Sao tome and principe production energy storage plant

Domestic energy production. Energy production includes any fossil fuels drilled and mined, which can be burned to produce electricity or used as fuels, as well as energy produced by nuclear

Sao Tome and Principe Green Hydrogen Market (2025-2031)

6Wresearch actively monitors the Sao Tome and Principe Green Hydrogen Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue

São Tomé and Príncipe will have new photovoltaic power

São Tomé and Príncipe will have a new photovoltaic power station to produce more than 10MW of energy, in a 60.7 million dollar project co-financed by the World Bank, the African

Solar gaining traction in Sao Tome and Principe

Nov 10, 2022 · The island nation of Sao Tome and Principe switched on the initial phase of its first 2 MW solar project in August. Construction of 1.4 MW of PV

São Tomé and Príncipe

Aug 15, 2025 · As a small island developing state (SIDS) highly vulnerable to climate change, São Tomé and Príncipe is taking ambitious and concrete steps to mitigate greenhouse gas

how is the energy storage industry in sao tome and principe

Sao Tome and Principe How is energy used in industry and services in Sao Tome and Principe? Understanding energy end uses To get an accurate picture of energy efficiency in a country, it

Clean energy projects for São Tomé and Príncipe

Nov 4, 2022 · Working with the country''s public utility, the Power & Water Company (EMAE), Cleanwatts will install solar PV plants across the country.

Sao Tome and Principe targets transition to clean energy in

São Tomé, August 2021 – Sao Tome and Principe commits to increased climate action measures included in the updated NDC. The Santomean Ministry of Infrastructures and Natural

Sao Tome and Principe Solar Hydrogen Panel Market (2025

Historical Data and Forecast of Sao Tome and Principe Solar Hydrogen Panel Market Revenues & Volume By Photovoltaic Electrolysis for the Period 2021-2031 Historical Data and Forecast

Bright Horizons: Cleanwatts'' Pioneering Solar Initiative in

Nov 24, 2022 · Partnering with the country''s public utility EMAE, we''re set to install photovoltaic plants at São Tomé''s national airport and on Príncipe Island. Spearheaded by our vice

sao tome and principe energy storage installation plant is

Sao Tome and Principe: Small island state in energy transition São Tome and Principe has been working in collaboration with UNIDO, the World Bank, UNDP and other organisations to

Sao Tome and Principe | Africa Energy Portal

Aug 16, 2025 · As the second smallest economy in Africa, São Tomé and Príncipe (STP) is a small island nation located in the Gulf of Guinea with a population of approximately 220,000

Sao Tome and Principe: Small island state in energy transition

Jul 27, 2021 · Sao Tome and Principe: Small island state in energy transition The Government of São Tomé and Príncipe expects to launch two national action plans in September 2021 with

São Tome and Príncipe – pv magazine International

Nov 25, 2019 · The island nation of Sao Tome and Principe switched on the initial phase of its first 2 MW solar project in August. Construction of 1.4 MW of PV capacity is now underway at two

SANTO AMARO PHOTOVOLTAIC SOLAR POWER PLANT,

Jul 28, 2025 · São Tomé and Príncipe, June 04, 2025. São Tomé and Príncipe takes another concrete step towards the energy transition with the inauguration of the 1.2 megawatt

Sao Tome and Principe: Assessment of cost-effective

This technical report summarises the main outcomes and findings of the assessment of cost-efectiveness of renewable energy technology options in Sao Tome and Principe and evaluates

News Centre | São Tomé & Príncipe | African Energy

Dec 12, 2022 · Free Issue 438 - 13 May 2021 São Tomé and Príncipe: Ties with Qatar São Tomé & Príncipe Strategy & risk Issue 424 - 08 October 2020 Sao Tome: Two small hydro plants

Sao Tome & Principe – pv magazine International

Nov 25, 2019 · The island nation of Sao Tome and Principe switched on the initial phase of its first 2 MW solar project in August. Construction of 1.4 MW of PV

São Tomé and Príncipe – Renewable Energy – Center for

Dec 4, 2024 · Investment Required This project presents an investment opportunity to develop critical renewable energy infrastructure in São Tomé and Príncipe, including solar photovoltaic

SANTO AMARO PHOTOVOLTAIC SOLAR POWER PLANT,

Jul 28, 2025 · São Tomé and Príncipe takes another concrete step towards the energy transition with the inauguration of the 1.2 megawatt photovoltaic solar park, integrated in the Santo

sao tome and principe international energy storage project

UNIDO to support development of first OTEC development in São Tomé and Principe | Energy The Spring 2023 issue of Energy Global hosts an array of technical articles focusing on

São Tomé and Príncipe – Renewable Energy – Center for

Dec 4, 2024 · This project presents an investment opportunity to develop critical renewable energy infrastructure in São Tomé and Príncipe, including solar photovoltaic plants, mini

Sao tome and principe energy storage 2025

Singapore has targeted 200MW of energy storage beyond 2025 and 2GW of solar by 2030, but will continue to rely on natural gas for the next 50 years, according to a government official.

