Power Tool Lithium Battery Market : Overview and Key Trends

Dec 12, 2024 · The Power Tool Lithium Battery Market is experiencing significant growth driven by the increasing demand for cordless power tools across industries such as construction,

Lithium Batteries in Power Tools

Compared with the previous nickel-cadmium nickel-metal hydride batteries, lithium batteries can well meet the market trend of miniaturization, lightweight and high efficiency of power tools due

Netherlands Power Tool Batteries Market (2024

Netherlands Power Tool Batteries Market (2024-2030) | Value, Companies, Segmentation, Size & Revenue, Industry, Outlook, Trends, Analysis, Growth, Forecast, Competitive Landscape, Share

Top Lithium-Ion Battery Manufacturers Suppliers in Netherlands

Aug 14, 2025 · Wholesale Lithium-Ion Battery for PV Systems? Simply put, a lithium-ion battery (commonly referred to as a Li-ion battery or LIB) is a type of rechargeable battery that is

Recondition Power Tool Batteries: Step-by-Step

Jan 4, 2025 · Power tool battery reconditioning is the process of restoring the performance of rechargeable batteries such as nickel-cadmium (NiCd), nickel

Power Lithium Battery Market : Italy | Netherlands | Spain

Jul 25, 2025 · The Netherlands boasts a thriving Power Lithium Battery market owing to its tech-savvy economy, robust logistics infrastructure, and innovation-driven policies.

Power Tool Lithium Battery Market Size, Trends, Share,

Overall, Power Tool Lithium Battery market plays a crucial role in helping businesses and organizations make informed decisions based on data-driven insights. As the demand for data

2032年电动工具锂电池市场分析及预测

常见问题 : 1. What is the market size of the Global Power Tool Lithium Battery Market? 2. Which region is expected to dominate the Global Power Tool Lithium Battery Market? 3. What are the

Power tool battery from the Netherlands, used power tool battery

Power tool batteries from the Netherlands 24 offers Price from €30 New and used Trusted sellers Currently in stock Quality construction equipment for sale at Machineryline

Are tools with lithium-ion batteries safe to use?

Jan 8, 2021 · Though the odds of one of your power-tool Li-Ion batteries catching fire are incredibly remote, it still pays to follow these practices: * Use original

Netherlands Power Tool Batteries Market (2024

Netherlands Power Tool Batteries Industry Life Cycle Historical Data and Forecast of Netherlands Power Tool Batteries Market Revenues & Volume By Technology Type for the Period 2020- 2030

Power Tool Batteries Explained: Pick up the right

Jan 23, 2019 · Li-ion, NiMH, NiCD, 18V, 1.3Ah, every one of these terms can get to be befuddling which is the reason we''ve explained power tool battery and

Learn More

- Upgrade power tool lithium battery

- Power tool lithium battery inverter

- Power tool lithium battery 48v

- Valletta power tool lithium battery customization

- Power tool lithium battery panel b

- Brunei Power Tool Lithium Battery

- Zambia Pack Power Lithium Battery New Energy 2025 Company

- Tajikistan electric tool lithium battery

- Tool Battery Lithium Battery Accessories

Industrial & Commercial Energy Storage Market Growth

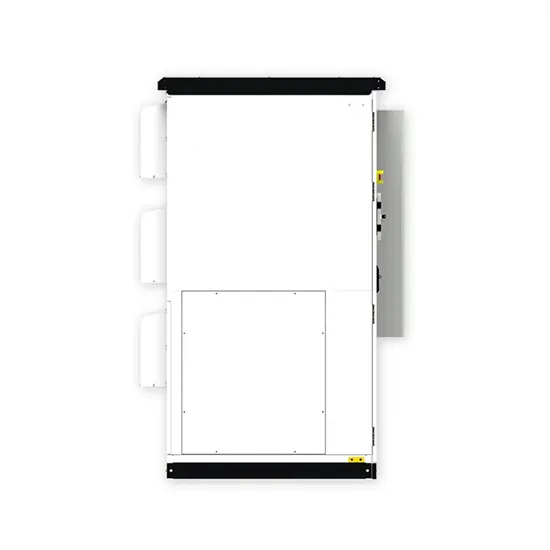

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

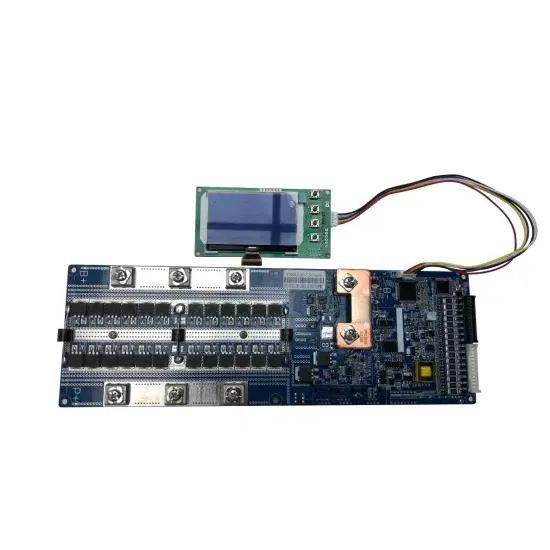

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.