The UK is open for Battery Energy Storage Systems (BESS)

Jan 31, 2025 · The UK Government''s ambition to decarbonize of the country''s power system by 2030 is a clarion call to the energy storage industry.

August 2024: GB battery energy storage research round-up

Wind generation drove 49 hours of negative prices in August Day-ahead wholesale power prices were negative for 49 hours in August. Only April saw more negative-priced hours - 53. The rise

Factcheck: Why expensive gas – not net-zero – is keeping UK

May 20, 2025 · While the UK is making significant investments in new clean-power capacity and in upgrading its electricity grid, "green levies" and network charges account for just 6% and

Daily UK Energy Market Update | Gas & Power

4 days ago · Get the latest UK gas and electricity wholesale prices. Updated daily with power market insights, price trends, and tips to help your business stay

Renewable Energy & Energy Price Cap: What to Expect

Mar 25, 2025 · Learn how renewable energy affects the energy price cap, wholesale prices, and household bills. See if wind and solar power can stabilise UK energy costs in the future.

Wholesale energy market update

Feb 27, 2025 · Wholesale energy market update UK wholesale energy prices rise amid low storage, colder weather and Ukraine transit deal expiry British Gas Business 27/02/2025 9:00

GB Wholesale Energy Market Negative Power Prices

Sep 9, 2024 · signal very positive trends and opportunities in the energy sector. This thought leadership piece looks at the fundamentals of why negative power prices occur in the

UK battery storage revenues to rebound after ''challenging

Oct 29, 2024 · Further, Modo reported that on 21 August, UK BESS systems provided over 600MW of power to the grid through the Balancing Mechanism (BM), boosting the sale price to

Wholesale power price definition must change under

Jul 11, 2025 · Wholesale power prices are more naturally defined by fossil-based power costs, but renewables create new cost categories that are neither traditional wholesale price nor network

Insights And Implications Of Uk Wholesale Electricity Prices

Feb 13, 2025 · UK wholesale electricity prices has been a focal point of discussion and analysis, especially given the recent volatility and price fluctuations. In this blog, Service Delivery

Electricity storage and market power

May 1, 2022 · Electricity storage is likely to be an important factor in balancing fluctuations in renewable generators'' output, but concentrated ownership could lead to market power. We

Market index prices | Insights Solution

5 days ago · Market Index Price data is received from each of the appointed Market Index Data Providers (MIDPs) and reflects the price of wholesale electricity in Great Britain for the relevant

6 FAQs about [London energy storage power wholesale price]

How does wholesale energy pricing affect electricity prices in the UK?

Once the wholesale price is set, suppliers add other costs such as distribution fees and operating costs, then set the tariffs they charge consumers. This is why wholesale energy pricing directly affects electricity prices in the UK. If you want a deeper dive into hedging, Simply Switch has a clear guide here: Business Energy Hedging.

How has wholesale trading impacted the battery market?

Wholesale trading revenues surged by £11.6k/MW/year, driven by 42% higher wholesale price spreads, which hit a two-year high. In addition to this, intraday power prices peaked at £1,780/MWh on January 8th, leading to the highest single-day battery revenues since 2022, with earnings of £394k/MW/year.

How does wholesale energy cost affect a customer's Bill?

The cost of suppliers purchasing wholesale energy is the largest component of a customer’s bill. Wholesale prices can vary significantly compared to other components of a household bill. We take wholesale prices into account when setting the level of the Price Cap every quarter. Day ahead contracts show the price evolution in the spot market.

How does a wholesale energy price work?

This allows suppliers to secure energy at an agreed price months—or even a year—ahead, providing security of supply and predictable costs for their customers. Once the wholesale price is set, suppliers add other costs such as distribution fees and operating costs, then set the tariffs they charge consumers.

Are battery energy storage revenues increasing in Great Britain?

