Saudi Arabia confirms bidders for 3.6GW solar

Oct 23, 2024 · The Saudi Power Procurement Company (SPPC) has confirmed a shortlist of bidders for its most recent public solar PV capacity tender. The fifth

Saudi Arabia shortlists bidders for its 3.7 GW solar power tender

Oct 24, 2024 · The Saudi Power Procurement Company (SPPC) has announced the shortlisted bidders for the fifth round of Saudi Arabia''s NationalRenewable Energy Program (NREP),

Huawei awarded largest energy storage contract

Oct 19, 2021 · Huawei Digital Power announced in a statement that it has signed a battery energy storage solution contract related to the Red Sea utilities

Saudi Arabia Awards 3.7 GW PV IPP Contracts: Chinese and

Oct 24, 2024 · Saudi Arabia''s latest PV IPP tender, totaling 3.7 GW, is divided into four projects. State Power Investment Corporation (SPIC) subsidiary Guodian Power, Masdar, and South

Saudi Arabia reveals bidders for 3.7 GW solar tender

Feb 12, 2024 · The tendered PV plants include the 2 GW (AC) Al Sadawi plant located in the country''s east and the 1 GW (AC) Al Masa''a project located in northern Hail province. It also

Middle East''s challenging outlook for PV industry

Nov 3, 2023 · Since 2017, Saudi Arabia has conducted four rounds of utility-scale PV tenders under the NERP, totaling 4,470 MW of capacity. Currently, many projects are still underway.

Developers prepare Saudi round six solar IPP bids

Apr 2, 2025 · Prequalified developers are forming teams to bid for the contracts to develop solar farms under the sixth round of Saudi Arabia''s National Renewable Energy Programme

Saudi Arabia electrical energy tenders

Jun 25, 2025 · Get access to latest Saudi Arabia electrical energy tenders and government contracts. Find business opportunities for Saudi Arabia electrical energy tenders, Saudi Arabia

Saudi Arabia''s 3.7 GW Solar Tender Attracts Lowest Bid Of

Oct 23, 2024 · Saudi Power Procurement Co. (SPPC) announced this week the shortlisted bidders for the final phase of the fifth round of the Saudi Arabian government''s National

Saudi Arabia pre-qualifies bidders in 2-GW battery storage tender

Jan 3, 2025 · Saudi Arabia has pre-qualified 33 companies in a tender that seeks to award 2,000 MW/ 8,000 MWh of battery energy storage system (BESS) projects.

Saudi Arabia : Safeer and Golden Chicken Signs a Solar PV

Apr 25, 2025 · Safeer, a joint venture between TotalEnergies and Zahid group, has signed a PPA agreement with Golden Chicken that includes the installation of solar power plant at their site

Project for Saad Solar PV Substation Project in Saudi Arabia

Tender Announcement: Covers information for RFPs, RFQs, EOI, pre-qualifications and procurement notices issued from various government & public organizations in Qatar.

Saudi renewable round six tender due by year

Jun 26, 2024 · US/India-based Synergy Consulting is providing financial advisory services to SPPC for the NREP fifth- and sixth-round tenders. The round five

6 FAQs about [Saudi Arabia Container Group Photovoltaic Tender]

How many solar PV IPPs are there in Saudi Arabia?

The round five solar PV IPPs took the total capacity of publicly tendered renewable energy projects in Saudi Arabia to over 10,300MW. Solar PV IPPs account for 79%, or about 8,100MW, of the total capacity. Four wind IPPs account for the remaining capacity. SPPC is procuring 30% of the kingdom's target renewable energy installed capacity by 2030.

How many solar PV plants are there in Saudi Arabia?

Renewable Energy Program (NREP), which include 3.7 GW of solar PV projects. The solar PV plants include the 2 GW Al Sadawi plant located in eastern Saudi Arabia, the 1 GW Al Masaa project located in the Hail province, the 400 MW Al Henakiyah 2 plant located in Madinah province and the 300 MW Rabigh 2 project located in Makkah province.

Who are the bidders for solar energy projects?

Bids for these projects were initially disclosed in February, and the shortlisted bidders include prominent energy companies from the Middle East, China, and Europe. The largest project in this round is the 2,000MW Al-Sadawi Solar PV Independent Power Producer (IPP) project.

What is the largest solar PV project in the UAE?

The largest project tendered in the fifth round is the 2000MW Al-Sadawi Solar PV IPP Project. The Emirati state-owned renewables developer Masdar (also known as the Abu Dhabi Future Energy Company) and SPIC Huanghe Hydropower Development – a Chinese state-owned power company – were shortlisted for this project as managing members.

What is the largest solar PV project in the 5th round?

The largest project tendered in the fifth round is the 2000MW Al-Sadawi Solar PV IPP Project. Image: Saudi Power Procurement Company The Saudi Power Procurement Company (SPPC) has confirmed a shortlist of bidders for its most recent public solar PV capacity tender.

How many bidders have been shortlisted for a solar project?

Each project had two bidders shortlisted, dominated by major Middle Eastern and international energy companies. The bids were first announced in February. The largest project tendered in the fifth round is the 2000MW Al-Sadawi Solar PV IPP Project.

Learn More

- Saudi Arabia photovoltaic p-type module prices

- Saudi Arabia produces photovoltaic module glass

- Saudi Arabia low carbon photovoltaic curtain wall application

- Vietnam photovoltaic container customization company

- New Zealand Auckland Sea Freight Photovoltaic Folding Container Wholesale

- Samoa container photovoltaic energy storage cost

- Hungary invests in photovoltaic container room

- Nepal photovoltaic folding container house wholesale

- Budapest Iron Photovoltaic Folding Container Wholesale

Industrial & Commercial Energy Storage Market Growth

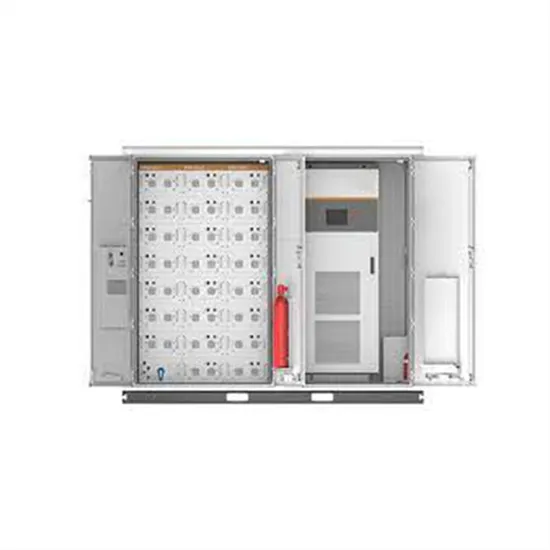

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.