Evaluating economic feasibility of liquid air energy storage systems

Apr 15, 2025 · Energy storage offers a solution to this issue. In particular, long-duration energy storage (LDES) technologies, capable of storing energy for over ten hours, are critical for grid

Energy storage financial forecasting Model Excel Template

Jul 16, 2025 · Energy storage financial forecasting Model Excel Template Powerful Excel template for forecasting the financials of Battery Energy Storage Systems (BESS), including revenue

Economic and financial appraisal of novel large-scale energy storage

Jan 1, 2021 · Energy storage can store surplus electricity generation and provide power system flexibility. A Generation Integrated Energy Storage system (GIES) is a class of energy storage

Energy Storage Financing for Social Equity

Jul 22, 2022 · Abstract Energy storage technologies are uniquely qualified to help energy projects with a social equity component achieve better financing options while providing the needed

Energy Storage Financial Model Analysis: Key Trends and

Jul 30, 2022 · The global energy storage market is projected to balloon to $490 billion by 2032 [1], making it the ultimate playground for investors and engineers alike. But how do you separate

Economic evaluation of photovoltaic and energy storage technologies

Jul 15, 2020 · The case study for Australia [] demonstrated that domestic PV systems with small installed capacity proved to be more viable options for investors compared to larger PV-energy

Financial and economic modeling of large-scale gravity energy storage

Jun 1, 2022 · From a financial and an economic perspective, the studied energy storage systems are feasible technologies to store large scales energy capacities because they generate

Modeling Financial Feasibility of Energy Storage

Feb 11, 2025 · Financial modeling frameworks are employed to assess key parameters such as capital expenditure, operational costs, energy storage capacity, lifespan, and market demand.

Part 6: Understanding the Financial Benefits of Energy Storage

Dec 10, 2024 · Understand the financial benefits of energy storage systems, including cost savings, ROI, incentives, and tips on how to make it pay you.

Comprehensive review of energy storage systems

Jul 1, 2024 · The applications of energy storage systems have been reviewed in the last section of this paper including general applications, energy utility applications, renewable energy

Energy Storage Finance and Investment

Dec 17, 2024 · Energy storage systems are critical components in the modern energy landscape, serving as pivotal mechanisms for enhancing the reliability and stability of power grids. With

Techno-economic profitability of grid-scale battery storage

Apr 1, 2025 · Annual average PPEI (profit per unit of energy installed): is a key economic metric that evaluates the financial returns of energy storage per unit of energy capacity, offering

Economic and Operational Benefits of Centralized Energy Storage Systems

Sep 24, 2024 · These results highlight the centralized ESS approach as a more economically advantageous and efficient solution, providing superior financial returns and optimized energy

Reports on FCAS Events & BESS Investment Returns in

5 days ago · Explore how FCAS events and Battery Energy Storage Systems (BESS) ensure grid stability and profitability in Australia''s National Electricity Market.

Evaluating the financial benefits of thermal energy storage in energy

Mar 1, 2025 · This study evaluates the financial viability of thermal energy storage (TES) in China, focusing on its potential to reduce costs in energy systems.

Financial Modeling of Energy Storage Investments

Modeling the financial returns of energy storage investments is a complex but essential task for an Energy Storage Analyst. By following the steps outlined in this article and leveraging tools like

What Investors Want to Know: Project-Financed Battery Energy Storage

Jun 20, 2023 · Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services

Integrating Battery Energy Storage Systems (BESS) into Solar

Aug 30, 2024 · As the renewable energy landscape evolves, the integration of Battery Energy Storage Systems (BESS) with Solar Photovoltaic (PV) systems has emerged as a game

What is the return rate of energy storage? | NenPower

Sep 30, 2024 · Return rate in energy storage systems (ESS) encapsulates the economic profitability derived from investing in these technologies. It signifies how much value is earned

The Standalone Energy Storage Market in India 1

Apr 28, 2025 · Key Findings Standalone Energy Storage Systems (ESS) are rapidly emerging as a key market, with 6.1 gigawatts of tenders issued in the first quarter of 2025 alone, accounting

What is the return rate of energy storage? | NenPower

Sep 30, 2024 · An examination of return rates sheds light on pricing structures across various markets. Energy storage can significantly mitigate peak demand charges and facilitate

Economic and financial appraisal of novel large-scale energy storage

Jan 1, 2021 · This paper presents and applies a state-of-the-art model to compare the economics and financial merits for GIES (with pumped-heat energy storage) and non-GIES (with a

Life cycle economic viability analysis of battery storage in

Oct 15, 2023 · With the income of battery storage from ancillary service market as well as energy market included and the battery capacity degradation considered, this paper adopts the

How to Calculate the Payback Period for Your Energy Storage

Sep 7, 2024 · Energy storage systems offer a multitude of benefits beyond financial returns, including energy independence, environmental sustainability, and enhanced property value.

Return on Investment (ROI) of Energy Storage

Mar 1, 2025 · Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity

Understanding the Return of Investment (ROI) of Energy Storage Systems

5 days ago · Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the

6 FAQs about [Financial Returns of Energy Storage Systems]

How does energy storage affect Roi?

The cost of electricity, including peak and off-peak rates, significantly impacts the ROI. Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the financial attractiveness of ESS installations.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Are energy storage returns undervalued?

Such complexity means the expected economic returns are often undervalued, especially if shortcuts are taken to simplify the analysis. Adopting a holistic approach that considers all revenue streams across a broad range of external events could improve the outlook of energy storage returns.

Is energy storage a good investment?

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To make an accurate calculation for your case and understand the potential ROI of the system, it’s best to contact an expert.

What is energy storage & how does it work?

Energy storage can store surplus electricity generation and provide power system flexibility. A Generation Integrated Energy Storage system (GIES) is a class of energy storage that stores energy at some point along with the transformation between the primary energy form and electricity.

How is energy stored in a wind system?

The wind system with energy storage can either sell to the grid at the CfD price or store the energy. If there is available storage space, then the energy is stored first. If there is no space, then the energy is sold through the CfD

Learn More

- What are the capacitor energy storage systems in Libya

- Several systems of energy storage power station

- Small Energy Storage Systems

- Requirements for battery energy storage systems for high-altitude communication base stations

- Protection clauses for battery energy storage systems in communication base stations

- Construction standards for battery energy storage systems at Vatican communication base stations

- Features of rare energy storage systems

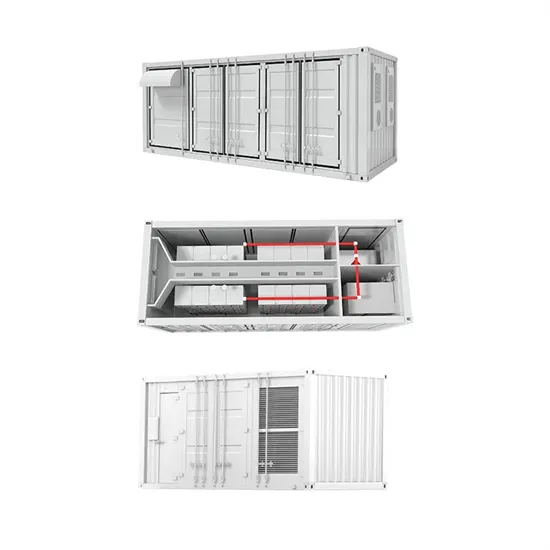

- Technical Difficulties of Containerized Energy Storage Systems

- Components of chemical energy storage systems

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.