Silver-carbon interlayers in anode-free solid-state lithium

Sep 1, 2023 · As an interlayer between the anode and the electrolyte of the all-solid-state lithium metal batteries (ASSLMBs), the silver-carbon (Ag-C) nanocomposite has been reported to

Saudi Energy Storage Development: Powering the Future

Jul 10, 2024 · Why Your Morning Coffee Depends on Saudi Arabia''s Batteries you''re sipping Arabic coffee in Riyadh while your phone charges using solar energy stored in a sand-based

From NEOM to Riyadh: How BESS Powers Saudi Arabia''s

Jul 1, 2025 · From NEOM''s futuristic vision to Riyadh''s urban transformation, Battery Energy Storage Systems are powering Saudi Arabia''s giga-projects with reliability and sustainability.

Riyadh Energy Storage: Powering Saudi Arabia''s Sustainable

Oct 21, 2022 · Riyadh energy storage projects are rewriting the rules of sustainable power. From mega-battery installations to sand-resistant solar farms, Saudi Arabia''s capital isn''t just

Energy Storage | Sustainable Energy Technologies Center

Aug 16, 2025 · Develop and commercialize the prototype for high energy and power density based electrochemical energy storage devices. Publications. Salah. Ud-Din Khan, Z.A.

Samsung''s Silver Solid State Battery Closer to

Apr 29, 2025 · Specifically, Samsung''s batteries utilize a silver-carbon (Ag-C) composite layer for the anode, which is credited with enabling the battery''s

From NEOM to Riyadh: How BESS Powers Saudi Arabia''s

Jul 1, 2025 · Saudi Arabia is redefining its future through ambitious giga-projects like NEOM, Qiddiya, and the Red Sea Project, alongside urban developments in Riyadh. These initiatives,

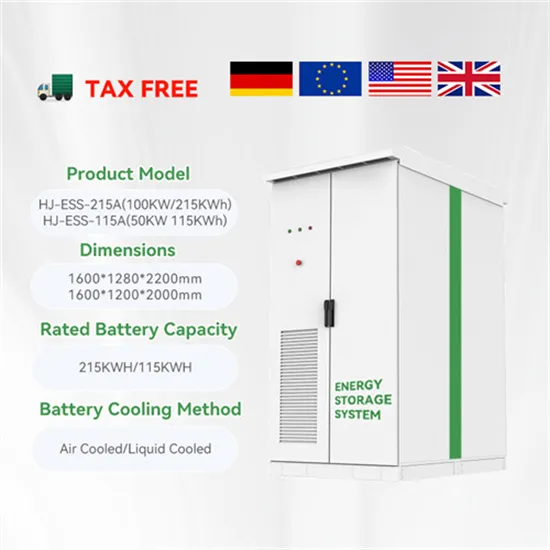

What Are Battery Rack Cabinets and Why Are They Essential?

Jun 15, 2025 · Battery rack cabinets are modular enclosures designed to securely house and organize multiple batteries in industrial, telecom, or renewable energy systems. They optimize

Samsung''s Silver Solid State Battery Technology.

Aug 14, 2024 · Samsung''s solid-state batteries could significantly impact the silver market, with each battery using up to 1 kg. If 20% of cars adopt this tech,

A high-performance flexible aqueous silver–zinc rechargeable battery

Aug 1, 2021 · Silver-zinc (Ag–Zn) battery are one of the promising aqueous zinc-based battery with non-toxic environment, stable output voltage and high energy density. Flexible electrode

Saudi Arabia commissions its largest battery energy

Jan 20, 2025 · Each unit integrates a 6 MW power conversion system (PCS) alongside four lithium iron phosphate (LFP) battery modules, each with a capacity of 5.365 MWh. This

Riyadh Qifeng Flywheel Energy Storage Project: Powering Saudi Arabia

Dec 7, 2020 · Why Riyadh Bet Big on Spinning Metal Saudi Arabia''s Vision 2030 isn''t just about moving away from oil—it''s about energy dominance 2.0. The Qifeng project uses 40-ton steel

