10 Energy Storage Companies to Know in 2025

Jan 21, 2025 · The race to develop efficient and scalable energy storage systems has never been more crucial. These technologies underpin the transition to a low-carbon future by ensuring

Top 10 Companies in the Global Battery Energy Storage

Jul 9, 2025 · The Global Battery Energy Storage Market was valued at USD 15.1 Billion in 2024 and is projected to reach USD 57.8 Billion by 2032, growing at a Compound Annual Growth

Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage companies in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Top 10 Battery Energy Storage Systems Companies of 2024

Apr 29, 2024 · Global Battery Energy Storage Systems (BESS) Companies size was valued at USD 6185.25 Million in 2023 and is expected to reach USD 51342.33 Million in 2032, growing

Top 10 Energy Storage Companies Powering Renewables

Jun 3, 2025 · The top 10 companies driving cutting-edge storage tech and supporting the push toward a safe and decentralized carbon-free future are highlighted in this article. 1. Tesla

Which companies need energy storage batteries? | NenPower

May 4, 2024 · Energy storage technologies have propelled the advancement of grid flexibility, enabling a smoother integration of renewable energy sources such as wind and solar. In the

Top 20 Energy Storage Battery Companies in 2024

This essay analyzes the top 20 energy storage battery companies in 2024, highlighting their historical trends, founding times, employee numbers, headquarters, development missions,

Top 10 Companies in the Global Battery Energy Storage

Jul 9, 2025 · This analysis highlights the Top 10 Companies in the Battery Energy Storage Industry – a combination of technology pioneers, energy giants, and system integrators

10 Best Battery Energy Storage Companies in 2025

Oct 5, 2024 · When it comes to the 10 Best Battery Energy Storage Companies, industry leaders like BYD, Tesla, MANLY Battery, and CATL set the benchmark with cutting-edge technology

Top 10 Energy Storage Companies Powering Renewables

Jun 3, 2025 · 10. China''s Sungrow Power Supply Co. Ltd. Sungrow is a top supplier of energy storage systems and inverter solutions. Sungrow''s significant contribution in promoting a

Which companies are energy storage batteries suitable for?

Jan 16, 2024 · Energy storage batteries are ideal for various industries and applications, specifically 1. Renewable energy integration, 2. Electric vehicles, 3. Utility-scale storage, 4.

Which are the top manufacturing Companies of Battery Energy Storage

Dec 10, 2024 · Introduction to the Battery Energy Storage Systems Market/Industry: The battery energy storage systems (BESS) market is poised for transformative growth, driven by the

Top 10 Energy Storage Companies to Watch in 2025

Aug 13, 2025 · In June 2025, CATL unveiled its next-generation high-capacity energy storage battery cell—a 587 Ah cell engineered specifically for utility-scale applications. With an energy

6 FAQs about [Which companies have power storage batteries ]

What are the best battery energy storage companies?

When it comes to the 10 Best Battery Energy Storage Companies, industry leaders like BYD, Tesla, MANLY Battery, and CATL set the benchmark with cutting-edge technology and global market dominance.

Who makes energy storage batteries?

Below are ten of the most influential energy storage battery manufacturers worldwide, covering a wide range of applications from residential to commercial and grid-level storage. The list is in no particular order: 1. CATL (Contemporary Amperex Technology Co., Limited) – China One of the largest manufacturers of lithium-ion batteries globally.

Which country has the most energy storage batteries?

China, in particular, is a major player, with CATL leading globally in battery deliveries for energy storage. The country’s aggressive push to build out its renewable energy capacity is supported by the large-scale implementation of energy storage lithium batteries.

What are the top 10 battery manufacturers in 2024?

Among the top 10 global battery manufacturers (power + energy storage) in 2024, six are Chinese companies: CATL, BYD, EVE Energy, CALB, Gotion High-Tech, and Sunwoda. Three South Korean companies—LG Energy Solution, Samsung SDI, and SK On—along with Japan’s Panasonic also made the list. Part 1. Breakdown of the Top 10 Battery Shipments in 2024

Who is shaping the future of battery energy storage?

Leading companies, from BYD, MANLY Battery to Johnson Controls, are playing pivotal roles in shaping the future of battery energy storage through strategic expansions and product innovations.

Which countries are adopting home energy storage batteries?

In Europe, the market is driven by high electricity costs and strong government support for renewable energy. Countries like Germany, Italy, and Spain are leading the way in the adoption of home energy storage batteries, supported by companies such as Enphase Energy battery storage and Fluence battery energy storage.

Learn More

- Which companies have energy storage power stations in Venezuela

- Which companies have energy storage power stations in Eritrea

- Solar power storage batteries in Bangladesh

- Advantages of installing energy storage batteries in wind power

- Which energy storage photovoltaic power generation company is the best in Vietnam

- Which company owns the solar energy storage power station

- Which company is the best in Albania Valley Power Energy Storage Equipment

- Which company in Freetown is good at energy storage power supply

- Commonly used energy storage batteries for wind power

Industrial & Commercial Energy Storage Market Growth

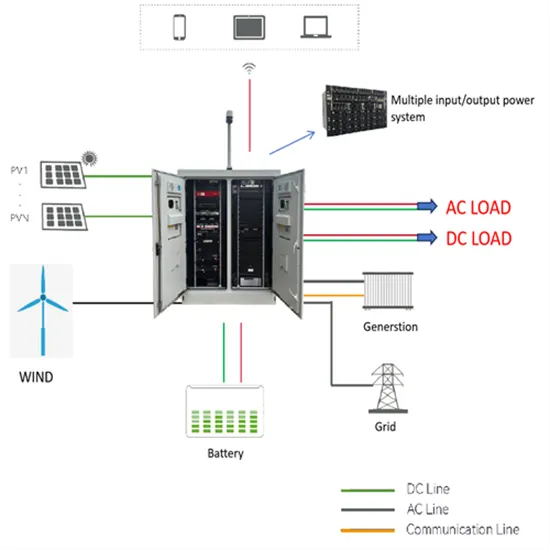

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.