Mozambique: Photovoltaic station in Cuamba to be

Apr 26, 2023 · The construction of a solar power station, in Cuamba district, in the northern Mozambican province of Niassa, which has already consumed 38 million dollars, will be

Power plant profile: Cuamba Solar PV Project, Mozambique

Feb 8, 2024 · Cuamba Solar PV Project is a 19MW solar PV power project. It is located in Niassa, Mozambique. According to GlobalData, who tracks and profiles over 170,000 power plants

The largest building and construction projects in Mozambique

Jul 16, 2025 · We give you a list of all the major building and construction projects currently under construction in Mozambique covering roads, rail, airports, sea ports, buildings, energy,

Mozambique''s First Large Scale Solar Plant – ASEZA

Located in Zambézia province, this 40 MW facility is a crucial step towards sustainable energy in a nation rich in hydro, gas, and solar potential but struggling with transmission and rural

Mozambique: Metoro solar project begins construction

Jan 16, 2020 · France''s Neoen announced on 19 December that it had reached financial close on its 41MWp Metoro solar PV project. Portugal''s Efacec has started to build the plant, which will

Mozambique, UAE Investors Forge ahead With Photovoltaic

Aug 1, 2024 · Investors from Mozambique and the United Arab Emirates will move forward with the installation of a 125 MegaWatt (MW) photovoltaic solar plant in the province of Tete,

Mozambique photovoltaic energy storage project

Mozambique''''s first solar plus storage IPP project breaks ground African focused renewable energy independent power producer, Globeleq, and its project partners, Source Energia and

Mozambique energy storage power station

6 · African power development company Ncondezi Energy Ltd (LON:NCCL) said on Friday it had secured approval for the study into the connection of its proposed 300-MW solar PV

Mocuba – The First Utility Scale PV Project in Mozambique

Jun 19, 2023 · Potential attractive grid locations were identified where Solar PV generation would be beneficial to the overall transmission grid performance, one of which is Mocuba

Engineering News

Feb 26, 2016 · The project will include a 500 m to 1 000 transmission line to the Mocuba power station and the construction of 500 m to 1 000 m of gravel road to connect the project site to

Top five solar PV plants in development in Mozambique

Sep 9, 2024 · Of the total global Solar PV capacity, 0.01% is in Mozambique. Listed below are the five largest upcoming Solar PV power plants by capacity in Mozambique, according to

Power plant profile: Matambo Solar PV Plant, Mozambique

Oct 21, 2024 · Matambo Solar PV Plant is a 200MW solar PV power project. It is planned in Tete, Mozambique. According to GlobalData, who tracks and profiles over 170,000 power plants

Cuamba Solar + BESS

5 days ago · The plant is the first IPP in Mozambique to integrate a utility-scale energy storage system and includes an upgrade to the existing Cuamba substation. The Cuamba Solar plant

6 FAQs about [Mozambique Communication Photovoltaic Base Station Construction Project Department]

Who built Mozambique's first large-scale solar power plant?

Capital and expertise from Scatec Solar, KLP and Norfund enabled the construction of Mozambique’s first large-scale solar power plant. Central Solar de Mocuba (CESOM) provides over 79 GWh of electricity annually, which is equivalent to the electricity consumption of more than 170,000 households in Mozambique.

Why did Mozambique build a photovoltaic power station in Mecufi?

The photovoltaic power station in Mecufi stemmed from the need to supply Mozambique with energy for the expansion of industrial activities in the northern part of the country, between Pemba and Palma. The documentation for the project, which will be developed through project financing, includes the concession to use the land for 25 years.

Who owns the photovoltaic power station in Mozambican?

The photovoltaic power station will be constructed on the basis of a fixed-price turnkey EPC agreement between Renco and Mozambican company Renco Tek, owned by Renco. The Operation & Maintenance agreement will be fulfilled by Renco Tek, a local company owned by Renco.

Will Moz energy build a solar park in Moçambique?

The state-owned company Electricidade de Moçambique has entered into an agreement with the local private company MOZ Energy for the construction of a solar park that will produce photovoltaic energy for the area. The solar park will have an overall power of 90 MW and will be built in stages.

What does Cuamba solar mean for Mozambique?

The plant is the first IPP in Mozambique to integrate a utility-scale energy storage system and includes an upgrade to the existing Cuamba substation. The Cuamba Solar plant supplies enough power for 21,800 consumers over the project’s life and is expected to avoid the equivalent of more than 172,000 tonnes of CO2 emissions

How will Mozambique's power plant's strategic location affect the grid?

The project’s strategic location will reduce energy transmission losses and improve the security of energy supply in northern Mozambique and stabilize the grid. It is estimated that the power plant’s connection to the EDM grid will result in a seven percent improvement in the network default level.

