How much does it cost to acquire an energy storage power station?

Aug 11, 2024 · Acquiring an energy storage power station involves various financial considerations. 1. The costs can range substantially based on the technology chosen and the

China building more pumped-storage power stations to

Mar 21, 2025 · In the mountainous region of Daixian County, north China''s Shanxi Province, a pumped-storage power station with a total installed capacity of 1.4 million kilowatts is set to

INVESTMENT RECOVERY RATIO OF ENERGY STORAGE

The service station integrates DC fast charging, solar PV, and energy storage, and is currently the biggest comprehensive energy storage service station investment in Guangxi, featuring the

481237_1_En_12_Chapter 149.

Aug 8, 2019 · uses particle swarm optimization algorithm based on hybridization and Gaussian mutation to get the energy storage capacity that maximizes the internal rate of return of the

How much electricity can the energy storage power station

Jul 11, 2024 · Analyzing capacity factors helps stakeholders understand the economics tied to energy storage investments. For utilities and grid operators, a clearer picture of anticipated

Return on investment for energy storage stations

Are battery energy storage systems a good investment? Energy storage systems (ESSs) are being deployed widely due to numerous benefits including operational flexibility, high ramping

Pumped storage power stations in China: The past, the

May 1, 2017 · The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Total efficiency of energy storage power station

In addition, by leveraging the scaling benefits of power stations, the investment cost per unit of energy storage can be reduced to a value lower than that of the user''s investment for the

Economic Analysis and Research on Investment Return of Energy Storage

Aug 22, 2021 · Economic Analysis and Research on Investment Return of Energy Storage Participating in Thermal Power Peak and Frequency Modulation Published in: 2021 Power

The development characteristics and prospect of pumped storage power

Aug 1, 2024 · This paper takes pumped storage investment cost and wind power consumption demand as the optimization goal, realizes the coordinated operation of pumped storage units

Energy storage power station payback period

The results show that the energy storage system has good economic benefits only in Beijing under the single electricity supply mode, the rate of return on investment is 12.5%, the internal

Flexible energy storage power station with dual functions of power

Nov 1, 2022 · The high proportion of renewable energy access and randomness of load side has resulted in several operational challenges for conventional power systems. Firstly, this paper

Economic and environmental analysis of coupled PV-energy storage

Dec 15, 2022 · A decline in energy storage costs increases the economic benefits of all integrated charging station scales, an increase in EVs increases the economic benefits of small-scale

INVESTMENT RECOVERY RATIO OF ENERGY STORAGE

The energy storage in new energy power plants could effectively improve the renewable energy penetration and the economic benefits by The rate of return on investment can be calculated

Total investment in energy storage power station

In addition, by leveraging the scaling benefits of power stations, the investment cost per unit of energy storage can be reduced to a value lower than that of the user''s investment for the

Battery energy storage power station investment

How has the cost of battery storage changed over the past decade? The cost of battery storage systems has been declining significantlyover the past decade. By the beginning of 2023 the

How much profit can energy storage power station investment

Oct 9, 2024 · 1. Investment in energy storage power stations can yield significant financial returns depending on various factors, such as location, technology utilized, and market dynamics.2.

What is the valuation of energy storage power station

Jul 26, 2024 · The valuation of energy storage power station acquisition involves several critical factors that collectively dictate the financial assessment and potential investment returns of

Operation effect evaluation of grid side energy storage power station

Jun 1, 2024 · Energy storage is one of the key technologies supporting the operation of future power energy systems. The practical engineering applications of large-scale energy storage

Investment decisions and strategies of China''s energy storage

Sep 1, 2023 · Based on the characteristics of China''s energy storage technology development and considering the uncertainties in policy, technological innovation, and market, this study

How much is the investment in operating an energy storage power station

May 30, 2024 · 1. INITIAL CAPITAL EXPENDITURES Operating an energy storage power station commences with a significant initial investment that encompasses a variety of costs. Initial

Collaborative optimal scheduling of shared energy storage station

Nov 1, 2023 · However, traditional energy storage is limited by its relatively low resource utilization and high cost. Firstly, to fully utilize the advantages of energy storage, a shared energy

