What energy storage technologies will Australia need as

Aug 1, 2024 · Pumped Hydro Energy Storage (PHES), Compressed Air Energy Storage System (CAES), and green hydrogen (via fuel cells, and fast response hydrogen-fueled gas peaking

Energy Storage: Opportunities and Challenges of

Feb 3, 2025 · This contributing report considers a wide range of energy storage technologies with direct applications in Australia''s electrical systems including both established and next

Australian transmission operator''s commercial

Jul 6, 2021 · Infrastructure service provider Lumea has opened up a process to tender for a 300MW grid-connected battery project near Melbourne, Australia, intending to build the project

More than 1GWh of battery storage systems deployed in Australia

Mar 29, 2022 · Australia will deploy more than 1GWh of battery energy storage systems in 2021, including 756MWh of non-residential battery energy storage projects, mainly large-scale grid

Top five energy storage projects in Australia

Sep 10, 2024 · The Geelong Big Battery Energy Storage System is a 300,000kW lithium-ion battery energy storage project located in Geelong, Victoria, Australia. The rated storage

Australia''s Essential Energy confirms V2G tech is

Apr 11, 2025 · The announcement came following a successful V2G trial using a Ford F-150 Lightning ute. Image: Solar Media. Australian electricity distributor

数据中心+储能,微软谷歌都在下场做的一件事| 数字

May 6, 2023 · 谷歌比利时的数据中心配备了5.5MWh的锂电池储能,其中的2.75MWh将用于优化比利时电网的需求响应计划,储能系统还将与其他分布

Top five energy storage projects in Australia

Apr 10, 2024 · In all, Australia''s total cumulative installed battery storage capacity by the end of 2023 was counted at 5,966MWh. Interestingly, residential still

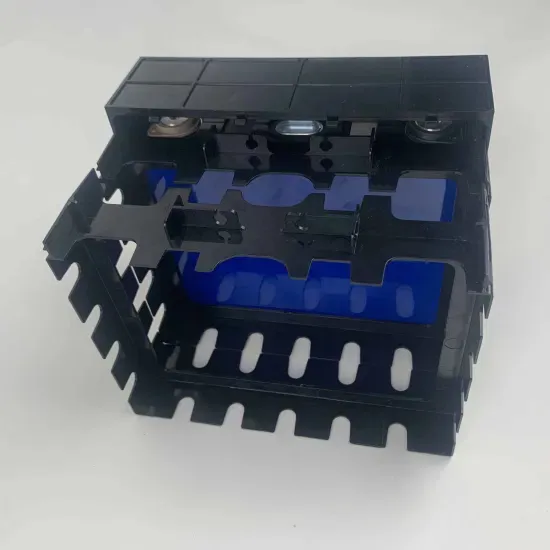

2.15MWh储能项目系统方案 2.15MWhEnergystora

Oct 25, 2023 · 1.1 系统概述System Overview 根据项目需求, 需要配备1 个20HQ 集装箱, 装箱容量为2.15MWhAccording to the project demand,one 20HQ container is needed to place the

PBPL powering Port West Stage 2 tenants with 100

Jan 24, 2025 · The embedded network will initially be supported by a 1MW rooftop solar system, a 1MW/1.75MWh Battery Energy Storage System (BESS) and a green Power Purchase

6 FAQs about [2 75mwh energy storage system in Australia]

How is energy stored in Australia?

Currently storage of electrical energy in Australia consists of a small number of pumped hydroelectric facilities and grid-scale batteries, and a diversity of battery storage systems at small scale, used mainly for backup. To balance energy use across the Australian economy, heat and fuel (chemical energy) storage are also required.

What is Australia's energy storage capacity?

Australia had 2,325MW of capacity in 2022 and this is expected to rise to 22,076MW by 2030. Listed below are the five largest energy storage projects by capacity in Australia, according to GlobalData’s power database. GlobalData uses proprietary data and analytics to provide a complete picture of the global energy storage segment.

How much energy storage capacity will Australia have in 2022?

Global energy storage capacity was estimated to have reached 36,735MW by the end of 2022 and is forecasted to grow to 353,880MW by 2030. Australia had 2,325MW of capacity in 2022 and this is expected to rise to 22,076MW by 2030.

How many MWh of energy storage is deployed in Australia?

According to figures published this week by solar PV and energy storage market consultancy Sunwiz, 2,468MWh of energy storage was deployed in Australia, with numbers in every segment surpassing the highest annual figures on record.

How much battery storage does Australia have in 2023?

In all, Australia’s total cumulative installed battery storage capacity by the end of 2023 was counted at 5,966MWh. Interestingly, residential still made up the largest share of that, with 2,770MWh accounting for 46% of the total, while utility-scale had a 44% share with 2,603MWh online and distributed C&I taking just a 10% share, with 593MWh.

Which energy storage options are a good option for the future?

Pumped Hydro Energy Storage (PHES), Compressed Air Energy Storage System (CAES), and green hydrogen (via fuel cells, and fast response hydrogen-fueled gas peaking turbines) will be options for medium to long-term storage. Batteries and SCs are assessed as a prudent option for the immediate net zero targets for 2030–2050.

Learn More

- 2 75mwh energy storage system in Czech-Republic

- 2 75mwh energy storage system in Lisbon

- Portable Energy Storage Power Supply in Sydney Australia

- Australia Sydney Energy Storage Power Supply Procurement Project

- What are the first batch of energy storage power stations in Sydney Australia

- Design of energy storage system for base station in Sydney Australia

- Australia Peak Valley Energy Storage Battery System

- 2 75mwh energy storage system in Peru

- 2 75mwh energy storage system in Cameroon

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.