Portugal to invest €400m in grid upgrades and BESS after

Jul 29, 2025 · The government of Portugal has announced plans to invest €400 million (US$466 million) to improve its grid management capabilities and increase its battery energy storage

Introduction to Battery Energy Storage Markets: Spain and Portugal

Jan 9, 2025 · This blog post forms part of our new series, "Introduction to BESS (Battery Energy Storage Systems) Markets", which will cover the drivers and revenue streams of different EU

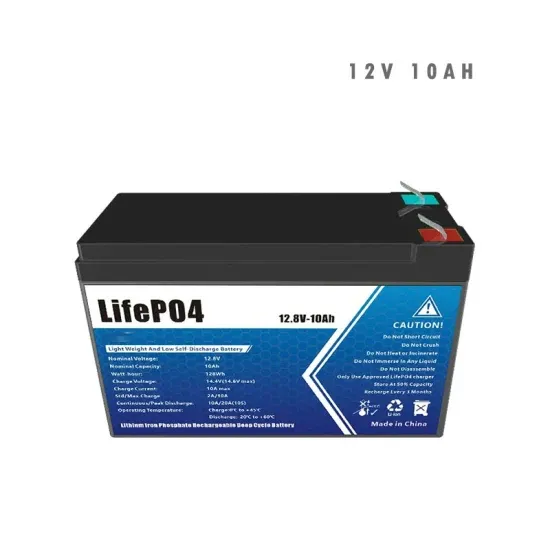

BESS Uninterruptible Power Supply Cost in Porto Portugal

Considering a battery energy storage system (BESS) for uninterrupted power in Porto? This guide breaks down pricing factors, industry applications, and cost-saving strategies for commercial

Portugal BESS Outdoor Power Supply Cost Market Insights

Portugal''s BESS market has grown 27% year-over-year, driven by solar integration and grid stability needs. Outdoor power supply systems typically range between €400/kWh to

Portugal to invest €400m in grid upgrades and BESS after

Jul 30, 2025 · The plan also includes the launch of an auction for large-scale BESS capacity by 2026, as well as €25 million in financial support to improve the resilience of critical

Portugal Goes For 500MW Of BESS

Aug 2, 2024 · To this end, the country''s Ministry of Energy announced on Wednesday that it has allocated €99.75 million ($107.6 million) in a bid to support 500 MW of energy storage projects.

Uruguay Uninterruptible Power Supply BESS Stabilizing

Why Uruguay Needs Advanced Battery Energy Storage Systems With 98% of its electricity already generated from renewable sources, Uruguay stands as a global leader in clean energy

Large-scale uninterruptible power supply BESS in East Africa

Revenue models for FTM utility-scale BESS depend heavily on the dynamics of the regions that providers are entering. Most utility-scale BESS players pursue a strategy of revenue stacking,

Luanda Uninterruptible Power Supply BESS Price Trends and

Summary: Explore the latest pricing trends for Battery Energy Storage Systems (BESS) in Luanda and learn how businesses can secure cost-effective, uninterrupted power solutions. Discover

Microsoft to roll out data center battery-sharing

Feb 23, 2023 · Microsoft wants to replicate a battery-sharing arrangement it has tested at a Dublin data center in Ireland. The scheme, announced in 2022,

Portugal BESS Outdoor Power Supply Cost Market Insights

As Portugal accelerates its renewable energy transition, Battery Energy Storage Systems (BESS) for outdoor applications have become a hot topic. This article breaks down the cost factors,

6 FAQs about [Portugal BESS sells new uninterruptible power supply prices]

Does Portugal support battery energy storage projects?

Portugal has awarded grant support to around 500MW of battery energy storage system (BESS) projects, using EU Recovery and Resilience Plan (RRP) funding, a bloc-wide scheme that has supported energy storage across the continent.

How will a smart energy system contribute to Portugal's climate goals?

The planned investment will fully contribute to the Portuguese climate goals by enhancing intelligent energy systems and their storage. This initiative aims to increase the capacity and flexibility of the national public grid, optimising the electrical system to handle the expected rise in electricity consumption.

Does greenvolt have a Bess project in Portugal?

Greenvolt and Galp have both deployed 5MW BESS projects in Portugal in the past. In eastern Europe, Moldova is in the process of completing a bidding process for the procurement of a 75MW BESS and 22MW internal combustion engine (ICE) project, called the Moldova Energy Security Project (MESA).

How much does Bess cost?

The cost of BESS has fallen significantly over the past decade, with more precipitous drops in recent years: This is nearly a 70% reduction in three years, owing to falling battery pack prices (now as low as $60-70/kWh in China), increased deployment, and improved efficiency.

Do Spain and Portugal use the same grid?

Overview: Spain and Portugal use the same grid, the Iberian Grid, through the MIBEL agreement established in 2004. Policy Environment: Spain has updated its National Energy Climate Plan (NECP) to increase its renewable and energy storage targets for 2030, and there are financial support schemes for co-located projects (renewables and BESS).

What are the revenue streams for Bess?

Revenue streams for BESS can typically be categorised into ancillary services, wholesale trading and capacity market mechanisms. Ancillary services encompass frequency regulation, voltage control, reserve services, and black start capabilities for the grid.

Learn More

- Portugal small power uninterruptible power supply

- Uninterruptible power supply prices in Johannesburg South Africa

- Portugal portable ups uninterruptible power supply

- Cape Town Uninterruptible Power Supply Vehicle BESS

- Uninterruptible power supply prices in Zambia

- Croatia BESS Uninterruptible Power Supply

- Gitega AC Uninterruptible Power Supply BESS

- Power supply transformation BESS uninterruptible power supply large quantities of stock

- Which BESS is the best uninterruptible power supply in South Sudan

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.