Saudi Arabia Solar Energy Market Size, Share & Growth

Solar photovoltaic accounts for over 65% market share in the Saudi Arabia Solar Energy Market among both solar energy types. The large share is attributed to the benefit of the cost

Saudi Arabia Solar PV Module Market Size, Share, Growth

The Saudi Arabia solar pv module market report provides a deep and thorough evaluation of the market, including value and volume trends and pricing history. Growth-inducing factors, market

Solar PPAs viable in Saudi Arabia at prices above $26.10/MWh

"The Sakaka solar PV plant operates under a 25-year PPA with an electricity price of $23.40/MWh, while the Dumat Al Jandal wind farm has a 20-year PPA with an electricity price

Saudi Arabia Solar PV Module Market 2024-2032

Aug 9, 2025 · The Saudi Arabia Solar PV Module Market can be segmented based on various factors, including module type, application, and end-user. Module types include

Saudi Arabia Solar PV Module Market to Grow at 10.12

Feb 25, 2025 · IMARC Group''s latest report, titled "Saudi Arabia Solar PV Module Market Report by Technology (Thin Film, Crystalline Silicon, and Others), Product Type (Monocrystalline,

pv dex: n-type module prices continue to fall in

Aug 7, 2024 · The price of n-type solar modules has continued to decline in Europe thanks to oversupply and "fierce competition" amongst manufacturers,

Saudi Arabia''s growing solar power capabilities | Gowling WLG

Mar 7, 2023 · In Saudi Arabia, solar power is a significant piece of its 2030 vision and economic plan (Vision 2030). In addition to the environmental benefits associated with solar power,

Full article: PV energy penetration in Saudi Arabia: current

Jan 22, 2024 · ABSTRACT Saudi Arabia is the largest country in the Middle East with huge solar energy resources but has achieved minimal adoption of photovoltaic energy systems (PV).

Performance evaluation and feasibility analysis of 10 kWp PV

Jun 1, 2022 · This paper aims to evaluate the performance and feasibility of a 10 kWp Photovoltaic system for housing buildings in various locations around Saudi Arabia. The

Feasibility study of the grid connected 10 MW installed capacity PV

Dec 1, 2017 · Abstract The study presents technical, environmental and economic aspects for the selection of viable sites for constructing 10 MW installed capacity grid connected photovoltaic

Photovoltaic Solar Module Imports into SAUDI ARABIA

Gain access to SAUDI ARABIA''s Photovoltaic Solar Module imports data, including information on top suppliers, top buyers, and shipment details such as quantity, price, HSN code and Trading

Solar Module Imports In Saudi-arabia | solar module export price

Information and reports on Solar Module Imports In Saudi-arabia along with detailed shipment data, import price, export price, monthly trends, major exporting countries countries, major

A transition toward localizing the value chain of photovoltaic

May 4, 2021 · The present paper draws attention to the importance of localizing the value chain of photovoltaic solar energy in Saudi Arabia based on the country''s vision for 2030 to meet the

Top Solar Panel Manufacturers Suppliers in Saudi Arabia

Aug 17, 2025 · Founded in 1981, Motech Industries Inc., also known as Motech Solar, is dedicated to the research, development, and manufacture of high-quality solar products and

6 FAQs about [Saudi Arabia photovoltaic p-type module prices]

Could a power purchase agreement make large-scale solar projects viable in Saudi Arabia?

Saudi scientists have determined the current price threshold for power purchase agreements (PPA) that could make large-scale PV and wind power projects viable in Saudi Arabia. They incorporated data from the 300 MW Sakaka solar farm and four potential utility-scale PV project sites.

How much does electricity cost in Saudi Arabia?

The average cost of electricity in Saudi Arabia as of March 2024 is: 3 Residential Electricity Price: Around USD 0.053 per kWh. There is currently no contribution Consulting Service Turnkey Service Explore Saudi Arabia solar panel manufacturing with market analysis, production statistics, and insights on capacity, costs, and industry growth trends.

How much does a solar PV plant cost?

“The Sakaka solar PV plant operates under a 25-year PPA with an electricity price of $23.40/MWh, while the Dumat Al Jandal wind farm has a 20-year PPA with an electricity price of $21.30/MWh,” the researchers said, acknowledging that technical and financial details for the plants are not fully available.

Who was shortlisted in Saudi Arabia's latest solar tender?

ACWA Power was among the shortlisted bidders in the latest tender. Image: ACWA Power. Shortlisted bids in Saudi Arabia’s latest solar tender have jumped significantly on the lowest price recorded in the country’s previous renewables programme, reflecting the hikes in PV equipment costs in recent months.

Are solar PV-wind technologies economically feasible in South Africa?

“Sensitivity analysis of PPA rates indicated that solar PV, wind energy, and hybrid solar PV-wind technologies are economically feasible in SA at PPA rates above $32.8/MWh, $26.1/MWh, and $50.6/MWh, respectively,” they concluded.

How much NPV should a solar project cost?

They said that to achieve zero NPV values, the other identified sites for solar deployment should host projects requiring PPA prices ranging from $26.10/MWh to $29.30/MWh.

Learn More

- Saudi Arabia produces photovoltaic module glass

- Morocco photovoltaic module specifications and prices

- Venezuela photovoltaic module prices

- Photovoltaic module prices in Maputo

- Serbia polycrystalline photovoltaic module prices

- Czech monocrystalline photovoltaic module prices

- Photovoltaic module prices View EK

- North Korean thin-film photovoltaic module prices

- Seamless installation of photovoltaic module prices

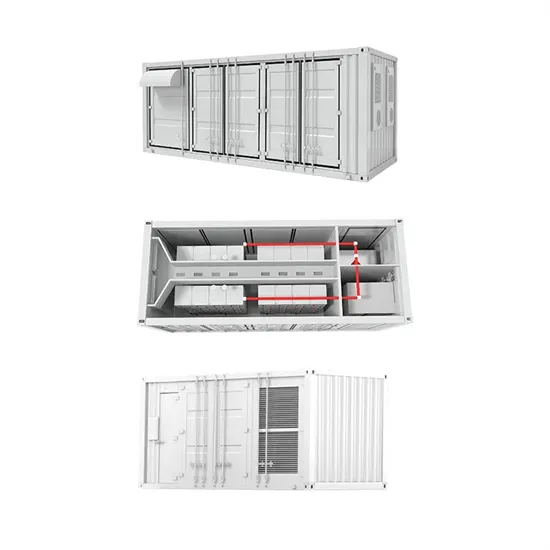

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

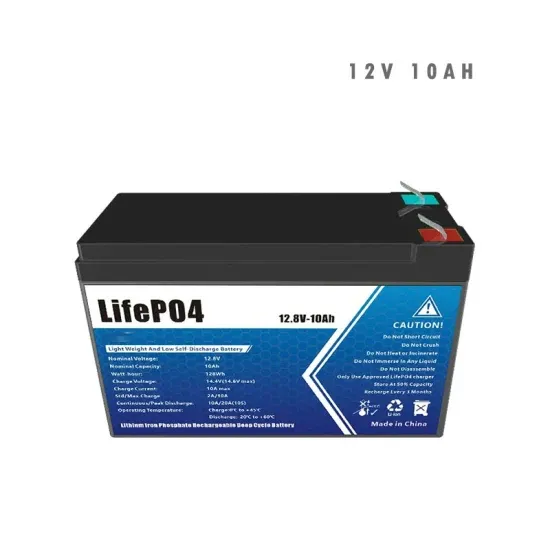

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.