A leading German manufacturer of uninterruptible power supplies (UPS

Jan 24, 2024 · General information Short Summary A reliable uninterruptible power supply (UPS) is a key requirement for stable and safe operation in general and for safety-critical systems

Monitoring System for Uninterruptible Power Supply

In this project, monitoring system for UPS was designed by using visual basic (VB) to provide a safe and constant 12V DC supply in the case of power disruption. The main power supply,

UNINTERRUPTIBLE POWER SUPPLY

Mar 24, 2025 · Inform product range varies from Uninterruptible Power Supply (UPS) Systems, Voltage Regulators, to DC Power Supply, Telecom Equipments, Battery chargers, Inverters,

Uninterruptible Power Supply Market Size, Growth and

Aug 18, 2025 · The Uninterruptible Power Supply Market is valued at USD 8,235 million and is projected to grow at a CAGR of 4.7% over the forecast period, reaching approximately USD

Design of an Uninterruptible Power Supply (UPS) Monitoring

Nov 23, 2024 · This paper presents the design of a UPS (Uninterruptible Power Supply) power monitoring system based on the STM32 microcontroller, aimed at achieving real-time

UPS-Systems, UPS-Solutions, Industrial UPS and Battery

Since 50 years, Statron is THE partner for uninterruptable power supply (UPS) solutions and battery systems. More than 30''000 UPS and battery systems have been successfully

Regenerative Uninterruptible Power Supply Ups Industry

Aug 14, 2025 · Vietnam Regenerative Uninterruptible Power Supply Ups Industry Research Report Market Vietnam''s emerging industrial sector and increasing digitalization drive the

A Critical Uninterruptible Power Supply Application | Mingch

Aug 12, 2025 · An uninterruptible power supply application in semiconductor manufacturing ensures clean, stable, and continuous power. That helps prevent wafer defects and

Uninterruptible Power Supply Market Size, Growth and

Aug 18, 2025 · Europe follows closely, driven by stringent regulations and a strong emphasis on energy efficiency. The Asia-Pacific region is anticipated to experience significant growth during

History of Uninterruptible Power Supplies (UPS)

Jul 30, 2025 · We delivered the large-capacity uninterruptible power supply (UPS) for a computer center operating continuously 24 hours a day, 365 days a year

Uninterruptible Power Supply (UPS) Systems: Market

Nov 15, 2024 · Abstracts This report analyzes the worldwide markets for Uninterruptible Power Supply (UPS) Systems in US$ Thousand by the following Product Segments: Upto 5 KVA, 5.1

uninterruptible power supply monitoring backup emergency

Uninterruptible Power Supply Monitoring Backup Emergency 12v Dc Portable New Energy Mini Ups For Wifi Router, Find Complete Details about Uninterruptible Power Supply Monitoring

6 FAQs about [Production of uninterruptible power supply for monitoring in Southern Europe]

What is uninterruptible power supply (UPS) market?

The Uninterruptible Power Supply (UPS) Market is witnessing substantial growth, fueled by the increasing demand for reliable power backup solutions across various sectors.

Which countries use uninterruptible power supplies (UPS) in 2024?

Legrand in October 2024 has launched its Keor MOD range of uninterruptible power supplies (UPS) in Europe that uses hot-swappable power modules, with intelligent energy management. France is also an important market of UPS systems owing to the government developments in digitization and smart city construction.

Which country has the largest uninterruptible power supply market?

U.S. accounted for over 75% share in North America uninterruptible power supply market, generating revenue of USD 3.6 billion in 2024. The US has the biggest national market of UPS systems, which have been prompted by the presence of key technology firms and advanced data facility build-up.

Where is the uninterruptible power supply market located?

Based on Region: North America holds the largest share of the Uninterruptible Power Supply (UPS) Market, accounting for approximately 38% of the total market value. This dominance is driven by the region’s advanced infrastructure, high adoption rates of technology, and significant investments in data centers and telecommunications.

What is the demand for uninterrupted power supply systems?

The demand for uninterrupted power supply (UPS) systems is surging, driven primarily by the rapid expansion of data centers and the proliferation of sensitive electronic equipment across various sectors.

How big is the uninterruptible power supply market in 2024?

The solution segment dominated with over 80% market share, generating around USD 9.5 billion in 2024. What is the market size of the uninterruptible power supply (UPS) market in 2024? The market was valued at USD 12.1 billion in 2024, with a projected CAGR of 5.6% from 2025 to 2034. What is the projected value of the UPS market by 2034?

Learn More

- Thailand Monitoring Uninterruptible Power Supply Equipment

- Southern Europe lithium energy storage power supply manufacturer

- Price of uninterruptible power supply in China and Europe

- Battery Bank Monitoring Uninterruptible Power Supply

- Moroni monitoring UPS uninterruptible power supply

- Senegal Flexible Uninterruptible Power Supply Model

- West Africa non-standard UPS uninterruptible power supply quotation

- Portugal BESS sells new uninterruptible power supply prices

- Uninterruptible power supply for electricity

Industrial & Commercial Energy Storage Market Growth

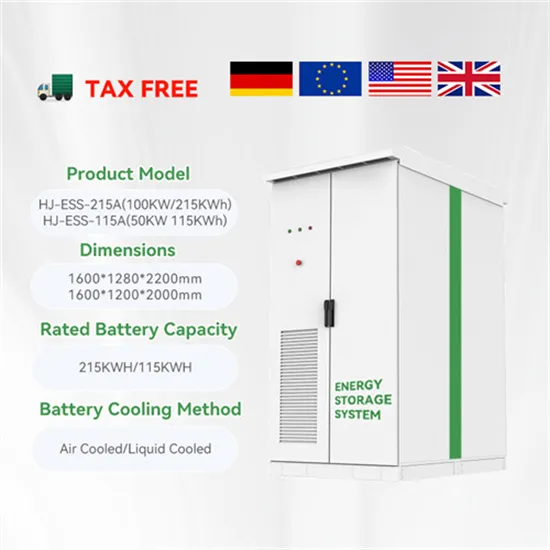

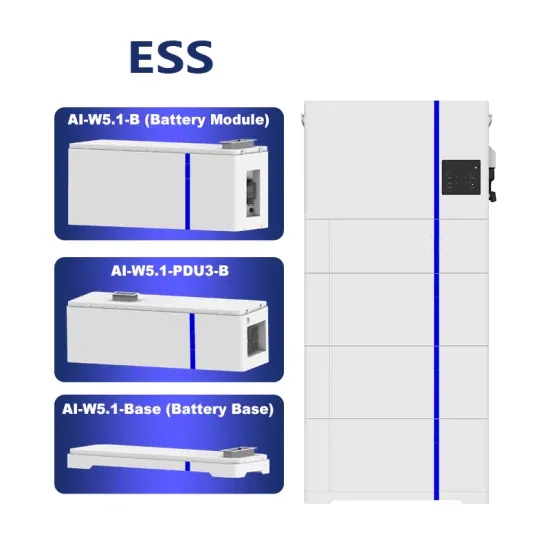

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.