Meed | Saudi Arabia evaluates 2.5GW energy storage bids

Oct 23, 2024 · National Grid Saudi Arabia, a wholly-owned subsidiary of Saudi Electricity Company (SEC), is evaluating bids for the contract or contracts to supply battery energy

Saudi Arabia prequalifies battery energy storage

Jan 2, 2025 · The SPVs will enter into a 15-year storage services agreement with the principal buyer. According to SPPC, the energy storage programme will

Saudi Arabia Emerges as a Leading Market for Energy Storage

4 days ago · Saudi Arabia is establishing itself as a significant player in the energy storage sector, now ranked among the top ten global markets for battery energy storage. This recognition

Saudi Arabia Rises to Global Top 10 in Energy Storage, Eyes

Feb 17, 2025 · According to energy consultancy Wood Mackenzie, Saudi Arabia is at the forefront of rapidly expanding energy storage markets. The Kingdom plans to operate 8 GWh of storage

Saudi''s 22 GWh Energy Storage Vision by 2026

Jun 10, 2025 · Saudi Arabia is fast-tracking its battery storage expansion under the National Renewable Energy Program, aiming for 48 GWh of storage capacity by 2030. Already, 26

Saudi Arabia Launches Construction of 2.5GW Grid-Scale Energy Storage

Apr 17, 2025 · Under the supervision of the Ministry of Energy, the Saudi Electricity Company (SEC) has announced the launch of the second phase of its battery energy storage system

Saudi Arabia invites 2.5GW battery storage bids

Aug 30, 2024 · National Grid Saudi Arabia, a wholly-owned subsidiary of Saudi Electricity Company (SEC), has tendered contracts for the construction of five battery energy storage

Saudi Arabia: Bidders revealed for 8GWh battery

Jan 2, 2025 · In addition to public-private partnerships such as through SPPC, Saudi Arabia will host gigawatt-hour scale battery storage facilities to integrate

SEC receives Bids for 1,000 MW Battery Energy Storage System

Apr 22, 2025 · Saudi Electricity Company (SEC) receives Bidders Proposals for Battery Energy Storage Systems (BESS) having Combined Capacity of 1,000 MW. The Project location is in

Saudi Arabia Emerges as a Leading Market for Energy Storage

4 days ago · Under the National Renewable Energy Program, which is overseen by the Ministry of Energy, Saudi Arabia aims to develop a total storage capacity of 48 gigawatt-hours by 2030.

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Feb 4, 2022 · Meeting the national renewable energy targets requires scaling up and systematic integration of variable renewable energy (VRE) systems into the power grid, which in turn

SPPC Starts the Qualification Process for the First

2 days ago · Riyadh, November 04, 2024, SPA -- The Saudi Power Procurement Company (SPPC), under the supervision of the Ministry of Energy, has started

BYD Got Saudi Arabia''s 12.5GWh Battery Storage System

Jan 15, 2025 · According to Official Account Weixin lD@gh_5d67ff58c348, recently, Saudi Electricity Company (SEC) announced the award of a series of contracts for Battery Energy

With an annual capacity of 5GWh, Hithium proposes to build

Oct 21, 2024 · Recently, Hithium, the world''s leading energy storage company, has taken an important step in the Middle East by announcing the establishment of a joint venture with

6 FAQs about [Riyadh energy storage system capacity]

Will Saudi Arabia develop a storage capacity of 48 gigawatt-hours?

Under the National Renewable Energy Program, which is overseen by the Ministry of Energy, Saudi Arabia aims to develop a total storage capacity of 48 gigawatt-hours by 2030. To date, projects totaling 26 gigawatt-hours have been tendered and are currently in various phases of development.

Is Saudi Arabia a leader in battery energy storage?

The Kingdom enters the top ten global rankings for battery energy storage with ambitious future capacity goals. Saudi Arabia is establishing itself as a significant player in the energy storage sector, now ranked among the top ten global markets for battery energy storage.

What is the capacity of Riyadh refinery?

Riyadh Refinery, located in the central region of Saudi Arabia, has a capacity of 120.000 barrels per day (BPD) and has a vacuum column, which permits processing of the heavier crude fractions.

How much energy is saved in Riyadh & Jeddah?

Energy savings for single measures on the building envelope vary from 1 – 27 % for Riyadh and 1 – 21 % for Jeddah. The measure providing the lowest energy saving for both cities is improved thermal bridges while improved window type achieves the highest energy savings.

What is a battery energy storage system (BESS)?

Saudi Electricity Company (SEC) has taken a significant step in modernising the Kingdom’s energy infrastructure with the awarding of contracts for a large-scale Battery Energy Storage System (BESS). The project, with a combined capacity of 2,500 MW/10,500 MWh, will enhance grid stability and support renewable energy integration.

How is Saudi Arabia transforming its energy sector?

Saudi Arabia's energy sector is undergoing a comprehensive transformation, reinforcing its leadership position in the production and export of a variety of energy forms. By the end of 2024, it is projected that the total capacity of renewable energy projects across all stages of development will reach 44.1 GW.

Learn More

- Substation capacity and energy storage capacity

- Antananarivo household energy storage installed capacity

- Energy storage battery capacity temperature compensation coefficient

- Energy storage container size installed capacity is how many liters

- Household large capacity energy storage

- Energy storage battery and capacity

- Built-in capacity of each energy storage device

- Electrochemical energy storage capacity configuration

- Guatemala communication base station flywheel energy storage photovoltaic power generation capacity

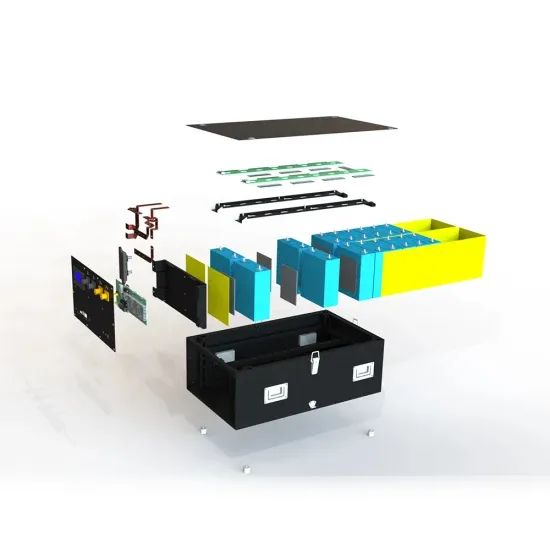

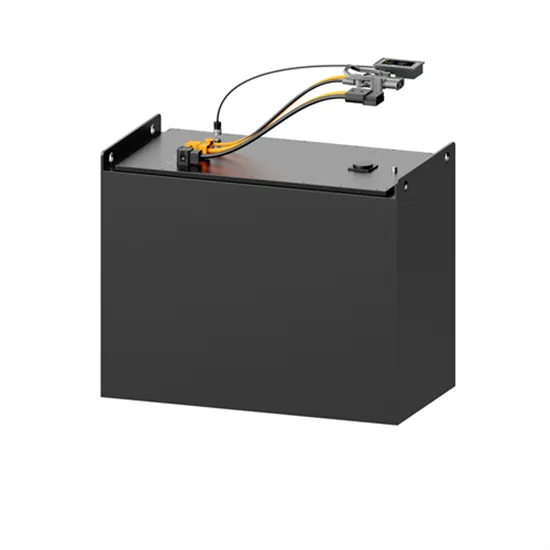

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.