Solar PV Inverter Industry Report 2024-2035: Central,

Jun 4, 2025 · Solar PV Inverter Industry Report 2024-2035: Central, String, and Micro Inverters to Capture Growing Market In 2024, solar PV dominated 45% of power generation investments

Photovoltaic Inverters Strategic Business Report 2025:

May 21, 2025 · Key growth drivers include advances in inverter technology, residential and commercial solar adoption, and integration with smart grid and energy management systems.

2025 Guide: Maximizing Value in Photovoltaic Grid-Connected Inverter

Why Solar Investors Are Rethinking Inverter Choices This Quarter As we approach Q2 2025, the photovoltaic (PV) inverter market''s facing a perfect storm. Component shortages, evolving grid

Supporting strategy for investment evaluation of photovoltaic

Dec 1, 2024 · Following the AHP multi-criteria analysis method, and based on the results presented, it is concluded that the preferred investment is the 500 MW photovoltaic power

Photovoltaic inverter investment opportunities

The top 10 global solar photovoltaic (PV) inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according to latest analysis by Wood

Utility-scale PV power plants – investment costs and

May 21, 2024 · AbstrAct It is essential to understand the investment and operating costs of photovoltaic power plants in terms of economic parameter calculations such as levelized cost

Photovoltaic Inverter Market Research Report 2033

According to our latest research, the global photovoltaic inverter market size reached USD 11.7 billion in 2024, driven by the accelerating transition towards renewable energy sources and

Global surge in solar PV inverter shipments highlights

The global energy landscape saw a significant shift in 2023, marked by a 56% increase in solar photovoltaic (PV) inverter shipments, to reach 536 GWac. China, a powerhouse in solar

PV Inverter Market Size, Share & Forecast Report, 2025-2034

The PV inverter market size crossed USD 34.6 billion in 2024 and is set to grow at a CAGR of 9.5% from 2025 to 2034, driven by positive outlook toward clean energy

PV Inverter Market Size, Share & Forecast 2025 to 2035

Apr 3, 2025 · PV Inverter Market Analysis by Product, Phase, Connectivity, Nominal Power Output, Nominal Output Voltage, Application, and Region through 2035 Advancing Solar

Reduced real lifetime of PV panels – Economic consequences

Jul 15, 2023 · Therefore, the PV plant owners want to increase the lifetime by enhanced damaged PV panel and inverter replacement assuming additional investment costs, which would

10 Best Brands and Models of Solar Panel

Jul 26, 2024 · A solar inverter, or solar panel inverter, is a pivotal device in any solar power system. Solar inverters efficiently convert the direct current (DC)

Photovoltaic Inverter Reliability Assessment

Nov 5, 2019 · As efforts to reduce PV module costs yield diminishing returns, understanding and reducing inverter costs becomes increasingly critical and is a cost- effective investment toward

Photovoltaic (PV) Inverter Market Size, Share and Forecast

Jun 19, 2025 · The Photovoltaic (PV) Inverter Market size was valued at USD 14,692.13 million in 2018, increased to USD 25,361.38 million in 2024, and is anticipated to reach USD 54,650.92

Solar PV Global Industry Report 2025: Growth Opportunities

Jun 19, 2025 · Solar PV investment surged in 2024, comprising 45% of power generation funding and is expected to maintain dominance for the next decade. Despite 2023...

Inverter Transformers for Photovoltaic (PV) power plants:

Dec 22, 2022 · In this paper, the author describes the key parameters to be considered for the selection of inverter transformers, along with various recommendations based on lessons

Current state of China''s photovoltaic inverter industry

Aug 17, 2024 · This article will discuss current state of China''s PV inverter industry, including industrial chain structure, policy support, market size, export situation, and future development

Analysis and Investment Recommendations of the

Abstract. This paper provides a comprehensive analysis and recommendations for investment in China''s photovoltaic industry. Through policy analysis and supply and demand model analysis,

The Effect of Inverter Failures on the Return on

Sep 18, 2017 · Return on investment (ROI) analyses of solar photovoltaic (PV) systems used for residential usage have typically shown that at least 10 to 12

