sudan new energy storage industrial park

When you''re looking for the latest and most efficient sudan new energy storage industrial park for your PV project, our website offers a comprehensive selection of cutting-edge products

Sudan Solar Energy and Battery Storage Market (2025-2031

Sudan Solar Energy and Battery Storage Industry Life Cycle Historical Data and Forecast of Sudan Solar Energy and Battery Storage Market Revenues & Volume By Type for the Period

Energy Storage System Industrial Park Sudan

South Sudan 1 solar park coupled with a 35 MWh storage system. 78 ''''In 2021, South Sudan installed a solar rooftop-diesel system for the Upper Nile University of Malakal in the country.9

Sudan Energy Storage Machinery and Equipment Market

Have you ever wondered how Sudan, a country with frequent power shortages, plans to keep the lights on? The Sudan energy storage machinery and equipment market holds the answer.

Sudan s New Energy Storage Box Manufacturer Powering

Now imagine battery storage systems keeping lights on and refrigerators running. That''s the reality modern energy storage boxes are creating across Sudan, where 72% of businesses

Unlocking Sustainable Growth Energy Storage Solutions for Sudan

Summary: Sudan''s industrial parks are embracing energy storage franchises to stabilize power supply, integrate renewables, and boost economic productivity. This article explores market

100kWh Solar Storage Systems Project in Sudan with ESS

Jul 18, 2025 · MOTOMA solar energy storage itallation in Sudan, using dual hybrid inverte and six M90 PRO lithium batteries. Learn how this nearly 100kWh solar storage systems setup delive

Sudan''s New Energy Storage Industry Project: Lighting Up

Enter Sudan''s new energy storage industry project, where solar panels meet cutting-edge batteries to rewrite the country''s energy script. With 59% electrification rates and heavy fossil

Energy Franchise Opportunities in Sudan

SP4U is a proponent of the renewable and sustainable power generation systems (decentralized power generation) specifically designed to supply energy to a farm, a house, a building, a

Energy Storage System Industrial Park Sudan

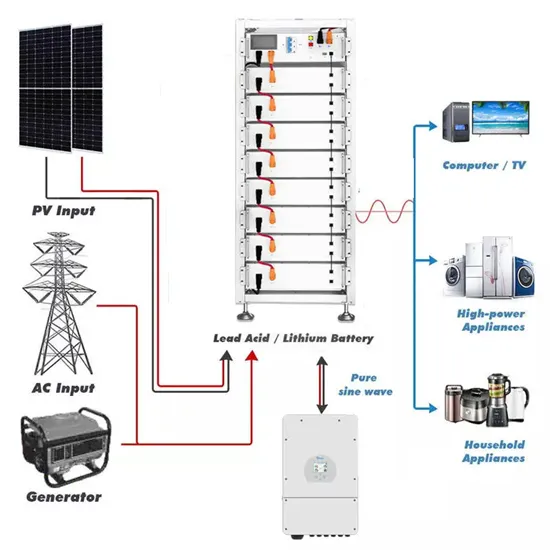

Industrial and commercial energy storage systems are different from large-scale energy storage peak-shaving and frequency-regulating power stations. Its main purpose is to use the peak

EXCLUSIVE SOUTH SUDAN OPENS ITS DOORS TO GLOBAL

South Sudan Industrial Park Battery Project The Juba Solar Power Station is a proposed 20 MW (27,000 hp) solar power plant in South Sudan. The solar farm is under development by a

sudan new energy storage industrial park

As the photovoltaic (PV) industry continues to evolve, advancements in sudan new energy storage industrial park have become critical to optimizing the utilization of renewable energy

Learn More

- Sudan Portable Energy Storage Industrial Park

- Industrial Park Energy Storage Base Station Battery

- Sucre Industrial Park Energy Storage System

- Libya Photovoltaic Energy Storage Industrial Park

- West Asia Energy Storage Industrial Park Project

- Sana Energy Storage Battery Industrial Park

- Norway Energy Storage Industrial Park

- Thimphu Industrial Park Industrial and Commercial Energy Storage System

- Energy Storage Investment Industrial Park

Industrial & Commercial Energy Storage Market Growth

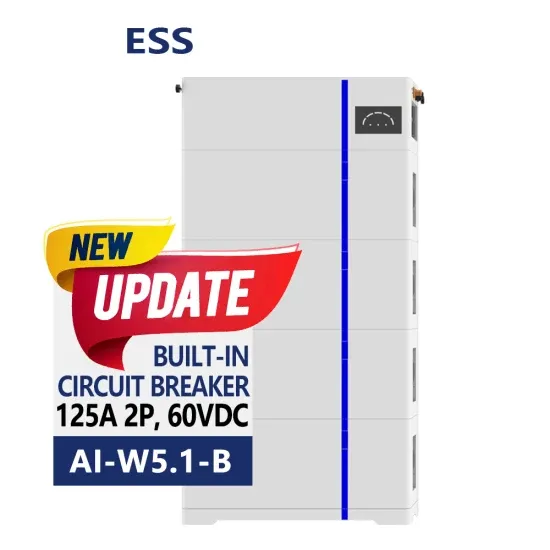

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

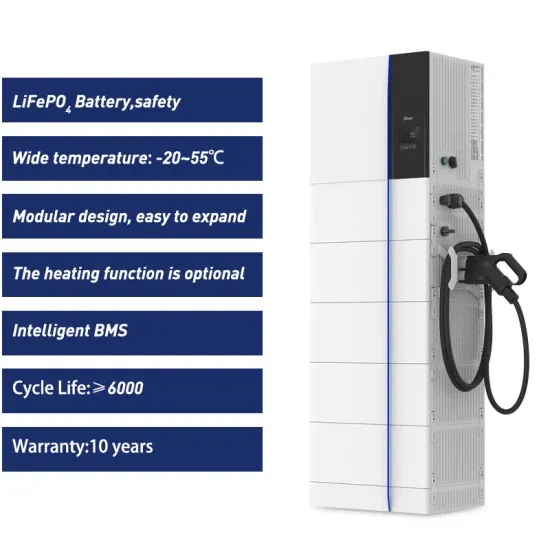

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.