How much does it cost to invest in an industrial energy storage power

Sep 24, 2024 · In summation, investing in an industrial energy storage power station requires a thorough examination of various financial parameters. The costs associated with such

Energy Storage Sizing Optimization for Large

May 17, 2021 · Net present value, investment payback period, internal rate of return are taken as the outer objective function, energy storage capacity is the

Study on the investment and construction models and value

Jul 26, 2025 · The results indicate that the CSSES model achieves the highest internal rate of return (11.5%) and the shortest payback period, while the DSSES model performs acceptable

How much investment can be recovered from energy storage power stations

Aug 24, 2024 · 1. The returns on investment from energy storage power stations vary, mainly influenced by factors such as initial outlay, operational efficiency, and market dynamics.2.

How much is the investment in energy storage power station?

Mar 5, 2024 · Investment in energy storage power stations typically ranges from 1.5 to 3 million dollars per megawatt (MW) of installed capacity, influenced by factors such as technology

Financial Analysis Of Energy Storage

6 days ago · The return of investment is an important metric about how attractive an investment may be. However this is an important note that energy storage usually does not generate

How much does it cost to invest in a ground source energy storage power

Aug 2, 2024 · 1. The cost of investing in a ground source energy storage power station can significantly vary based on several factors, including project size, location, and technology

4 FAQs about [Total investment return rate energy storage power station]

What is storage NPV in terms of kWh?

The storage NPV in terms of kWh has to factor in degradation, round-trip efficiency, lifetime, and all the non-ideal factors of the battery. The combination of these factors is simply the storage discount rate. The financial NPV in financial terms has to include the storage NPV, inflation, rising energy prices, and cost of debt.

Is energy storage a good investment?

The return of investment is an important metric about how attractive an investment may be. However this is an important note that energy storage usually does not generate electricity savings directly, but allows the transport or trading of electricity. This usually results in storage not having a high ROI like solar investments, for example.

What is the storage NPV for a red battery?

The storage NPV for the red battery in terms of kWh delivered over 10 years results in a calculation of: 945KWh delivered from a battery designed for 100KWh per year. Mapping from yearly to daily -> 100kWh / 365 = 0.274kWh nominal delivering 945kWh over 10 years.

How is the NPV of a supertitan battery calculated?

For an electricity cost of €0.15/kWh and a timeframe of 20 years, the results are: SuperTitan battery NPV: +€233.91 LFP battery: -€6.87 IRR is calculated using the same concept as net present value (NPV), except it sets the NPV equal to zero.

Learn More

- Total investment in energy storage power stations

- Investment amount of peak-shifting energy storage power station

- Greek Energy Investment Energy Storage Power Station

- Wind and solar energy storage power station investment

- 2MW energy storage power station investment

- LCOE discount rate for energy storage power station

- How much investment is needed for a 20mwh energy storage power station

- Energy storage power station research and development

- Global Compressed Air Energy Storage Power Station

Industrial & Commercial Energy Storage Market Growth

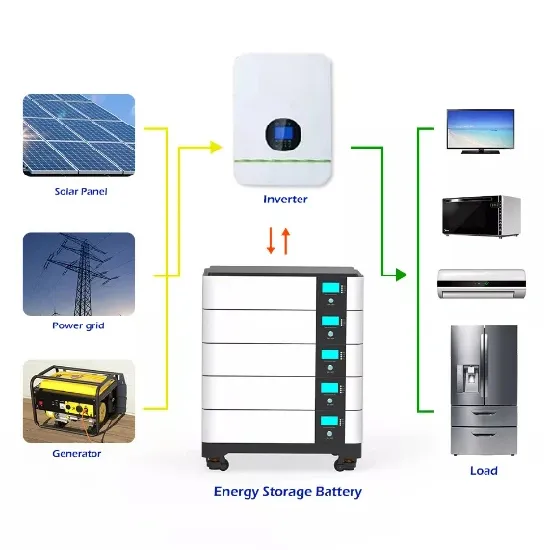

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.