Battery energy storage revenues in Great Britain reached a rate of £88k/MW/year in January 2025, marking a 5% increase from December 2024 and the first back-to-back monthly revenue increase since early 2024. Source: Modo Energy Note: Monthly ME BESS GB revenues since January 2024

Where can I find energy stats UK?

Energy Stats UK can be found on various social media platforms posting daily tariff pricing graphs and summaries. Be sure to follow @energystatsuk on Twitter / X, Bluesky, Mastodon and Instagram. Note: The current and past performance of energy pricing is not necessarily a guide to the future.

Learn More

- Niger portable energy storage power supply wholesale price

- Bhutan energy storage portable power wholesale price

- Honiara Energy Storage Power Wholesale Price

- Warsaw household energy storage power wholesale price

- Paramaribo lithium energy storage power wholesale price

- Spanish mobile energy storage vehicle wholesale price

- Energy storage power station grid price difference

- Cyprus Sunshine Energy Storage Power Supply Price

- Wholesale price of mobile energy storage vehicle in Busan South Korea

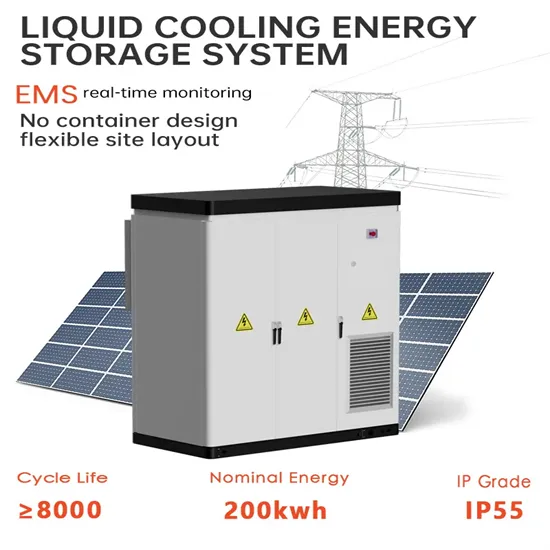

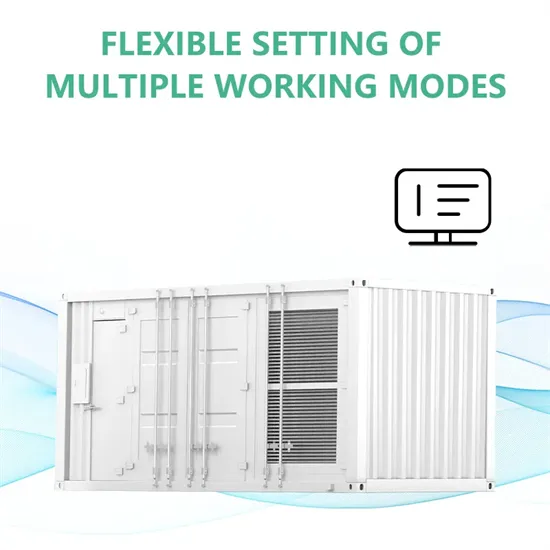

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

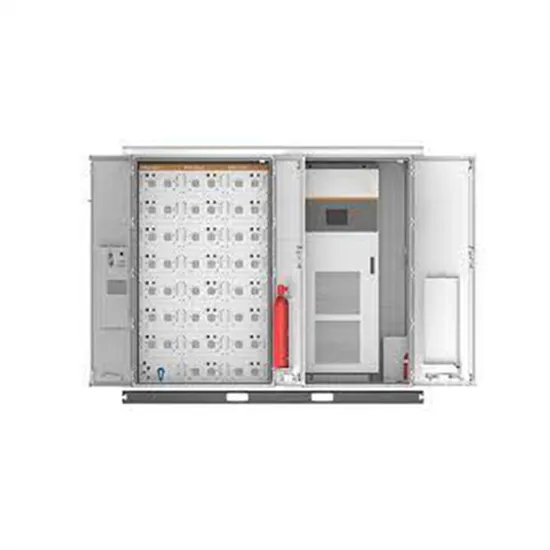

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.