The role of energy storage in Australia''s future energy

ISF''s participation consists of two research projects: a multiple-scenario approach to model the potential requirement for uptake of energy storage to ensure Australia''s energy security, and

Rare Earth Elements in Renewable Energy Technologies

Furthermore, rare earth elements are essential in the development of energy storage technologies. Lithium-ion batteries, which are widely used in electric vehicles and renewable

17 Top Energy Storage Companies in Australia · August 2025

Aug 1, 2025 · Detailed info and reviews on 17 top Energy Storage companies and startups in Australia in 2025. Get the latest updates on their products, jobs, funding, investors, founders

Large-Scale Battery Storage Knowledge Sharing Report

2.2 Scope The data and insights presented in this report are sourced, in a large part, from ARENA co-funded LSBS projects; Energy Storage for Commercial Renewable Integration – South

Battery Energy Storage Systems

Sep 12, 2024 · The transition to renewable energy generation requires energy storage solutions to preserve the current system resilience, ensuring that supply matches the demand needs within

Australia''s Energy Landscape: A Spotlight on Battery Energy Storage System

Nov 14, 2024 · Australia''s journey towards a sustainable energy future is gaining momentum, and Battery Energy Storage Systems (BESS) are emerging as a powerful tool to help us get there.

Energy Storage Technology in Australia

6 days ago · Allegro Energy We can have much cheaper batteries without rare metals. Born in the Hunter, Allegro''s battery design uses readily available materials without compromising

What energy storage technologies will Australia need as

Aug 1, 2024 · Pumped Hydro Energy Storage (PHES), Compressed Air Energy Storage System (CAES), and green hydrogen (via fuel cells, and fast response hydrogen-fueled gas peaking

Large-scale battery storage investment in Australia reached

May 30, 2025 · The first quarter (Q1) of 2025 has seen a surge in investment for large-scale battery storage in Australia, with six projects worth a total of A$2.4bn ($1.5bn) reaching the

6 FAQs about [Australia s rare energy storage system]

Which energy storage technology is best for Australia's energy needs?

The CEC said emerging LDES technologies coupled with the energy storage systems in place, would be the best suite to appropriately manage Australia’s needs. In March this year, the ARENA held an Insights Forum which covered energy storage and technologies that can bring system security to the grid.

How can renewable storage technology transform Australia?

Renewable storage technologies have the potential to revolutionise clean and reliable energy access in remote communities, support cost-effective decarbonisation in industry and transform Australia into a green hydrogen export superpower.

What is Australia doing about energy storage?

Australia is actively progressing along the risk development curve of energy storage and is one of the nations at the forefront of facility size and knowledge on the global level (e.g., Victoria Big Battery and the South Australian Hornsdale facilities).

Is energy storage a viable solution to Australia's energy security and reliability needs?

The report finds that energy storage is both a technically feasible and an economically viable approach to responding to Australia’s energy security and reliability needs to 2030, even with a high renewables generation scenario.

What is EnergyAustralia's energy storage project?

The energy storage project will provide EnergyAustralia with a natural hedge against such market fluctuations and help stabilise energy prices and ensure a more resilient energy supply. “At EnergyAustralia, our purpose is to lead and accelerate the clean energy transformation for all,” said EnergyAustralia Managing Director, Mark Collette.

Which energy storage options are a good option for the future?

Pumped Hydro Energy Storage (PHES), Compressed Air Energy Storage System (CAES), and green hydrogen (via fuel cells, and fast response hydrogen-fueled gas peaking turbines) will be options for medium to long-term storage. Batteries and SCs are assessed as a prudent option for the immediate net zero targets for 2030–2050.

Learn More

- Australia Peak Valley Energy Storage Battery System

- What are the first batch of energy storage power stations in Sydney Australia

- Czech rare energy storage system

- Design of energy storage system for base station in Sydney Australia

- Australia Sydney Energy Storage Power Supply Procurement Project

- 2 75mwh energy storage system in Australia

- How to connect the energy storage power supply of the communication base station

- Energy storage ratio of Palau s power stations

- Which battery energy storage system is best in China and Africa

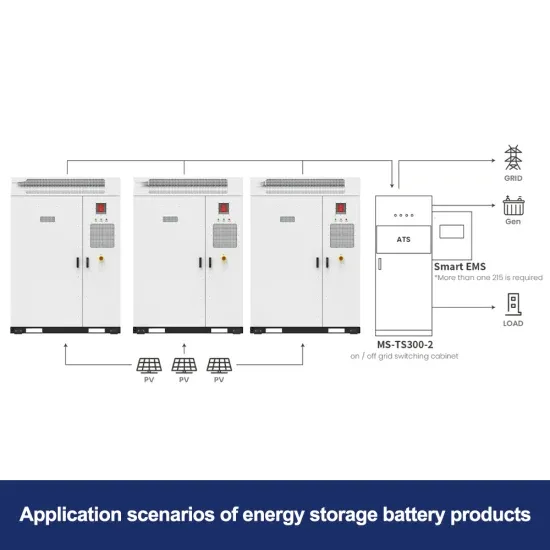

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

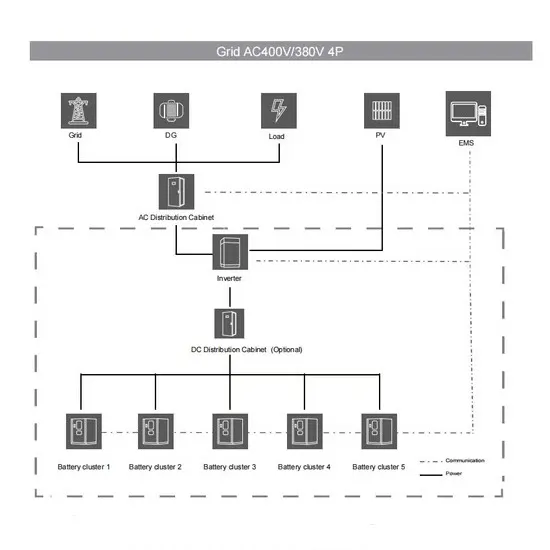

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.