What are the wellington energy storage container

What are the wellington energy storage container manufacturers Does CentrePort have a battery energy storage system? CentrePort is taking another step on its energy journey with an onsite

Fire service ''comfortable'' with battery energy storage facility

Dec 20, 2023 · CENTRE WELLINGTON – In response to fears the province won''t have enough power to meet demand by 2028, the organization managing Ontario''s power supply is looking

Wellington New Energy Storage Company: Powering the

Still think energy storage is just glorified AA batteries? Consider this: Wellington''s latest solid-state battery prototype could power your EV from Cape Reinga to Bluff on a single charge.

Wellington Container Energy Storage: The Future of Portable Power

Dec 9, 2020 · Wellington''s first container energy sharing platform lets businesses split costs, with systems rotating between construction sites, outdoor events, and backup power duty. Early

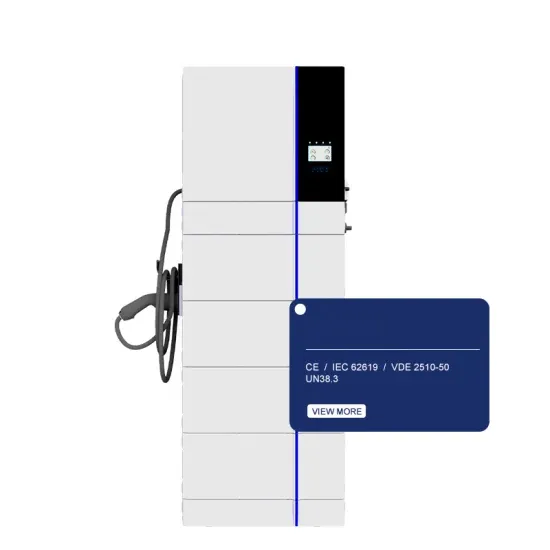

Wellington containers | C&I Energy Storage System

The Article about Wellington containersContainer Energy Storage Battery Power Stations: The Future of Modular Energy Solutions Imagine a world where shipping containers do more than

Energy storage battery cabinet wellington sales

Enershare leading manufacturer of battery energy storage systems Enershare leading manufacturer of battery energy storage systems (BESS) with solutions for utility applications,

Wellington Battery Energy Storage System, Australia

Feb 14, 2025 · The Wellington Battery Energy Storage System (BESS) is planned to be developed in the central west New South Wales (NSW), Australia. The project will comprise a

Wellington container energy storage plant

Certain companies have been qualified by the IESO to put proposals forward for battery storage facilities on 20-year contracts,bringing about the joint Alectra-Convergent venture known as

wellington household energy storage battery chassis manufacturer

How Containerized Battery Energy Storage System Works Due to its high cycle lifetime, The energy storage system containers are also used for peak-shaving, thereby reducing the

Wellington Energy Storage Container Transport: Solving Renewable Energy

Why Energy Storage Transport Keeps Utility CEOs Awake at Night You know how they say "energy doesn''t disappear, it just changes form"? Well, that''s sort of true—until you try moving

Containerized Battery Energy Storage Systems (BESS)

Huijue''s containers are designed for durability and efficiency, integrating advanced battery technology with smart management systems. These turnkey solutions are ideal for industrial

Wellington Container Energy Storage: The Future of Portable Power

Dec 9, 2020 · A shipping container humming quietly near Wellington''s waterfront, powering an entire film set through the night. No diesel fumes, no noise complaints - just clean energy on

Wellington Energy Storage Terminal Manufacturer: Powering

Nov 3, 2022 · As a leading Wellington energy storage terminal manufacturer, we''ve noticed 63% of web visitors last quarter were researching "modular grid solutions" – proof the industry''s

6 FAQs about [Wellington battery energy storage container manufacturer]

Where is Wellington South Battery energy storage system being developed?

Wellington South Battery Energy Storage System is being developed in NSW, Australia. (Credit: Sungrow EMEA on Unsplash) The Wellington Battery Energy Storage System (BESS) is planned to be developed in the central west New South Wales (NSW), Australia. The project will comprise a grid-scale BESS with a total discharge capacity of around 400MW.

What is the Wellington Battery energy storage system (BESS)?

The Wellington Battery Energy Storage System (BESS) is planned to be developed in the central west New South Wales (NSW), Australia. The project will comprise a grid-scale BESS with a total discharge capacity of around 400MW. AMPYR Australia, a renewable energy assets developer in the country, owns 100% of the BESS project.

Which is the largest battery storage project in NSW?

This will make Wellington BESS one of the largest battery storage projects in NSW. Wellington is being constructed at 6773 and 6909 Goolma Road, Wuuluman NSW 2820. The project site is situated within the Central-West Orana Renewable energy Zone (CWO REZ), in the Dubbo Regional Council local government area (LGA).

What is the target capacity of the Wellington Bess?

The target capacity of the Wellington BESS is 500 MW / 1,000 MWh, making it one of the largest battery storage projects in NSW. The Wellington BESS will connect to the adjacent TransGrid Wellington substation, adjacent to the Central West Orana Renewable Energy Zone (Central West Orana REZ).

Does CentrePort have a battery energy storage system?

CentrePort is taking another step on its energy journey with an onsite battery energy storage system (BESS) which will improve resilience and enhance the potential for future emission reductions.

What is the Wellington Bess?

The Wellington BESS will connect to the adjacent TransGrid Wellington substation, adjacent to the Central West Orana Renewable Energy Zone (Central West Orana REZ). It will complement nearby existing renewable energy generation assets as well as the proposed additional generation to be delivered as part of the Central West Orana REZ.

Learn More

- Vietnam Ho Chi Minh Energy Storage Battery Container Manufacturer

- Wellington Energy Storage Battery Cabinet Manufacturer

- Wellington local energy storage battery manufacturer

- Industrial Park Battery Energy Storage Container Manufacturer

- Paramaribo container energy storage battery manufacturer

- Kyrgyzstan lithium battery energy storage equipment manufacturer

- Kingsdon Iron Lithium Battery Energy Storage Container Quote

- Peru Arequipa smart energy storage battery manufacturer

- Energy storage battery container application scenarios

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.