Photovoltaic (PV) Inverter Market Size, Share and Forecast

Jun 19, 2025 · The Photovoltaic (PV) Inverter Market demonstrates strong geographical diversification, with Asia Pacific leading in terms of installations due to large-scale solar

Return on investment analysis and simulation of a 9.12

Mar 1, 2017 · The PV panel array absorbs electricity in the form of direct current, the micro-inverters (small inverters placed on each individual panel, unlike a central inverter which

Studie: Current and Future Cost of Photovoltaics

Apr 13, 2017 · Financial and regulatory environments will be key for reducing costs in the future. The cost of hardware sourced from global markets will de-crease irrespective of local

Photovoltaic systems: Investment in the future

Jul 14, 2025 · An investment in photovoltaics (PV) currently pays for itself quickly. Four trillion dollars for environmentally friendly energy The energy sector

Solar Installed System Cost Analysis | Solar

Apr 3, 2025 · Solar Installed System Cost Analysis NREL analyzes the total costs associated with installing photovoltaic (PV) systems for residential rooftop,

6 FAQs about [Photovoltaic inverter investment]

How much is the PV inverter market worth?

The PV inverter market was valued at USD 25.5 billion, USD 29.9 billion, and USD 34.6 billion in 2022, 2023, and 2024, respectively. The string inverter market is expected to grow at a CAGR of 9.8% between 2025 and 2034 due to their cost-effectiveness, scalability, and ease of installation.

Why did the PV inverter market grow in 2024?

In 2024, the PV inverter market experienced consistent growth as a result of increasing solar installations in Asia-Pacific (particularly China and India) with government incentives and declining solar panel prices. Residential surged in Europe, fueled by energy security needs following the Russia- Ukraine war.

What is a modern PV inverter?

Companies are launching modern PV inverters, especially smart or grid-tied inverters, that offer advanced functionalities such as voltage regulation, frequency support, and remote monitoring, which align with the needs of intelligent energy networks.

How is PV inverter market segmented?

Based on phase, the PV inverter market is segmented into single phase and three phase. The three phase segment held 86% market share in 2024, owing to swift industrial development favored by commercialization throughout the emerging countries, along with considerable operational flexibility across various applications.

How much is the PV inverter generators industry worth in 2025?

The PV inverter generators industry is valued at USD 1.7 billion in 2025. As per FMI's analysis, the PV inverter will grow at a CAGR of 6.4% and reach USD 3.2 billion by 2035.

Which country has the highest demand for PV inverters?

Huawei holds the highest market share worldwide. What are the most critical factors for the demand growth of PV inverters? Solar installation growth, government policies, and technological improvements. Which regions experience the highest usage of PV inverters? China, the United States, and Europe exhibit the most extensive usage.

Learn More

- Kyiv Photovoltaic Power Inverter Supply

- Photovoltaic inverter for photovoltaic power station

- Which inverter is better for photovoltaic use

- Photovoltaic inverter installation guide

- Target audience for photovoltaic inverter sales

- Which photovoltaic inverter is better for conversion

- 100 kW photovoltaic inverter

- Morocco communication base station inverter grid-connected photovoltaic power generation quotation

- Price of smart photovoltaic inverter

Industrial & Commercial Energy Storage Market Growth

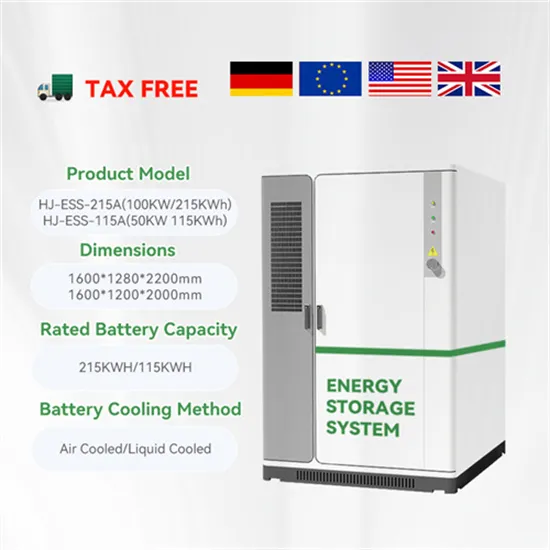

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.