Top 6 Insulating Glass Manufacturers in Sri Lanka (2025)

Globe Glass Pvt Ltd is the largest manufacturer of glass products in Sri Lanka, offering a variety of energy-saving and eco-friendly glass solutions, including double glazed glass, which is

Sri Lanka Building Integrated Photovoltaics (BIPV) Glass

Sri Lanka Building Integrated Photovoltaics (BIPV) Glass Market (2024-2030) | Growth, Forecast, Analysis, Share, Companies, Segmentation, Outlook, Value, Size & Revenue, Trends,

Building Integrated Photovoltaic System (BiPV)

Feb 22, 2023 · Photovoltaic Foundry Pte. Ltd. (PvFoundry®️) is an Invent-and-Build solar technology company headquartered in Singapore since 2016. PvFoundry®️ specialises in

Guidelines on Rooftop Solar PV Installation for Solar

Oct 25, 2022 · Preface This document provides a general guideline and best practices guide for the installation of rooftop solar PV systems in Sri Lanka. The guide was prepared based on the

55kg/h-1000kg/h Solar Panel Recycling Machine for Photovoltaic Glass

We are Solar Panel Recycling Machine manufacturer & provide 55kg/h-1000kg/h Solar Panel Recycling Machine for Photovoltaic Glass and Si Power - Henan Zhengyang Machinery

Sri Lanka Solar PV Glass Market (2024-2030) | Size

Historical Data and Forecast of Sri Lanka Solar PV Glass Market Revenues & Volume By Utility for the Period 2020- 2030 Sri Lanka Solar PV Glass Import Export Trade Statistics Market

Advancements in Photovoltaic Glass Technology

Aug 19, 2025 · Photovoltaic glass integration in factoriesPhotovoltaic glass integration transforms factory roofs and walls into power-generating assets while maintaining structural integrity and

Top 13 Glass Recycling Companies in Sri Lanka (2025) | ensun

The glass recycling industry in Sri Lanka presents several key considerations for potential stakeholders. Understanding the regulatory framework is crucial, as the government has

Guidelines on Rooftop Solar PV Installation for Solar

Aug 9, 2024 · Preface This document provides a general guideline and best practices guide for the installation of rooftop solar PV systems in Sri Lanka. The guide was prepared based on the

S S Glass | Sri Lanka''s Trusted Glass Importer & Distributor

At S S Glass, we import premium-quality glass from globally recognized manufacturers including Saint-Gobain, Guardian Industries, AGC Asia Pacific, and more. As a trusted glass importer

Solar Glass Market Size, Trends, Growth Report, 2025-2033

Aug 14, 2025 · Photovoltaic cells are integrated into solar glass, enabling it to convert solar radiation into electrical power. Government rules that are favorable to the development of solar

Understanding Low Embodied Carbon Materials in

1 day ago · Our photovoltaic glass technology directly supports your goals by integrating energy-efficient solutions designed to minimize embodied carbon in new or renovated buildings.

6 FAQs about [Sri Lanka photovoltaic glass]

Is Sri Lanka a good place for solar energy?

Sri Lanka is located close to the equator and receives abundant sunlight throughout the year, making it an ideal location for solar energy generation. According to a 2017 study by the Asian Development Bank (ADB), Sri Lanka has a high potential for solar power with an average solar insolation of 4-6 kWh/m2 per day. How Does Solar Energy Work?

How does solar power benefit Sri Lanka?

Scaling up domestic solar generation will reduce reliance on imported coal and oil, improving energy security and current account deficits. The CEB expects solar power to account for 20% of generation by 2030 from zero today. How does solar power benefit the economy of Sri Lanka?

What is the installed solar capacity in Sri Lanka?

Solar power is an emerging energy source in Sri Lanka. According to the Ceylon Electricity Board (CEB), the installed solar capacity was around 164 MW as of 2018, contributing 0.4% of total electricity generation. However, solar adoption is rapidly increasing driven by favorable policies.

Which solar panels are best for Sri Lanka?

Monocrystalline and polycrystalline silicon panels are well-suited for Sri Lanka's climate. Monocrystalline panels made from a single silicon crystal tend to be slightly more efficient in high temperatures. Polycrystalline panels with silicon fragments are cheaper but marginally less efficient.

Who created the first solar atlas of Sri Lanka?

The first solar atlas of Sri Lanka was prepared by the National Renewable Energy Laboratory (NREL) of USA, in 2005, as the Wind and Solar Resource Atlas of Sri Lanka and Maldives. Such attempts in exploring solar resources of the country provided valuable information leading to gross estimates of solar potential.

How much solar radiation does Sri Lanka receive?

Sri Lanka receives significant amount of solar radiation across all geographical regions. The Global Horizontal Irradiance (GHI) varies between 1,247 kWh/m 2 to 2,106 kWh/m 2. It is interesting to note that the intensity of solar irradiation in lowland areas is high compared to mountainous regions.

Learn More

- How much does photovoltaic panels cost in Sri Lanka

- Sri Lanka photovoltaic panel installation manufacturer

- Myanmar photovoltaic curved glass price

- Load requirements for photovoltaic glass

- Bamako Photovoltaic Glass

- Perovskite cTO photovoltaic glass

- Photovoltaic glass heating

- Is ultra-white glass photovoltaic glass

- Guinea-Bissau resumes taxing photovoltaic glass

Industrial & Commercial Energy Storage Market Growth

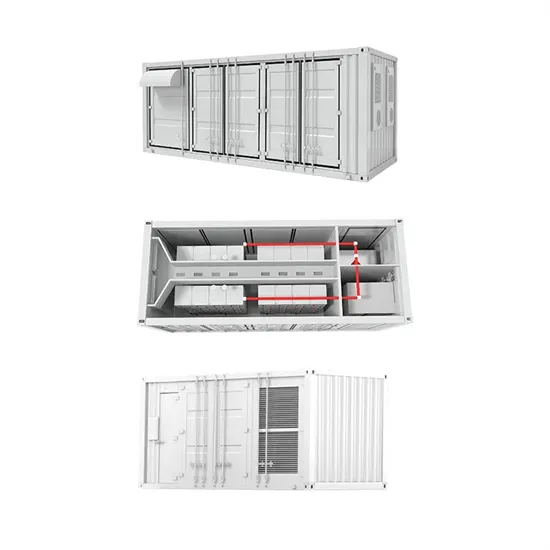

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.