Learn More

- South Africa Communications Photovoltaic Base Station Construction Project Department

- Tender for solar photovoltaic project of communication base station

- Samoa communication base station inverter grid-connected construction project bidding

- Warsaw communication base station battery construction project

- Rabat communication base station wind and solar complementary project construction

- Construction of solar photovoltaic power station for communication base station

- Bidding for West Asia Communication Base Station Inverter Grid Connection Construction Project

- Uzbekistan 5g communication base station wind power construction project

- Jakarta 5g communication base station inverter construction project

Industrial & Commercial Energy Storage Market Growth

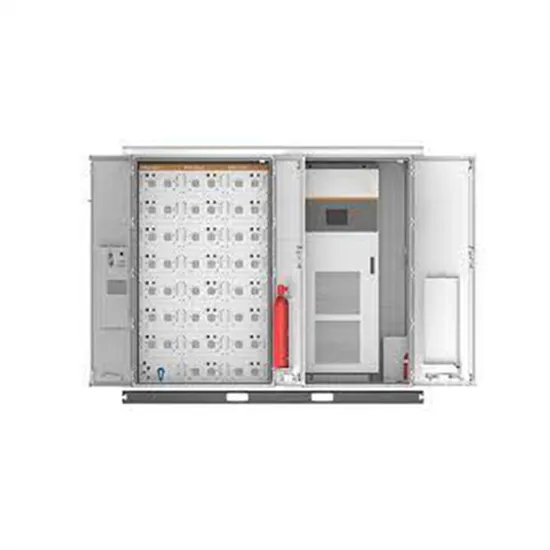

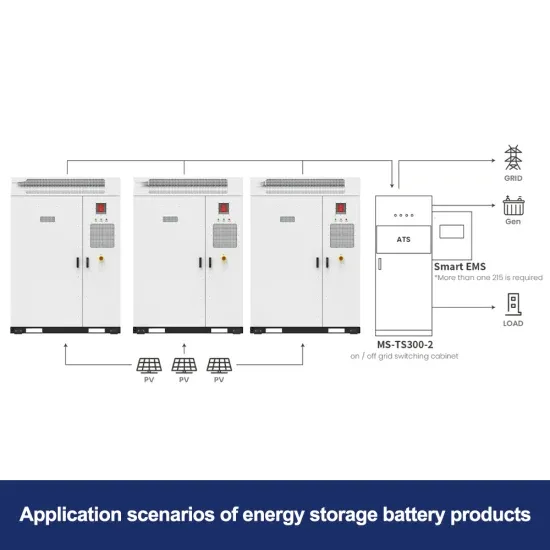

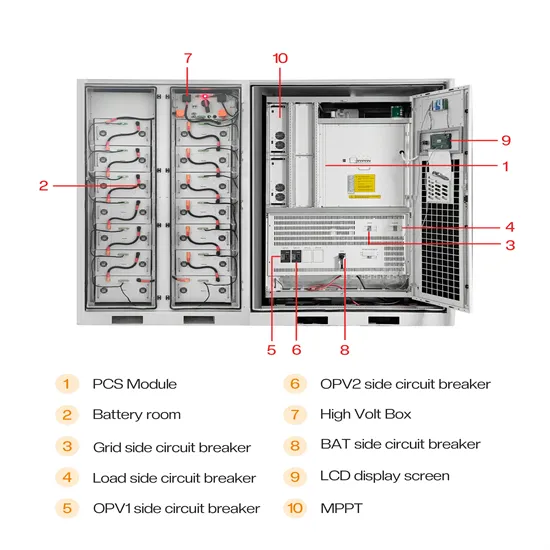

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

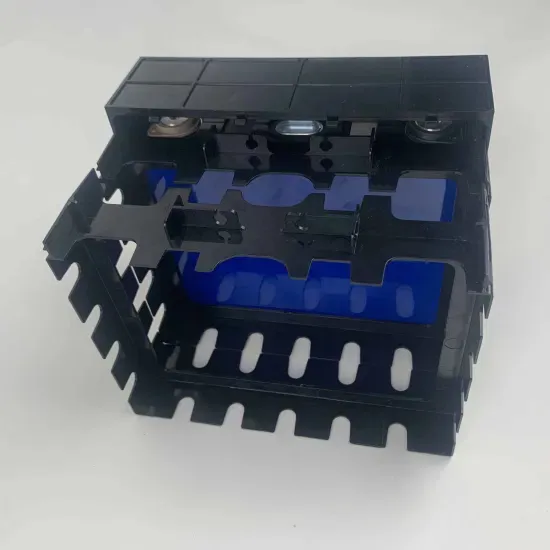

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.