hydrogen energy storage sao tome and principe

Sao Tome and Principe: Energy Country Profile A few points to note about this data: Renewable energy here is the sum of hydropower, wind, solar, geothermal, modern biomass and wave

New power storage in the Sao Tome Energy Valley

The island nation of Sao Tome and Principe switched on the initial phase of its first 2 MW solar project in August. Construction of 1.4 MW of PV capacity is now underway at two airports, and

Sao Tome Photovoltaic Energy Storage Power Station

Does Sao Tome & Principe have solar power? According to data from the International Renewably Energy Agency (IRENA), Sao Tome and Principe did not have any grid-connected

Rooftop Photovoltaic Solutions in Sao Tome and Principe

Summary: As Sao Tome and Principe advances toward renewable energy adoption, rooftop photovoltaic panels are becoming a cornerstone of its sustainability strategy. This article

5 FAQs about [Sao Tome and Principe Hydrogen Energy Photovoltaic Site 100KWh]

Does Sao Tome & Principe have solar power?

According to data from the International Renewably Energy Agency (IRENA), Sao Tome and Principe did not have any grid-connected solar generation capacity installed at the end of 2021. The World Bank says Sao Tome and Principe has an electricity access rate of around 76%, with 92% of the total coming from imported diesel.

How much power does Emae have in Sao Tome & Principe?

EMAE’s total installed generation capacity (Table 2) on the islands of Sao Tome and Principe is22.5 MW, consisting of 20.6 MW from diesel plants and 1.92 MW from hydro plants.

Who owns electricity in Sao Tome & Principe?

Electrical power in the country is provided by theEmpresa de Agua e Electricidade (EMAE), a public-private company that is 51% owned by the Government of Sao Tome and Principe, and the remaining 41% is jointly owned by the private sector, with Sonangol holding 40% and a local anonymous enterprise owning the remaining 9%.

When will a 300 kW power plant be installed in Sao Tome?

Cleanwatts told pv magazine that it started developing 1.1 MW at Sao Tome airport and 300 kWp at Principe airport in August. It expects to complete the arrays by the end of this year. Another 300 kWp will be installed next year at other communities in Sao Tome.

Does Sao Tome and Principe have a national energy policy?

Sao Tome and Principe has not yet developed a National Energy Policy. However, with every change in Government, the incoming Government formulates its development plan with the last one prepared in October 2013 and entitled “Grandes Opções do Plano para 2014” (Major Options of the Plan for 2014).

Learn More

- Sao Tome and Principe Photovoltaic Equipment Energy Storage Project

- Tbilisi Hydrogen Energy Photovoltaic Site

- Specifications and dimensions of photovoltaic panels for water pumps in Sao Tome and Principe

- Maintenance contract for photovoltaic base stations in Sao Tome and Principe

- BESS price of photovoltaic panels in Sao Tome and Principe

- Bandar Seri Begawan s first hydrogen energy photovoltaic site

- Sao Tome and Principe Energy Storage Comprehensive Utilization Project

- Serbia Energy Building Photovoltaic Site

- Sao Tome lithium energy storage power supply sales price

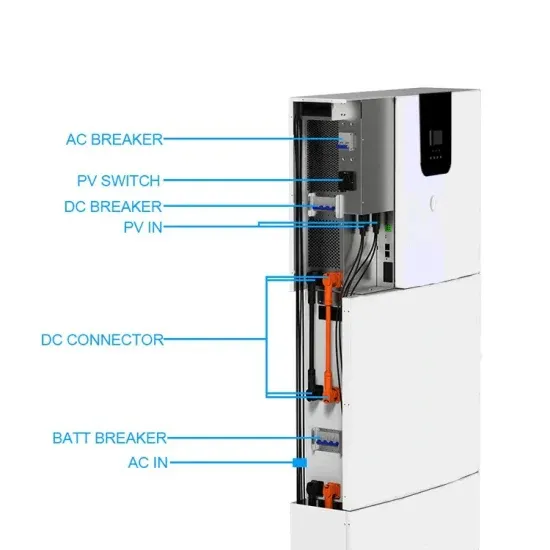

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

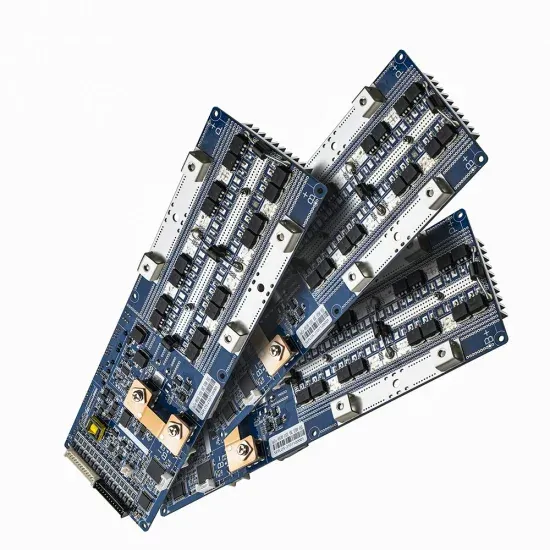

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.