Top 10 energy storage companies in Brazil

3 days ago · Due to various incentives and policies, Brazil''s optical storage market has seen a rapid growth. The document presents a comprehensive list of the top 10 energy storage

Brazilian energy storage container power station company

As a global pathfinder, leader and expert in battery energy storage system, BYD Energy Storage specializes in the R& D, manufacturing, marketing, service and recycling of the energy storage

Best Battery Energy Storage Container Manufacturer and

Jul 15, 2025 · Explore our CE certified Battery Energy Storage Containers. We are a leading manufacturer, supplier, and factory for reliable energy storage solutions.

Brasilia integrated mobile energy storage power supply

Mobile Solar Container Stations for Emergency and Off-Grid Power Designed for mobility and fast deployment, our foldable solar power containers combine solar modules, storage, and

Brasilia High Frequency Inverter Converted to 12V

Summary: Explore how the Brasilia high frequency inverter converted to 12V powers renewable energy systems, off-grid solutions, and mobile applications. Discover its efficiency metrics, real

top 10 brazilian energy storage companies

ATLAS POWER. Battery Energy Storage Systems with proprietary hardware and software. Meet Gabriel, Viccenzo and Diogo that work here. ATLAS POWER is a Brazilian energy tech startup

Botswana Energy Storage Container Production: Powering

Jun 5, 2024 · 1. Solar + Storage = Economic Goldmine With electricity demand growing at 6% annually (double the continental average), Botswana''s energy storage container production

UCB and Powin Partner To Accelerate Brazil''s Utility-Scale Energy

Mar 11, 2025 · PORTLAND, Ore.—February 18, 2025 — Powin, a U.S.-based global energy storage integrator and UCB, a leading provider of energy storage solutions in Brazil, have

Kuwait energy storage container manufacturer

Huijue Group''''s container energy storage is composed of 10/20/40-foot prefabricated cabins. It is a kind of energy storage battery system, energy management system, monitoring system,

Energy Storage Equipment, Energy storage solutions,

Huijue Group''s energy storage solutions (30 kWh to 30 MWh) cover cost management, backup power, and microgrids. To cope with the problem of no or difficult grid access for base stations,

6 FAQs about [Brasilia production energy storage container manufacturer]

What are the top 10 energy storage companies in Brazil?

Due to various incentives and policies, Brazil's optical storage market has seen a rapid growth. The document presents a comprehensive list of the top 10 energy storage companies including Baterias Moura, BYD, Freedom Won, Blue Nova Energy, Intelbras, Huntkey, FIMER, SMA Solar, Sungrow, and SolarEdge.

What are Brazil's potential energy storage opportunities?

However, the opportunities are substantial, especially with Brazil's vast renewable energy resources, particularly in hydropower and solar energy, creating a demand for efficient energy storage solutions. Environmental concerns are also pertinent, as the production and disposal of batteries can have ecological impacts.

Is Brazil ready for utility-scale energy storage?

“The demand for utility-scale energy storage in Brazil is poised to grow exponentially as the country continues its transition to renewable energy and strengthens its grid infrastructure,” said Marcelo Rodrigues, Sales & Innovation VP of UCB.

Where is Brazil's first commercial wind power & energy storage project located?

In March 2021, Acumuladores Moura and Baterias Duran jointly developed Brazil’s first commercial wind power + energy storage project and put it into operation. It is located in the state of Bahia in northeastern Brazil, with a total capacity of 1.5MW/3MWh, aiming to provide local Agricultural irrigation provides stable and clean energy.

What factors influence the battery storage industry in Brazil?

When exploring the battery storage industry in Brazil, several key considerations come into play. The regulatory environment is essential, as the Brazilian government has been increasingly supportive of renewable energy initiatives, which can influence market dynamics.

Who is the largest battery supplier in Brazil?

BYD (002594.SZ) is Brazil’s largest battery supplier and has two factories in Brazil, producing lithium-ion batteries and solar modules respectively. BYD will start producing new N-type TOPCON photovoltaic modules in Brazil in December 2022, with a power capacity of 575W.

Learn More

- Kiribati Energy Storage Container System Manufacturer

- Wellington battery energy storage container manufacturer

- Moscow Energy Storage Container Production Base

- Business building energy storage container manufacturer

- Ghana container energy storage cabinet manufacturer

- Helsinki container energy storage cabinet manufacturer

- Hanoi Ning container photovoltaic energy storage manufacturer

- Amman Industrial and Commercial Energy Storage Container Manufacturer

- Malabo liquid cooling energy storage container manufacturer

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

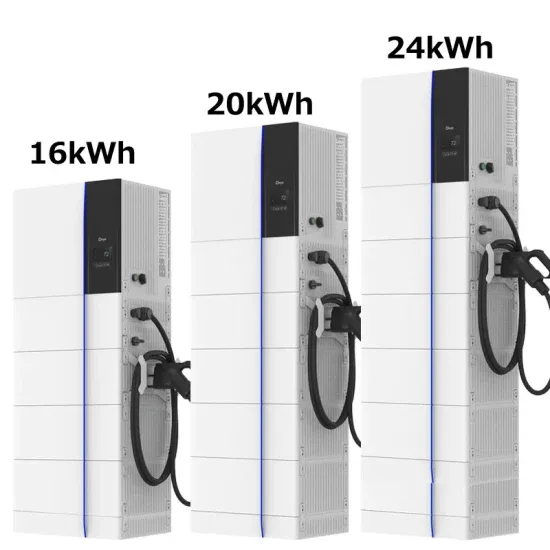

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.