Top 15 Lithium-ion Battery Manufacturers: A Global Review

Jun 26, 2025 · Discover the top 15 lithium-ion battery manufacturers for 2025 in our global guide. We compare the best companies for EV, industrial, and custom lithium batteries to find your

Marcos opens first EV battery plant in

Oct 1, 2024 · President Ferdinand Marcos inaugurated on Monday the first factory for electric vehicle batteries in the Philippines, calling it the "future" of clean

LIST OF BATTERY MANUFACTURERS IN METRO MANILA

What are the top 10 power lithium battery manufacturers in the world? The world''s top 10 Power Lithium battery manufacturing companies include China''s CATL, BYD Company, Panasonic,

Directory of Lithium battery Suppliers & manufacturers in Philippines

Aug 31, 2023 · Choose New & Economical suppliers & manufacturers in Philippines from 60 Lithium battery exporters based on export shipments till Aug - 23 with Price, Buyer, Qty, Ph,

List Of Battery Manufacturers in Metro Manila

May 5, 2025 · There are 12 Battery Manufacturers in Metro Manila as of May 5, 2025; which is an 0.00% increase from 2023. Of these locations, 7 Battery Manufacturers which is 58.33% of all

Top Lithium-Ion Battery Manufacturers Suppliers in Philippines

2 days ago · Our website lists lithium-ion batteries from reputable brands all over the world. As a result, you can expect that the lithium-ion batteries that we offer are of the best variety. They

Top Lithium-Ion Battery Manufacturers Suppliers in Philippines

2 days ago · Wholesale Lithium-Ion Battery for PV Systems? Simply put, a lithium-ion battery (commonly referred to as a Li-ion battery or LIB) is a type of rechargeable battery that is

BSLBATT® completes delivery of lithium-ion batteries to

Aug 29, 2023 · Our Filipino client consolidated its small warehouse in Manila into two large distribution centers and replaced the fleet of forklifts at both locations from previously using

Battery Manufacturers in the Philippines

Narada Global Service Philippines, Inc. "Impacting Lives with Energy" Business type: manufacturer Product types: batteries deep cycle, batteries lead acid sealed AGM, batteries

LEOCH | To Provide Reliable And Innovative Power Supply

Leoch mainly produces reserve power batteries, SLI batteries and motive power batteries and they include series products such as AGM VRLA batteries, VRLA-GEL battery, pure lead

6 FAQs about [Manila Tool Lithium Battery Manufacturer]

Who is the best lithium ion battery manufacturer in the Philippines?

Luzon Power Tech Solutions, based in Manila, rounds out the list of top lithium ion battery manufacturers in the Philippines. Since its inception in the mid-2010s, LPTS has focused on providing high-quality lithium batteries for automotive and industrial applications.

Why should you choose a battery company in Manila?

Companies in Manila are well-placed to manage imports of raw materials such as lithium, necessary for the production of lithium ion batteries, and to export finished products globally. Founded in the early 2000s, Philippine Battery Incorporated has grown to become one of the leading battery manufacturers in the Philippines.

Which country has the best battery industry in the Philippines?

Cebu is another significant player in the Philippines’ battery industry. Known for its robust manufacturing sector, Cebu has attracted numerous battery suppliers, including specialists in lead acid battery supplier Philippines and lithium ion battery suppliers Philippines.

What makes PBI the best battery company in the Philippines?

Moreover, PBI has established strong partnerships with local and international firms, enhancing their capability to innovate and stay ahead in the market. Located in Davao, Mindanao Energy Systems Inc. is another top contender in the Philippines’ battery market, specializing particularly in lithium ion batteries and solar battery systems.

Why is Manila a key hub for battery supply in the Philippines?

As the capital and one of the largest cities in the Philippines, Manila stands as a central hub for the battery supplier Philippines industry. The city’s extensive port facilities and well-developed logistics infrastructures serve as the backbone for the distribution and supply chains of battery manufacturers.

Why should you invest in lithium batteries in the Philippines?

Our mission is to empower sustainable mobility through cutting-edge lithium batteries, ensuring reliable performance and a cleaner environment. The battery industry in the Philippines is rapidly evolving, driven by the increasing demand for renewable energy and electric vehicles.

Learn More

- India Mumbai tool lithium battery manufacturer

- Netherlands Power Tool Lithium Battery

- Ulaanbaatar lithium battery pack supplier manufacturer

- South Tarawa pack lithium battery custom manufacturer

- Valletta power tool lithium battery customization

- Egypt energy storage lithium battery manufacturer

- Polish tool lithium battery

- Sana electric tool lithium battery

- Solomon Islands Power Tool Lithium Battery

Industrial & Commercial Energy Storage Market Growth

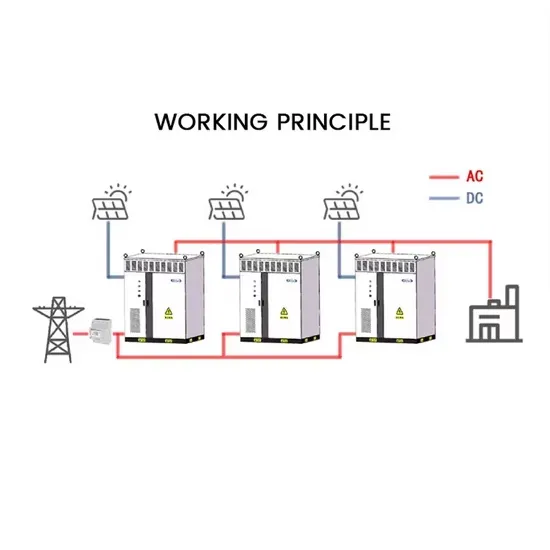

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.