.

Learn More

- The largest photovoltaic glass manufacturer in Cape Verde

- Yemen photovoltaic glass installation costs

- Indonesia s largest photovoltaic glass company

- Photovoltaic glass transport vehicle

- Huawei South Sudan Photovoltaic Glass Industry

- Maputo Photovoltaic Conductive Glass

- Semi-finished photovoltaic glass

- Marshall Islands double glass photovoltaic curtain wall installation

- Is there photovoltaic glass production in Nigeria

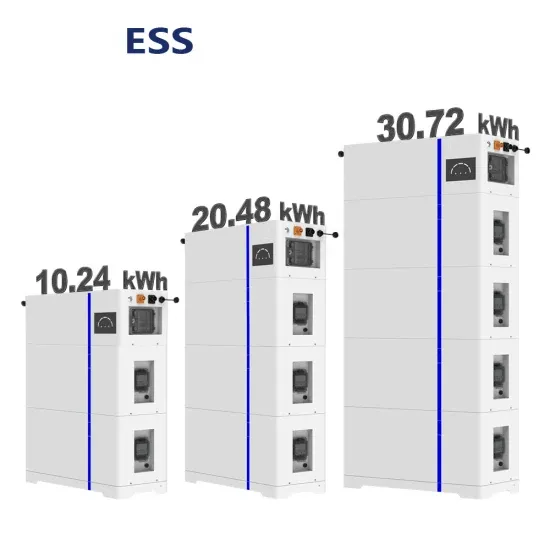

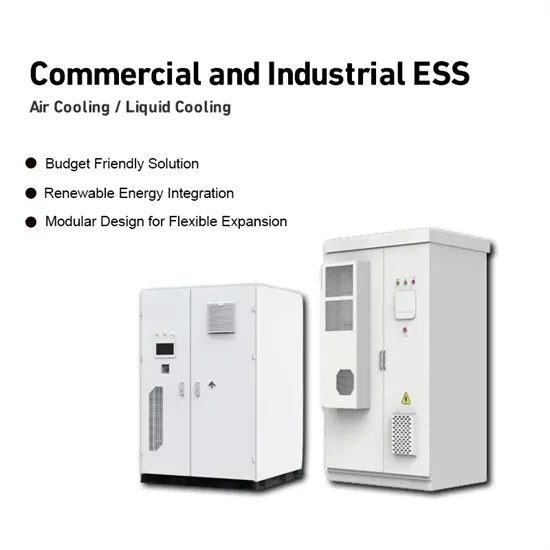

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

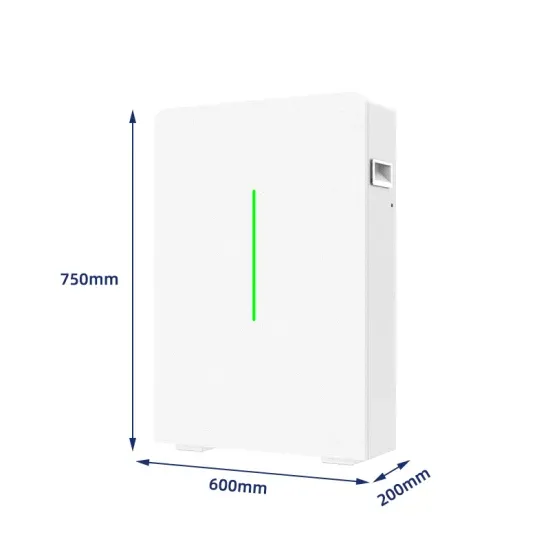

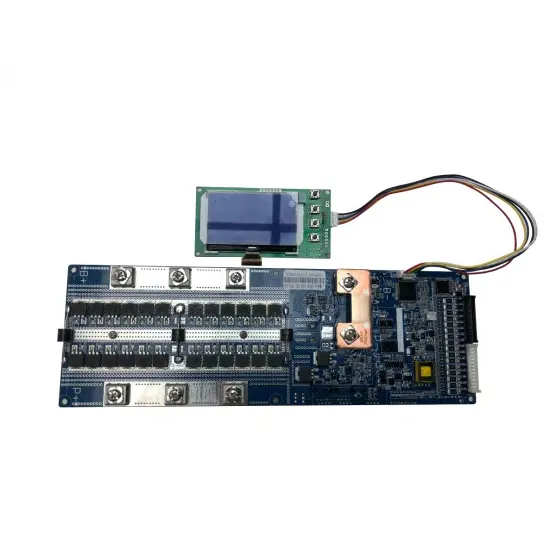

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.