A Brief Analysis Of The Reduction In China''s Photovoltaic Export Tax

Nov 18, 2024 · We believe that the competitiveness of Chinese photovoltaic enterprises does not require tax rebate benefits at all. The reduction in export tax rebate rate is another extension of

Economics of Solar Photovoltaic Systems

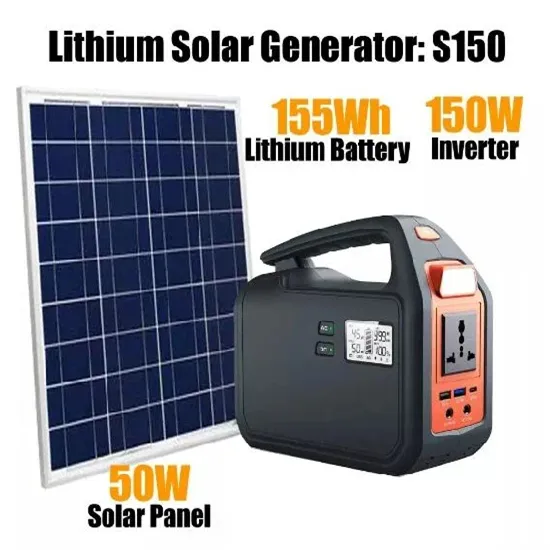

Jan 29, 2024 · Solar photovoltaic (PV) systems convert sunlight directly into electricity (Figure 1). Systems can be any size from a single panel about 200 Watts to hundreds of panels totaling

China adjusts its export policies with a 9% tax discount for

Jun 14, 2025 · In a joint statement issued by the Ministry of Finance and the State Taxation Administration, it was revealed that the export tax rebate rate for photovoltaic products, along

The price does not include additional taxes, fees, and surcharges

Jan 1, 2016 · In the past two decades, pricing research has paid increasing attention to instances where a product''s price is divided into a base price and one or more mandatory surcharges, a

How does the solar rebate work? | South African Revenue

Jun 26, 2024 · The solar energy tax credit applies to the 2024 YOA only and the amount allowed as a deduction will be 25% of the cost of the above solar PV panels up to a maximum of R15

The prospects for cost competitive solar PV power

Apr 1, 2013 · New solar Photovoltaic (PV) installations have grown globally at a rapid pace in recent years. We provide a comprehensive assessment of the cost competitiveness of this

China to Reduce Export Tax Rebate on Solar Products, Driving Price

Nov 19, 2024 · Starting December 1, 2024, China will lower the export tax rebate for solar cells and panels from 13% to 9%. This change is expected to raise the price of Chinese solar

China adjusts its export policies with a 9% tax discount for

Jun 14, 2025 · China has announced significant changes to its export tax rebate policies, effective from December 1, impacting various industries, including photovoltaic (PV) products. In a joint

Tax and Energy Series : China

Jun 3, 2024 · If an eligible energy service company that carries out an energy performance contracting project meets the relevant provisions of the Corporate Income Tax law, it is entitled

Homeowner''s Guide to the Federal Tax Credit for Solar

Jul 1, 2024 · Homeowner''s Guide to the Federal Tax Credit for Solar Photovoltaics Disclaimer: This guide provides an overview of the federal investment tax credit for those interested in

Solar panel tax incentive for individuals: Frequently asked

Mar 29, 2023 · For example, a person buys 10 solar PV panels at a cost of R4000 per panel (total cost of R40 000). That person would be able to claim 25% of the cost up to R15 000, thus R10

Frequently Asked Questions About the Solar Tax

Jul 3, 2025 · Today, with the cost of solar panels falling and the cost of grid electricity rising, the solar tax credit is more like the cherry on top of already

Tax and Energy Series : China

Jun 3, 2024 · In order to support the development of new energy in China, the country has been implementing a series of preferential policies nationwide for new energy vehicles, energy

SOLAR PANEL TAX INCENTIVE FOR INDIVIDUALS

Jan 31, 2024 · Individuals will be able to claim a rebate to the value of 25% of the cost of new and unused solar photovoltaic (PV) panels, up to a maximum of R15 000 per individual.

A Brief Analysis Of The Reduction In China''s Photovoltaic Export Tax

Nov 18, 2024 · 4. Since the second half of the year, the industry has proposed a variety of supply reform methods such as production restrictions and price restrictions, and policy adjustments

Solar Photovoltaic Panels Tax Rebate: Is the Tax Rebate the Right Tax

Jan 12, 2024 · Therefore, the solar PV panels tax credit does not adopt an all-encompassing approach by ensuring that all taxpayers can benefit of the incentive. The authors of this paper

Tax Basis for Solar PV Projects: Treasury Guidance

Jul 11, 2011 · The benchmarks used by Treasury for solar PV cost basis are predicated on an open-market, arm''s-length transaction between two entirely unrelated parties with adverse

Federal Solar Tax Credits for Businesses

Feb 26, 2024 · Disclaimer This resource from the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) provides an overview of the federal investment and production tax

6 FAQs about [The price of photovoltaic panels does not include tax]

Does China have a tax rebate for solar panels?

China’s Ministry of Finance and State Taxation Administration have announced a reduction in the export tax rebate for photovoltaic products. Starting Dec. 1, the rebate for unassembled solar cells (HS Code 85414200) and assembled PV modules (HS Code 85414300) will drop from 13% to 9%.

Does China's PV cut 4% export tax rebate rate?

China's PV cuts 4% export tax rebate rate a big deal On November 15, China's Ministry of Finance and the State Administration of Taxation announced a reduction in the export tax rebate rate for certain products, including refined oil, photovoltaic (PV) products, batteries, and some non-metallic mineral products, from 13% to 9%.

How will China's new tax rate affect solar PV businesses?

At the 13% rate, China’s solar PV businesses will have received tax rebates totalling USD 3.43 billion. This would be reduced by just over USD 1 billion at the new 9% rate.

Should solar PV export tax rebate policy be abolished?

Southern Weekend quoted a solar PV industry insider as saying that the export tax rebate policy for the industry should be completely abolished because “China’s solar PV industry has developed to a mature stage and is the major player in the business”.

Which PV products have reduced export tax rebate rates?

According to the above-mentioned government announcements, PV products included in the list of products with reduced export tax rebate rates are for PV cells, either installed or not in modules.

How does China's rebate rate affect photovoltaic exports?

This represents a 4% decrease in the rebate rate for photovoltaic exports, significantly impacting China's PV market, which heavily relies on exports.

Learn More

- The price of new photovoltaic panels in Marseille

- Price of 48V photovoltaic panels

- What is the retail price of photovoltaic panels in Tiraspol

- Andorra la Vella new photovoltaic panels for sale price

- Price of photovoltaic panels for villas in Djibouti

- Price of photovoltaic panels installed in Jakarta

- Price of installing photovoltaic panels in vineyards

- Price of installing photovoltaic panels on the ground

- Algeria new photovoltaic panels selling price

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.