List of UPS Cabinet Companies in China

List of UPS Cabinet Companies in China, Suppliers, Distributors, Manufacturers, Importer. Include Renda Electricity Group, Sun Power Supply Co., Ltd, Guangzhou Jalon Electronic Equipment

Cabinet Processing Manufacturer, Sheet Metal Processing

Tianjin Xintong Tech. Co., Ltd. Is located in Tianjin where is about 120km away from Beijing and 50km away from Xingang port. It is very convenient for transportation. And it is a professional

Ups Battery Cabinet Manufacturers & Suppliers

ups battery cabinet manufacturers/supplier, China ups battery cabinet manufacturer & factory list, find best price in Chinese ups battery cabinet manufacturers, suppliers, factories, exporters &

Eaton battery solutions brochure

Apr 15, 2025 · The IBC-SW cabinet is our newest and smallest battery cabinet of-fering, with one large string of batteries inside. This welded cabinet offers flexibility in adding runtime with a

Eaton three-phase UPS battery handbook

Apr 3, 2025 · If I have the serial number from the Eaton UPS or battery cabinet, can I find out how old the batteries are? Every Eaton battery has a manufacturer date code that indicates when it

5 FAQs about [UPS battery cabinet processing manufacturer]

Is UPS battery center an original equipment manufacturer?

UPS Battery Center does not imply that any of its products are original equipment manufacturer replacement batteries. Specifications are subject to change without notice. All product and company names are trademarks or registered trademarks of their respective holders.

What is uninterruptible power supply (UPS)?

Uninterruptible power supply (UPS) is the last line of defense to ensure the safe and stable operation of the key equipment of the communication base station. There are many stringent requirements on the security and reliability of BMS, and dauntu energy storage has made full preparations.

What is mpinarada integrated battery cabinet solution?

MPINarada integrated battery cabinet solution offers aturn-key battery and battery cabinet option for UPS battery backup. Cabinet solutions are available in both size and color to match most UPS system manufacturers.

What are external battery racks & cabinet design encasing solutions?

Our External Battery Racks and Cabinet design encasing solutions are a premium brand that offer industry-standard features in custom design measurements at competitive pricing. They can accommodate various combinations of Batteries, up to maximum number of strings for complete battery ranges.

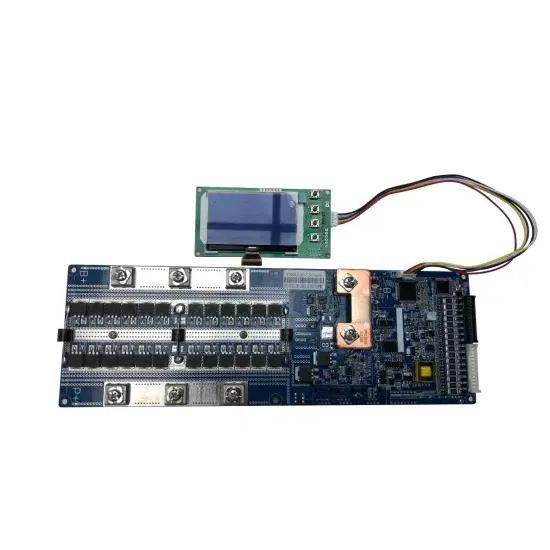

What is battery management system?

Battery management system used in the field of industrial and commercial energy storage.

Learn More

- Irish UPS battery cabinet manufacturer

- Brazzaville outdoor communication battery cabinet manufacturer

- Somaliland computer room battery cabinet manufacturer

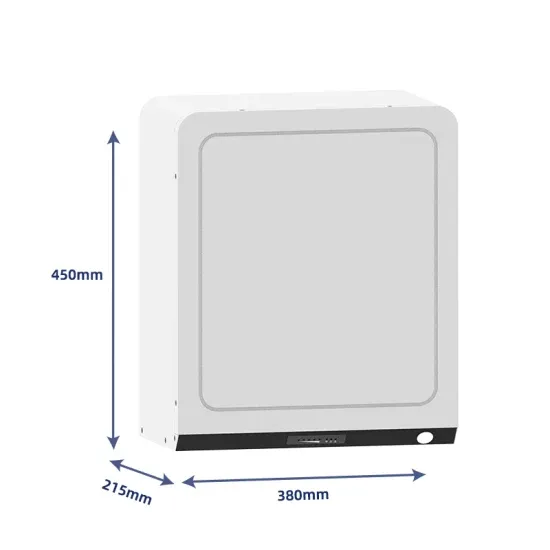

- 8 UPS battery cabinet dimensions

- Cape Town Smart Battery Cabinet Manufacturer

- Israel UPS battery cabinet full set production direct sales

- UPS battery cabinet c1 installation

- Ups battery cabinet professional customization

- UPS battery cabinet placed close to the ground

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.