Financial Analysis Of Energy Storage

Aug 20, 2025 · Determining the appropriate discount rate and term of energy storage is the key to properly valuing future cash flows. A battery of 1kWh will deliver less than 1kWh throughout its

Return on Investment Evaluation and Optimal Sizing of

Sep 20, 2022 · In Ontario, Canada, electricity in large commercial buildings is charged depending on energy consumption, peak demand, and global adjustment (GA). Installing a

Return on investment in battery storage systems | TESLA ENERGY

Jul 20, 2025 · In this article, we will explore what you need to know about investing in battery storage, how the market is evolving, what return on investment assumptions are, and what

Return on Investment for Battery Storage System

Oct 10, 2024 · In this article, we''ll understand the concept of return on investment for battery storage systems, including the factors affecting it and how to calculate it. We will also provide

Economic Analysis of the Investments in Battery

Apr 27, 2021 · Such operational challenges are minimized by the incorporation of the energy storage system, which plays an important role in improving the

Return on Investment (ROI) of Energy Storage Systems:

Mar 1, 2025 · Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity price differentials, government

How can I calculate the return on investment

Aug 7, 2024 · Return on Investment (ROI) in energy storage signifies a financial metric that gauges the profitability of investing in energy storage technologies.

What is the return on investment for battery storage?

Smart battery storage reduces energy costs for companies and generates additional revenue from stabilising the energy grid. And because it replaces fossil fuel sources, companies reduce their

Systemwide energy return on investment in a sustainable

Jan 3, 2024 · This study examines the net energy performance of nine decarbonisation global energy transition scenarios until 2050 by applying a newly developed systemwide energy

The Economics of Battery Storage: Costs,

Jan 12, 2024 · This analysis delves into the costs, potential savings, and return on investment (ROI) associated with battery storage, using real-world statistics

GB BESS Outlook Q4 2024: Battery business case and investment

Watch the video for a flavour of the full report. Introduction Battery revenues have increased so far in 2024, from a winter low. We estimate that battery revenues must increase further to ensure

GB BESS Outlook Q3 2024: Battery business case and investment

Battery revenues have increased so far in 2024, from a winter low. We estimate that battery revenues must increase further to ensure an investable rate of return on the upfront Capex

Return on Investment Evaluation and Optimal Sizing of

Sep 20, 2022 · In Ontario, Canada, electricity in large commercial buildings is charged depending on energy consumption, peak demand, and global adjustment (GA). Installing a behind-the

Maximising Solar ROI with Battery Energy Storage Systems

May 30, 2025 · Get the most from your solar power return on investment with BESS and learn how battery storage can optimize energy usage & reduce waste.

German battery investment dynamics ''extremely

Apr 28, 2025 · The potentially faster return on investment at solar sites which have batteries added are attracting German developers and site owners. Janis

Return on Investment (ROI) of Energy Storage

Mar 1, 2025 · Explore the Return on Investment (ROI) of energy storage systems for commercial and industrial applications. Learn how factors like electricity

Understanding the Return of Investment (ROI): battery energy storage

2 days ago · In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can

Optimal investment strategy based on a real options approach for energy

Jun 1, 2024 · Abstract Energy storage systems (ESSs) are widely recognized as a possible solution for integrating the increasing renewable energy penetration in electrical grids.

6 FAQs about [Return on investment in energy storage batteries]

How do I calculate return on investment on a battery energy storage system?

To calculate the return on investment (ROI) on a battery energy storage system, you need to consider several factors, including: Capital costs: This includes the cost of purchasing and installing the system. There are significant incentives which impact the capital costs.

What factors influence the ROI of a battery energy storage system?

Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control.

How do I assess the ROI of a battery energy storage system?

In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control. External Factors that influence the ROI of a BESS

Is battery storage a good investment?

The economics of battery storage is a complex and evolving field. The declining costs, combined with the potential for significant savings and favorable ROI, make battery storage an increasingly attractive option.

How does energy storage affect Roi?

The cost of electricity, including peak and off-peak rates, significantly impacts the ROI. Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the financial attractiveness of ESS installations.

Is energy storage a good investment?

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To make an accurate calculation for your case and understand the potential ROI of the system, it’s best to contact an expert.

Learn More

- How long does it take to get a return on investment in energy storage batteries

- Total investment return rate energy storage power station

- Photovoltaic energy storage batteries in Dubai UAE

- Gel batteries for solar energy storage

- Energy storage batteries reduce maximum demand

- Can energy storage batteries be equipped with capacitors

- How long is the warranty period for energy storage batteries

- How to add batteries to solar energy storage cabinets

- Antananarivo develops energy storage batteries

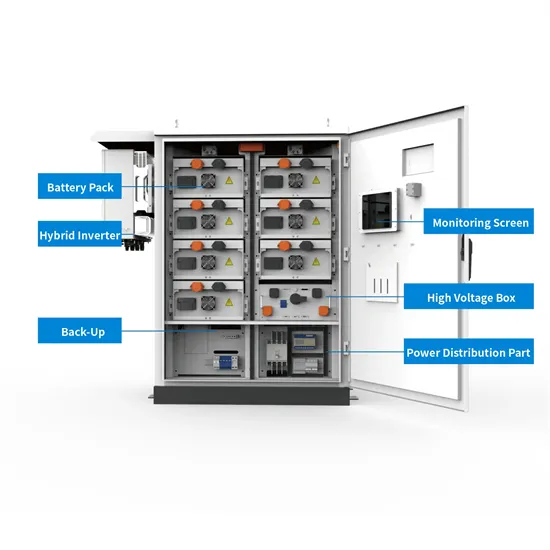

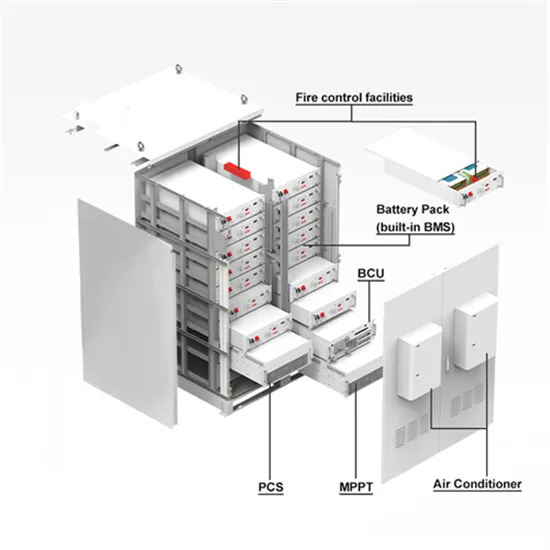

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.