Second-generation Silicon-carbon Battery on HONOR

Jun 23, 2024 · The Second-generation Silicon-carbon Battery integrates cutting-edge silicon-based materials, delivering enhanced performance and extended battery life, even in

Saudi Arabia''s demand for energy storage solutions is

6 days ago · The renewable energy boom in Saudi Arabia makes battery energy storage solutions indispensable. For global developers, EPC firms, and utility companies, partnering with GSL

6 FAQs about [Riyadh Silver-based Carbon Battery Cabinet]

Is Saudi Arabia developing a large-scale battery storage project?

The project is among several large-scale battery storage initiatives being developed in Saudi Arabia. In an ongoing procurement, the Saudi Power Procurement Company (SPPC) is tendering four 500 MW / 2,000 MWh BESS projects.

Which country has a 2 GWh battery energy storage system?

The 2 GWh battery energy storage system (BESS) features 122 prefabricated storage units, designed and supplied by China’s BYD. Saudi Arabia has officially connected its largest battery energy storage system (BESS) to the grid, marking a significant milestone in the country’s renewable energy expansion.

Why is energy storage important in Saudi Arabia?

Energy storage is a vital component of this transition, providing grid flexibility and enabling the integration of intermittent power sources such as solar and wind. The project is among several large-scale battery storage initiatives being developed in Saudi Arabia.

What is a typical battery cabinet?

A typical cabinet integrates batteries, racking and chargers into an indoor (NEMA 1 or IP21) or outdoor (NEMA 3R or IP54) rated enclosure. There are many different options and accessories available, making every system unique and built to your site-specific needs.

What is Bisha battery storage?

The Bisha battery storage facility, owned by Saudi Electric Company (SEC), features 122 prefabricated storage units, designed and supplied by China’s BYD. Each unit integrates a 6 MW power conversion system (PCS) alongside four lithium iron phosphate (LFP) battery modules, each with a capacity of 5.365 MWh.

Who are Saudi power procurement Company (SPPC) bidders?

In an ongoing procurement, the Saudi Power Procurement Company (SPPC) is tendering four 500 MW / 2,000 MWh BESS projects. The list of prequalified 33 bidders was released earlier in January, revealing Masdar, ACWA Power, EDF, and TotalEnergies as competitors for 15-year storage services agreements.

Learn More

- Where is the photovoltaic communication battery cabinet in Riyadh

- Scheme and design of energy storage battery cabinet

- The internal structure of the battery in the energy storage cabinet and the station cabinet

- Pretoria battery cabinet integrated system

- Battery Cabinet A23

- What are the battery energy storage cabinet manufacturers in Bloemfontein

- How to check the model of lithium iron phosphate battery station cabinet

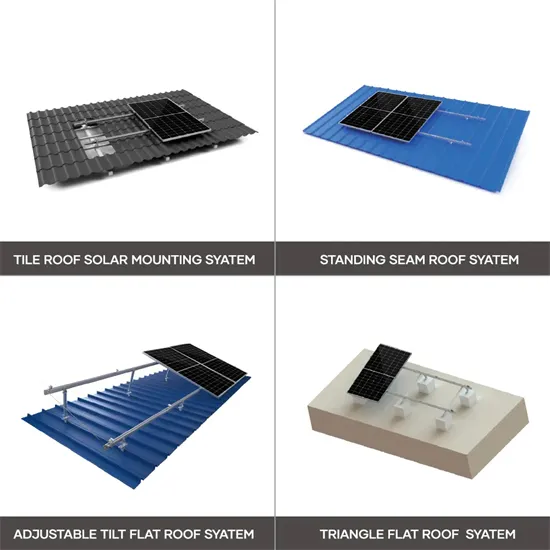

- How to charge the battery cabinet liquid cooling energy storage solar panels

- Lithium battery station cabinet falls

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.